JMD Ventures Faces Intense Selling Pressure Amid Significant Price Declines

2025-04-02 09:45:05JMD Ventures Ltd is currently facing significant selling pressure, with the stock showing only sellers today. This trend has resulted in consecutive days of losses, with a notable decline of 2.10% in today's trading session. Over the past week, JMD Ventures has decreased by 3.19%, while its performance over the last month reveals a staggering drop of 23.19%. In comparison to the Sensex, which has gained 0.47% today, JMD Ventures has significantly underperformed. The stock's performance over various time frames further highlights this trend: it has lost 43.95% over the past three months and 33.93% over the past year, while the Sensex has shown a modest increase of 3.35% during the same period. Year-to-date, JMD Ventures is down 46.11%, contrasting sharply with the Sensex's decline of only 2.25%. Currently, the stock is trading close to its 52-week low, just 1.86% away from Rs 6.86. Additionally, JMD Ventu...

Read MoreJMD Ventures Ltd Sees Increased Buying Activity Amidst Market Volatility and 52-Week Low

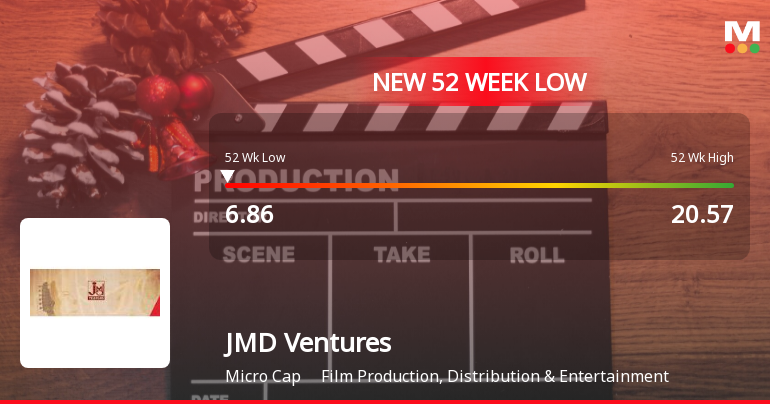

2025-04-01 15:15:04JMD Ventures Ltd, a microcap company in the film production, distribution, and entertainment industry, is witnessing significant buying activity today, with a performance increase of 1.56%. This contrasts sharply with the Sensex, which has declined by 1.74%. Over the past week, JMD Ventures has shown a slight decrease of 0.70%, while the Sensex fell by 2.50%. Despite a challenging month where JMD Ventures has dropped 21.54%, the stock's performance today indicates a potential shift in market sentiment. The company has recently hit a new 52-week low of Rs. 6.86, suggesting that the current buying pressure may be driven by investors looking for value in a stock that has seen substantial declines. In terms of moving averages, JMD Ventures is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a bearish trend over the short to medium term. However, the stock's long-term perfor...

Read More

JMD Ventures Faces Financial Struggles Amid Broader Market Downturn and Declining Stakeholder Confidence

2025-04-01 11:44:45JMD Ventures, a microcap in the film industry, has hit a new 52-week low amid a broader market decline. The company has faced significant challenges, including a 32.56% drop in performance over the past year and a 98.4% decrease in profits, raising concerns about its financial stability.

Read More

JMD Ventures Faces Challenges Amid Significant Stock Volatility and Declining Performance

2025-03-28 09:42:13JMD Ventures, a microcap in the film industry, has faced significant volatility, reaching a new 52-week low. The company has struggled over the past year, with a notable decline in stock performance and ongoing operating losses. Concerns about debt servicing and reduced promoter stake further highlight its challenging market position.

Read More

JMD Ventures Faces Continued Decline Amid Weak Fundamentals and Investor Confidence Issues

2025-03-28 09:42:06JMD Ventures, a microcap in the entertainment sector, has hit a new 52-week low amid ongoing volatility. The company has faced significant declines over the past year, underperforming its sector and struggling with operating losses, negative EBITDA, and a sharp drop in profitability. Promoter confidence is also decreasing.

