Jindal Worldwide's Technical Indicators Show Mixed Signals Amid Market Evaluation Shift

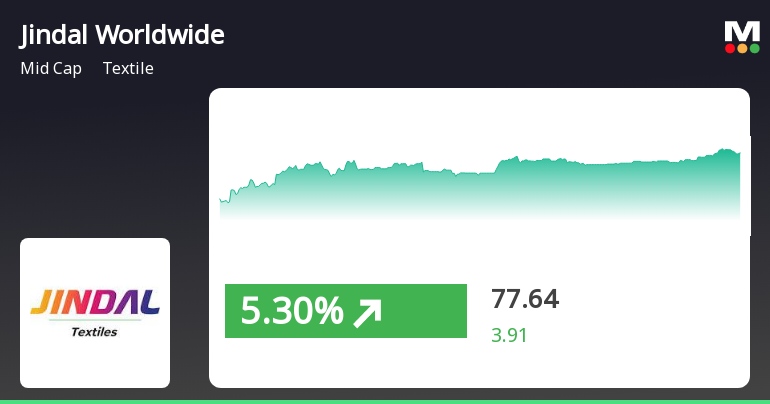

2025-04-03 08:02:07Jindal Worldwide, a midcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 76.48, showing a notable increase from the previous close of 73.73. Over the past year, Jindal Worldwide has demonstrated a stock return of 15.30%, outperforming the Sensex, which returned 3.67% in the same period. The technical summary indicates a mixed performance across various indicators. While the MACD shows a bullish trend on a monthly basis, the weekly outlook remains bearish. The Bollinger Bands and On-Balance Volume (OBV) both reflect bullish signals, suggesting positive momentum in the stock's performance. However, the KST and Dow Theory present a more cautious view, with mildly bearish and no trend signals, respectively. In terms of price movement, Jindal Worldwide has experienced a 52-week high of 94.19 and a low of 5...

Read More

Jindal Worldwide's Strong Performance Highlights Resilience in Textile Sector Amid Market Gains

2025-04-02 14:35:15Jindal Worldwide, a midcap textile company, has experienced notable gains, marking its fourth consecutive day of increases. The stock is trading above key moving averages, reflecting a strong upward trend. Over the past year, it has significantly outperformed the broader market, delivering a substantial return compared to the Sensex.

Read More

Jindal Worldwide's Technical Shift Signals Potential Market Sentiment Change Amid Debt Concerns

2025-04-02 08:03:39Jindal Worldwide, a midcap textile company, has experienced an evaluation adjustment reflecting changes in its technical indicators, shifting to a mildly bullish trend. Key metrics indicate a solid return on capital employed, while the stock trades at a discount compared to peers, despite facing challenges with debt levels.

Read MoreJindal Worldwide's Technical Indicators Show Mixed Signals Amid Market Dynamics

2025-04-02 08:03:28Jindal Worldwide, a midcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 73.73, showing a notable increase from the previous close of 71.42. Over the past year, Jindal Worldwide has demonstrated resilience with a return of 10.44%, outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed performance across various indicators. While the moving averages on a daily basis suggest a positive trend, the MACD and KST metrics reflect a bearish stance on a weekly basis, with monthly readings showing a mildly bearish outlook. The Bollinger Bands present a contrasting view, indicating bullish momentum on a monthly scale. In terms of price performance, Jindal Worldwide has seen fluctuations with a 52-week high of 94.19 and a low of 54.11. The stock's per...

Read More

Jindal Worldwide Experiences Trend Reversal Amid Mixed Market Signals and Volatility

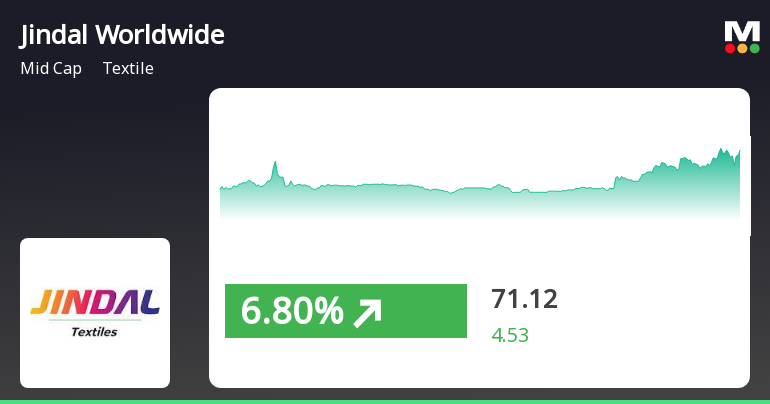

2025-04-01 10:15:19Jindal Worldwide, a midcap textile company, gained 7.07% on April 1, 2025, despite underperforming its sector. The stock shows mixed signals with varying moving averages. In a broader market context, the Sensex opened lower and is experiencing volatility, contrasting with Jindal's recent weekly performance.

