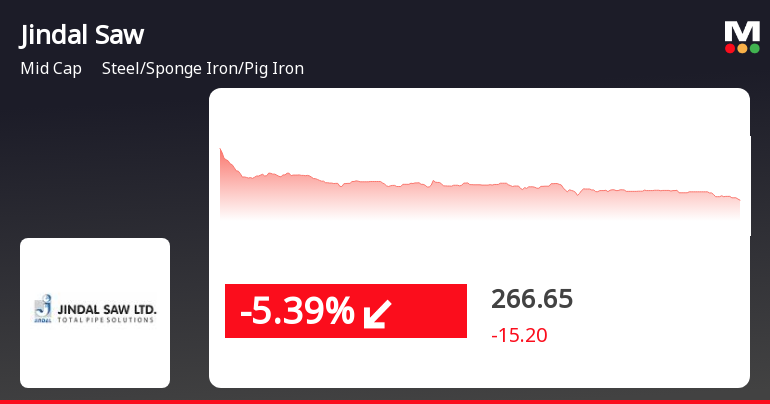

Jindal Saw Faces Mixed Trends Amid Broader Market Fluctuations and Long-Term Growth

2025-03-25 13:30:19Jindal Saw, a midcap player in the steel industry, saw a decline on March 25, 2025, underperforming the broader market. Despite recent fluctuations, the stock has shown significant long-term growth over three, five, and ten years, outperforming the Sensex in those periods while facing a year-to-date drop.

Read More

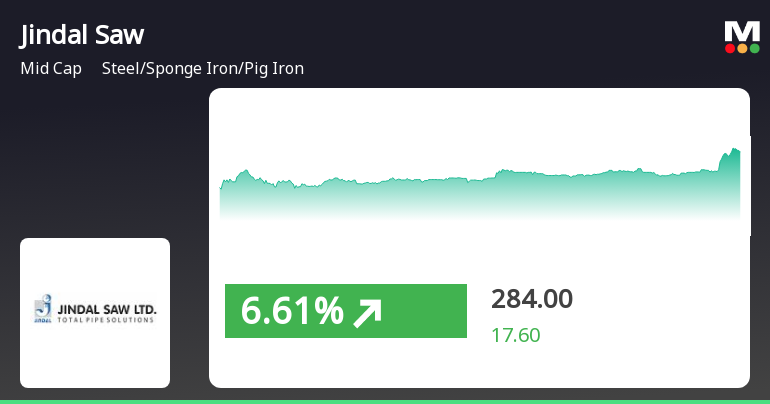

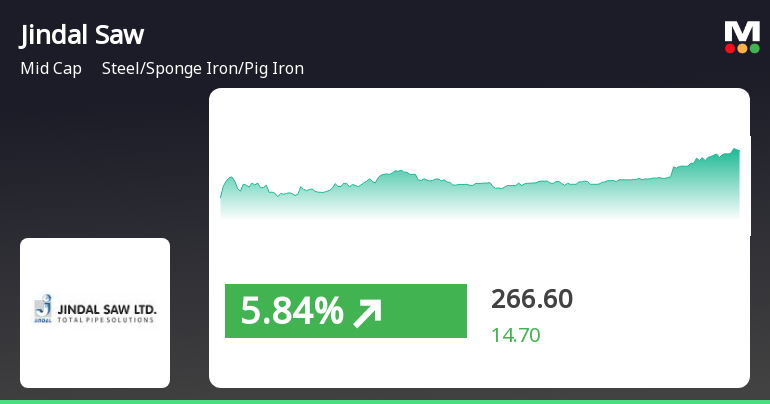

Jindal Saw Shows Strong Short-Term Gains Amid Mixed Long-Term Trends in Steel Sector

2025-03-20 15:15:18Jindal Saw, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has experienced notable gains, outperforming its sector for three consecutive days. The stock's performance shows a mixed trend across various moving averages, while its long-term growth remains impressive, reflecting significant increases over three and five years.