Read MoreJMD Ventures Faces Intense Selling Pressure Amid Significant Price Declines and Losses

2025-03-27 09:45:04JMD Ventures Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company, operating in the film production, distribution, and entertainment industry, has experienced consecutive days of losses, reflecting a troubling trend for investors. In terms of performance, JMD Ventures has declined by 2.63% today, contrasting sharply with the Sensex, which has gained 0.20%. Over the past week, the stock has lost 4.35%, while the Sensex has risen by 1.43%. The one-month performance reveals a staggering decline of 24.25% for JMD Ventures compared to a modest 3.79% increase in the Sensex. Looking at longer-term metrics, JMD Ventures has seen a 47.93% drop over the past three months and a 32.27% decline over the past year, while the Sensex has posted a 6.09% gain in the same timeframe. Year-to-date, the stock is down 45.80%, significantly underperforming the Sensex, whi...

Read MoreJMD Ventures Faces Intense Selling Pressure Amid Significant Price Declines and Losses

2025-03-26 13:20:05JMD Ventures Ltd is currently facing significant selling pressure, with today's trading session showing only sellers in the market. The stock has recorded a notable decline of 3.48% today, sharply contrasting with the Sensex, which has only dipped by 0.63%. This marks a continuation of a troubling trend, as JMD Ventures has experienced consecutive days of losses, with a weekly decline of 5.58% compared to the Sensex's gain of 2.76%. Over the past month, JMD Ventures has plummeted by 26.64%, while the Sensex has risen by 3.92%. The three-month performance reveals a staggering drop of 49.60% for JMD Ventures, against a slight decline of 1.20% for the Sensex. Year-to-date, the stock is down 46.49%, contrasting sharply with the Sensex's marginal decline of 0.78%. Currently, JMD Ventures is trading close to its 52-week low, just 1.85% away from Rs 6.91. The stock is also underperforming its sector by 1.65% and...

Read MoreJMD Ventures Ltd Sees Buying Surge After 19 Days of Declines, Hits 52-Week Low

2025-03-25 15:25:06JMD Ventures Ltd, a microcap player in the Film Production, Distribution & Entertainment sector, is witnessing significant buying activity today, marking a performance increase of 1.99%. This contrasts sharply with the Sensex, which has seen a slight decline of 0.04%. Notably, this uptick comes after a prolonged period of consecutive losses, as the stock has gained after 19 days of continuous decline. Despite today's positive movement, JMD Ventures has faced challenges over the past week, with a decrease of 4.13%, and a more substantial drop of 24.00% over the past month. Year-to-date, the stock is down 44.56%, while its one-year performance shows a decline of 33.43%. However, over a five-year horizon, JMD Ventures has outperformed the Sensex with a gain of 222.42%, compared to the Sensex's 173.19%. Today's trading session saw the stock open at a new 52-week low of Rs. 6.91, indicating a potential trend r...

Read MoreJMD Ventures Faces Intense Selling Pressure Amid Consecutive Losses and New 52-Week Low

2025-03-25 09:45:05JMD Ventures Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company, which operates in the film production, distribution, and entertainment sector, has experienced a troubling trend of consecutive losses. Over the past week, JMD Ventures has declined by 7.87%, and its performance over the last month has plummeted by 26.96%. In stark contrast, the Sensex has shown resilience, gaining 4.22% over the week and 5.19% over the month. Today, JMD Ventures hit a new 52-week low of Rs. 6.91, reflecting a 1.99% drop in value. The stock's year-to-date performance is down 46.72%, while it has lost 36.02% over the past year. Notably, JMD Ventures has underperformed the Sensex significantly, which has risen by 7.75% in the same timeframe. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend....

Read MoreRe-revised Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

09-Apr-2025 | Source : BSEThe Exchange has received re-revised Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 09 2025 for Kailash Prasad Purohit

Revised Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

08-Apr-2025 | Source : BSEThe Exchange has received revised Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 08 2025 for Kailash Prasad Purohit

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

08-Apr-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on April 08 2025 for Kailash Prasad Purohit

Corporate Actions

No Upcoming Board Meetings

JMD Ventures Ltd has declared 5% dividend, ex-date: 15 Sep 15

JMD Ventures Ltd has announced 10:1 stock split, ex-date: 04 Dec 17

JMD Ventures Ltd has announced 1:1 bonus issue, ex-date: 23 Sep 22

No Rights history available