Jindal Drilling's Valuation Adjustments Reflect Strong Financial Performance and Market Dynamics

2025-04-02 08:10:41Jindal Drilling & Industries has experienced a recent evaluation adjustment, influenced by its financial metrics and market position. Despite a revision in valuation, the company has shown strong financial performance, with significant growth in net sales and operating profit, indicating a solid return on capital employed.

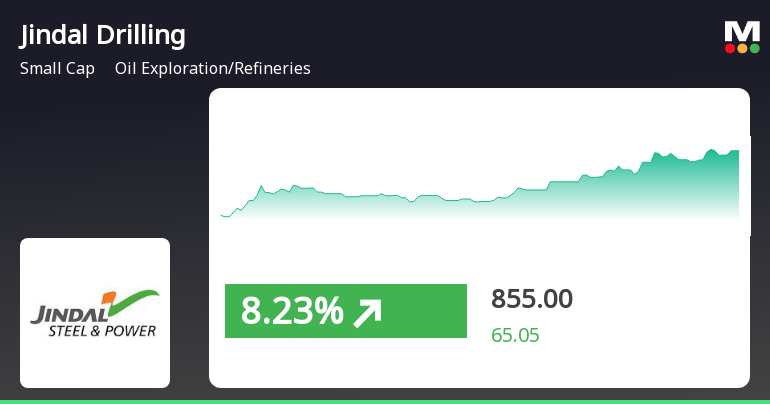

Read MoreJindal Drilling Shows Mixed Technical Trends Amid Strong Yearly Performance and Volatility

2025-04-02 08:02:51Jindal Drilling & Industries, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 855.45, showing a notable increase from the previous close of 833.10. Over the past year, Jindal Drilling has demonstrated strong performance, with a return of 35.42%, significantly outpacing the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands are bullish for both weekly and monthly assessments, suggesting some positive momentum. However, the KST reflects a more cautious stance, being bullish weekly but mildly bearish monthly. In terms of price performance, Jindal Drilling has reached a 52-week high of 990.50 an...

Read MoreJindal Drilling Adjusts Valuation Amid Competitive Oil Sector Landscape

2025-04-01 08:00:13Jindal Drilling & Industries has recently undergone a valuation adjustment, reflecting its current standing in the oil exploration and refinery sector. The company’s price-to-earnings ratio stands at 18.68, while its price-to-book value is recorded at 2.00. Other key financial metrics include an EV to EBIT ratio of 19.92 and an EV to EBITDA ratio of 12.49, indicating its operational efficiency relative to its enterprise value. In terms of returns, Jindal Drilling has shown notable performance over various periods. Year-to-date, the stock has returned 7.58%, while over the past year, it has achieved a return of 30.98%. Over a three-year span, the company has delivered an impressive 243.26% return, significantly outperforming the Sensex, which has returned 34.42% in the same timeframe. When compared to its peers, Jindal Drilling's valuation metrics present a mixed picture. While it is positioned as expensiv...

Read More

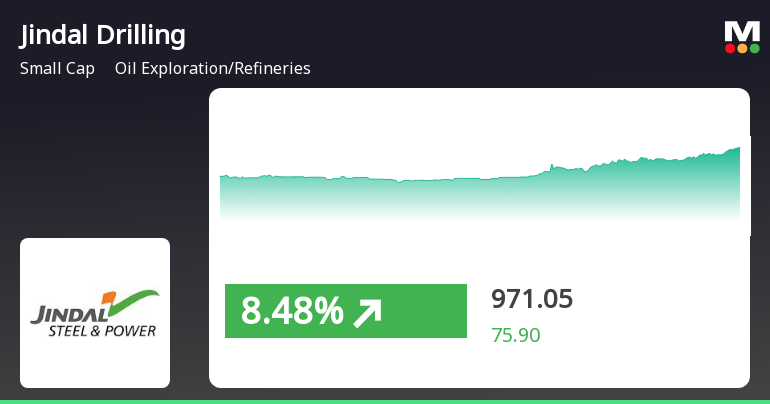

Jindal Drilling Shows Strong Momentum Amid Positive Small-Cap Market Trends

2025-03-18 13:30:16Jindal Drilling & Industries has demonstrated strong performance, gaining 7.9% and nearing its 52-week high. The stock has outperformed its sector and shows a consistent upward trend, trading above key moving averages. The broader market also reflects positive momentum, particularly in small-cap stocks.