Read More

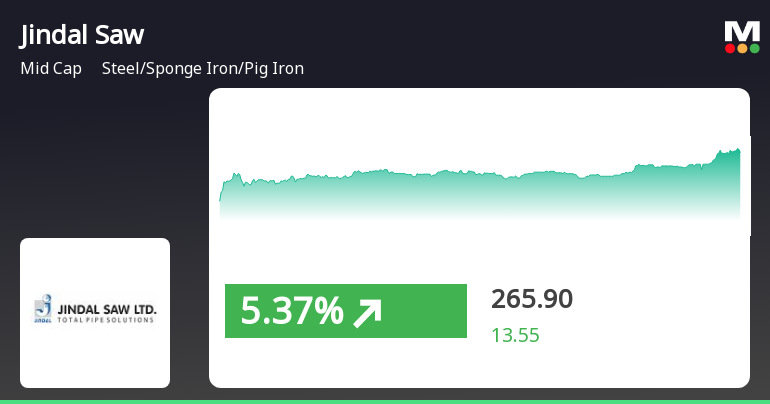

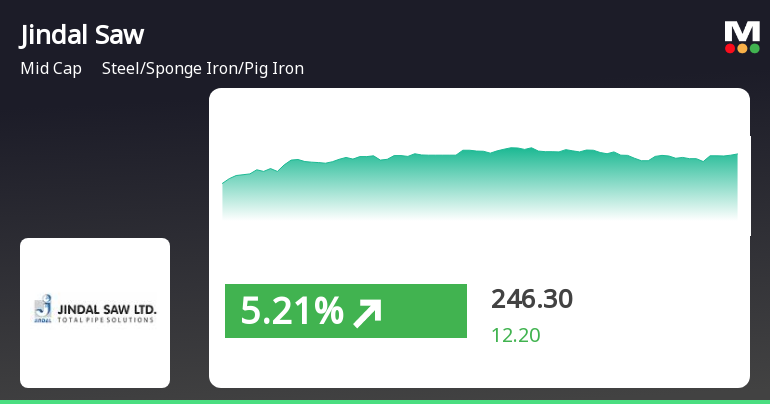

Jindal Saw Shows Strong Relative Performance Amid Mixed Short-Term Trends

2025-03-18 15:15:49Jindal Saw, a midcap player in the Steel industry, experienced significant trading activity on March 18, 2025, outperforming its sector. The stock has shown a strong long-term performance, with notable gains over three and five years, despite facing challenges in the shorter term and a year-to-date decline.

Read More

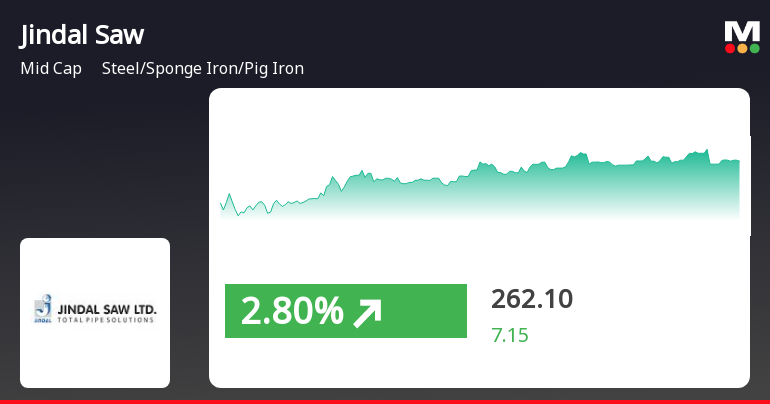

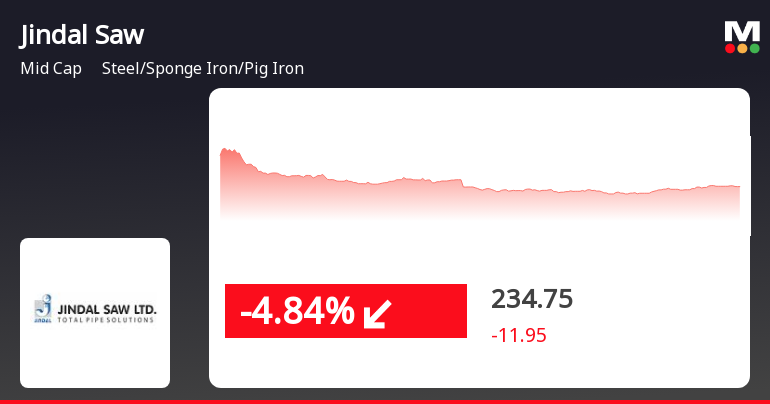

Jindal Saw Faces Decline Amid Broader Market Downturn and Sector Underperformance

2025-03-10 15:30:21Jindal Saw, a midcap player in the steel industry, saw its shares decline significantly today amid a broader market downturn. Despite a brief intraday high, the stock has faced a cumulative drop over the past two days and has underperformed its sector recently, particularly over the last three months.