Read MoreJindal Worldwide's Technical Indicators Reflect Mixed Signals Amid Strong Long-Term Performance

2025-04-01 08:01:14Jindal Worldwide, a midcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 71.42, showing a notable increase from the previous close of 66.59. Over the past year, Jindal Worldwide has demonstrated a return of 14.86%, outperforming the Sensex, which recorded a return of 5.11% in the same period. In terms of technical indicators, the MACD shows a mixed outlook with a bearish signal on the weekly chart and a bullish signal on the monthly chart. The Relative Strength Index (RSI) remains neutral on both weekly and monthly bases, indicating a lack of strong momentum in either direction. Bollinger Bands suggest a mildly bearish trend on the weekly scale, while the monthly perspective leans mildly bullish. Moving averages indicate a mildly bullish sentiment on a daily basis, contrasting with the mildly bearish si...

Read More

Jindal Worldwide Outperforms Textile Sector Amid Market Volatility and Gains Momentum

2025-03-28 13:45:15Jindal Worldwide, a midcap textile company, has demonstrated strong performance, gaining 5.5% on March 28, 2025, and surpassing sector averages. The stock has shown consecutive gains over two days, achieving a total return of 30.16%. It remains above several moving averages, despite broader market volatility.

Read MoreJindal Worldwide Ltd Sees Surge in Stock Activity Amid Rising Investor Participation

2025-03-28 10:00:13Jindal Worldwide Ltd, a mid-cap player in the textile industry, has experienced significant activity today, hitting its upper circuit limit with a high price of Rs 66.31. The stock recorded a notable change of Rs 11.05, reflecting a 20% increase in value. This surge comes as the stock has gained for the last two consecutive days, accumulating a total return of 20% during this period. The trading session saw a total volume of approximately 75.89 lakh shares, resulting in a turnover of around Rs 47.90 crore. The stock's performance today aligns well with sector trends, as it outperformed the broader market, with a 1D return of 1.48%, compared to the sector's 0.15% and the Sensex's decline of 0.31%. In terms of moving averages, Jindal Worldwide's current price is higher than its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Additionally, the stock has seen a ...

Read MoreJindal Worldwide Ltd Sees 21.33% Surge Amid Strong Buying Activity and Trend Reversal

2025-03-27 15:25:06Jindal Worldwide Ltd is witnessing significant buying activity today, with a remarkable 21.33% increase in its stock price, sharply outperforming the Sensex, which rose by only 0.45%. This surge comes after two consecutive days of declines, indicating a potential trend reversal. The stock reached an intraday high of Rs 66.61, reflecting strong buyer interest. Over the past week, Jindal Worldwide has gained 13.79%, while the Sensex has only increased by 1.68%. However, its performance over the past month shows a decline of 3.30%, contrasting with the Sensex's rise of 4.05%. Notably, the stock has hit a new 52-week low of Rs 54.11 today, which may have prompted buying as investors perceive value at lower price levels. The stock's volatility today was notable, with an intraday fluctuation of 6.17%. Currently, Jindal Worldwide's price is above its 5-day and 20-day moving averages but remains below its 50-day,...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended on 31st March 2025

Disclosure Under Regulation 30 (5) Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations): Details Of Key Managerial Personnel Of The Company

04-Apr-2025 | Source : BSEDisclosure under Regulation 30(5)

Appointment of Company Secretary and Compliance Officer

04-Apr-2025 | Source : BSEAppointment of Company Secretary and compliance officer

Corporate Actions

No Upcoming Board Meetings

Jindal Worldwide Ltd has declared 20% dividend, ex-date: 09 Sep 24

Jindal Worldwide Ltd has announced 1:5 stock split, ex-date: 31 Oct 18

Jindal Worldwide Ltd has announced 4:1 bonus issue, ex-date: 28 Feb 25

No Rights history available