Read More

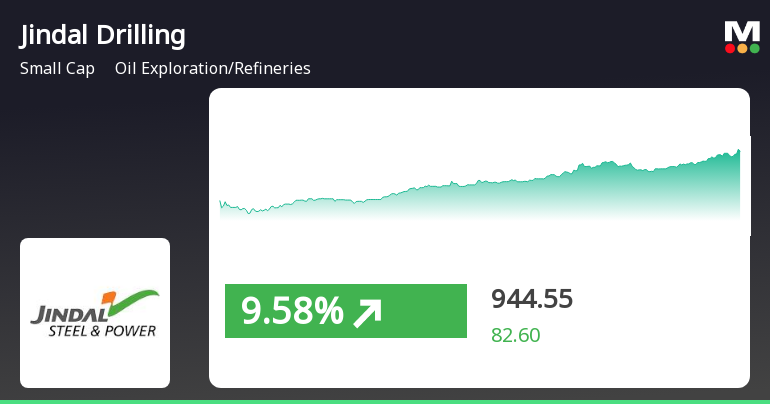

Jindal Drilling's Strong Performance Highlights Resilience in Oil Sector Amid Market Trends

2025-03-11 14:00:17Jindal Drilling & Industries has demonstrated strong performance, gaining 8.7% on March 11, 2025, and outperforming its sector significantly. The stock reached an intraday high of Rs 930, reflecting notable volatility. Over the past week, it surged by 18.22%, with impressive long-term gains over three and five years.

Read More

Jindal Drilling Reports Strong Growth and Operational Efficiency Amid Oil Sector Boom

2025-03-11 08:05:50Jindal Drilling & Industries has recently adjusted its evaluation, reflecting strong performance in the oil exploration and refinery sector. Q3 FY24-25 results show significant annual growth in net sales and operating profit, alongside a remarkable net profit increase and high operational efficiency metrics, positioning the company favorably in the small-cap segment.

Read MoreJindal Drilling Shows Mixed Technical Signals Amid Strong Long-Term Performance

2025-03-11 08:01:22Jindal Drilling & Industries, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 861.95, having seen fluctuations with a previous close of 898.45 and a 52-week high of 990.50. Today's trading range has been between 852.80 and 916.45, indicating active market participation. The technical summary for Jindal Drilling highlights a predominantly bullish sentiment across various indicators. The MACD shows bullish trends on both weekly and monthly scales, while moving averages also reflect a bullish stance on a daily basis. However, the KST indicates a mildly bearish trend on both weekly and monthly levels, suggesting some mixed signals in the short term. In terms of performance, Jindal Drilling has demonstrated significant returns compared to the Sensex. Over the past year,...

Read More

Jindal Drilling & Industries Shows Trend Reversal Amid Broader Market Recovery

2025-03-05 11:15:17Jindal Drilling & Industries experienced a notable performance on March 5, 2025, reversing a two-day decline with a significant gain. The stock outperformed its sector and showed mixed trends in moving averages. Meanwhile, the broader market, led by mid-cap stocks, also saw positive movement.

Read MoreJindal Drilling Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-02-28 08:01:27Jindal Drilling & Industries, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 801.00, down from a previous close of 870.10, with a notable 52-week high of 990.50 and a low of 497.25. Today's trading saw a high of 870.00 and a low of 788.40. The technical summary indicates a mixed performance across various indicators. The MACD shows bullish signals on both weekly and monthly charts, while the RSI remains neutral. Bollinger Bands reflect a mildly bullish stance, and moving averages also suggest a mildly bullish trend. However, the KST and Dow Theory present a more cautious outlook, with mildly bearish signals on the weekly chart and a bullish stance on the monthly chart. In terms of returns, Jindal Drilling has demonstrated resilience compared to the Sensex. Over the past ye...

Read MoreUpdate On Arbitration Award

04-Apr-2025 | Source : BSEUpdate on Arbitration Award

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Purchase Of Jack-Up Rig Jindal Pioneer From Discovery Drilling Pte. Limited Singapore.

05-Mar-2025 | Source : BSEPurchase of Jack-up rig Jindal Pioneer from Discovery Drilling Pte. Limited Singapore.

Corporate Actions

No Upcoming Board Meetings

Jindal Drilling & Industries Ltd has declared 10% dividend, ex-date: 14 Aug 24

Jindal Drilling & Industries Ltd has announced 5:10 stock split, ex-date: 06 Nov 08

No Bonus history available

No Rights history available