Read MoreJindal Saw's Technical Indicators Reflect Mixed Sentiment Amid Strong Long-Term Performance

2025-03-07 08:01:51Jindal Saw, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 273.45, showing a notable increase from the previous close of 251.90. Over the past year, Jindal Saw has demonstrated a return of 18.25%, significantly outperforming the Sensex, which recorded a modest gain of 0.34% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. The daily moving averages also reflect a mildly bearish sentiment, while the KST and OBV metrics present a mixed picture. Notably, Jindal Saw has shown impressive ...

Read More

Jindal Saw Shows Resilience Amid Mixed Market Trends and Small-Cap Gains

2025-03-06 12:15:17Jindal Saw has demonstrated notable performance, gaining 5.6% on March 6, 2025, and achieving consecutive gains over two days for a total return of 12.32%. The stock is currently above several short-term moving averages, indicating a mixed trend amid broader market fluctuations.

Read More

Jindal Saw Shows Resilience Amid Market Fluctuations and Sector Outperformance

2025-03-05 09:45:27Jindal Saw has experienced a notable rebound, gaining 5.23% on March 5, 2025, after two days of decline. The stock reached an intraday high of Rs 246.25 and has outperformed its sector. Despite mixed moving averages, it demonstrates resilience in a fluctuating market environment.

Read More

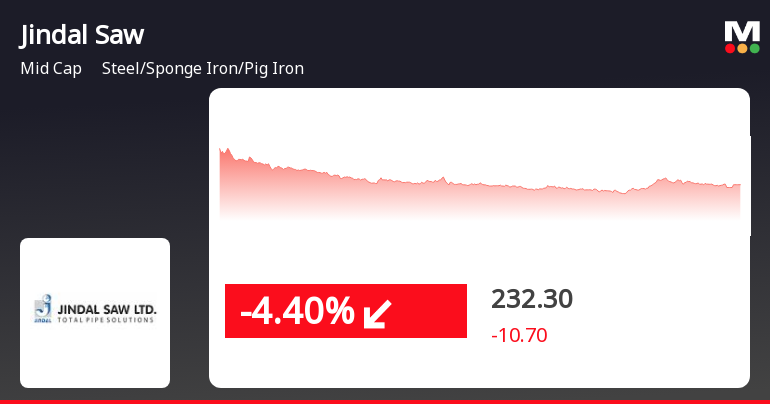

Jindal Saw Faces Market Challenges Amid Broader Sector Underperformance

2025-03-03 11:15:32Jindal Saw, a midcap player in the Steel/Sponge Iron/Pig Iron industry, faced a significant decline on March 3, 2025, underperforming its sector amid broader market challenges. The stock traded below key moving averages, reflecting a bearish trend, while its monthly performance showed a slight decrease compared to the Sensex.

Read More

Jindal Saw Faces Significant Stock Decline Amid Broader Market Challenges in February 2025

2025-02-14 13:15:33Jindal Saw's stock has declined significantly, underperforming its sector and the broader market. The stock reached an intraday low and is trading below key moving averages, indicating a bearish trend. Over the past month, it has faced notable challenges, contrasting with more stable performance in the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEas attached

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

02-Apr-2025 | Source : BSEThis is with reference to the captioned subject we wish to inform you that the Companys officials will be meeting physically with an investor on one-to-one basis on Tuesday April 8 2025 at 02:30 PM (IST) at New Delhi.

Announcement under Regulation 30 (LODR)-Acquisition

27-Mar-2025 | Source : BSEAs attached

Corporate Actions

No Upcoming Board Meetings

Jindal Saw Ltd has declared 200% dividend, ex-date: 11 Jun 24

Jindal Saw Ltd has announced 1:2 stock split, ex-date: 09 Oct 24

No Bonus history available

No Rights history available