Technical Indicators Signal Bearish Trend for John Cockerill India Amid Market Dynamics

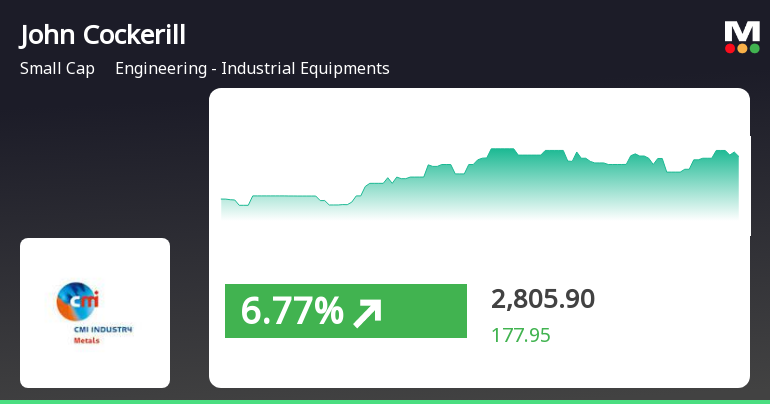

2025-03-27 08:00:20John Cockerill India, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,039.05, down from a previous close of 3,200.00, with a notable 52-week high of 6,443.00 and a low of 2,383.00. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators reflect a mildly bearish stance. The daily moving averages also align with this trend. The Bollinger Bands indicate a mildly bearish outlook on both weekly and monthly bases, while the RSI shows no significant signals at this time. When examining the company's performance relative to the Sensex, John Cockerill India has demonstrated varied returns. Over the past week, the stock has returned 7.88%, significantly outperforming the Sensex's 2.44%. However, on a year-to-date ...

Read MoreJohn Cockerill India Experiences Technical Trend Shifts Amid Market Volatility

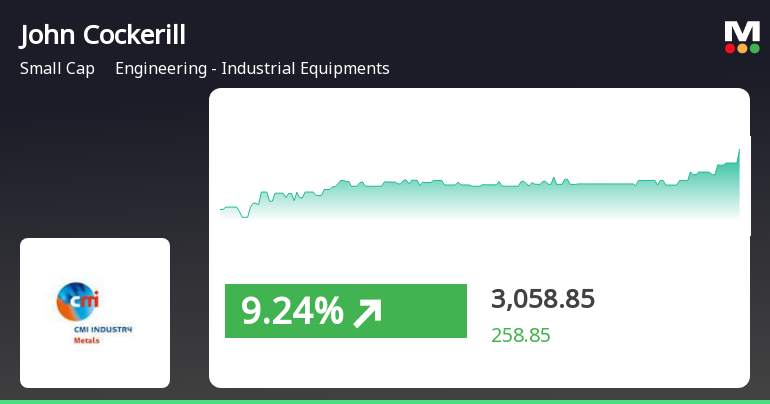

2025-03-26 08:00:38John Cockerill India, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock price has shown notable fluctuations, currently standing at 3,200.00, up from a previous close of 3,052.85. Over the past week, the stock reached a high of 3,233.00 and a low of 3,080.00, indicating active trading. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious market environment. The KST indicates a bearish trend on both weekly and monthly scales, while the Dow Theory presents a mildly bullish view on a weekly basis, with no clear trend monthly. When comparing the company's performance to the Sensex, Jo...

Read More

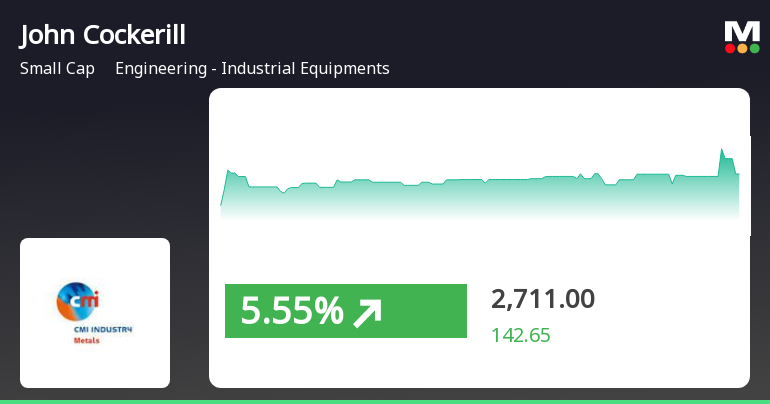

John Cockerill India Surges Amid Broader Market Gains and Mid-Cap Momentum

2025-03-24 13:15:13John Cockerill India, a small-cap engineering firm, has seen notable stock activity, achieving a 7.44% increase on March 24, 2025. The stock has outperformed its sector and recorded a total return of 13.93% over two days, while the broader market, including the Sensex, has also risen significantly.

Read More

John Cockerill India Shows Mixed Performance Amidst Recent Stock Surge

2025-03-21 13:30:16John Cockerill India has experienced notable trading activity, with a significant intraday high reached. The stock has shown a mixed short-term trend against longer-term indicators and has outperformed the Sensex over the past week, despite a decline in the last three months and a negative year-to-date performance.

Read More

John Cockerill India Shows Short-Term Gains Amid Long-Term Decline in Performance

2025-03-19 11:15:15John Cockerill India has shown strong short-term performance, with a significant increase on March 19, 2025, and an impressive return over the past three days. However, its longer-term performance reflects a decline compared to the broader market, which has seen modest gains.

Read More

John Cockerill India Shows Short-Term Gains Amid Long-Term Challenges in Stock Performance

2025-03-05 12:30:14John Cockerill India, a small-cap engineering firm, experienced notable gains on March 5, 2025, outperforming the broader market. Despite recent increases, the stock remains below key moving averages and has faced significant declines over the past three months and year-to-date, though it has shown impressive long-term growth.

Read MoreJohn Cockerill India Experiences Quality Grade Change Amidst Financial Challenges

2025-02-27 08:00:03John Cockerill India, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current financial standing. The company has faced notable challenges, particularly in sales growth and EBIT performance over the past five years, with sales growth recorded at -2.10% and EBIT growth significantly declining by 187.48%. Key financial metrics indicate a concerning trend, with the EBIT to interest ratio averaging at -0.35, suggesting difficulties in covering interest expenses. Additionally, the company's debt to EBITDA ratio stands at 1.19, while net debt to equity is reported at 0.00, indicating a lack of leverage. The sales to capital employed ratio is at 2.15, and the tax ratio is 24.97%. In comparison to its peers, John Cockerill's performance appears less favorable, with several competitors demonstrating stronger financial metrics. Fo...

Read MoreValuation Grade Change Signals Challenges for John Cockerill India Amidst Competitive Landscape

2025-02-24 12:56:36John Cockerill India, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -253.32 and an EV to EBITDA ratio of -325.17, indicating significant challenges in profitability. The price-to-book value stands at 6.45, while the EV to sales ratio is recorded at 3.17. Despite these figures, the company boasts a robust return on capital employed (ROCE) of 32.30%, although its return on equity (ROE) is negative at -2.55%. In comparison to its peers, John Cockerill's valuation appears less favorable. For instance, companies like L G Balakrishnan and HLE Glascoat are positioned more attractively within the market, showcasing stronger financial metrics. While John Cockerill has experienced a notable return of 106.01% over three years, its year-to-date performance shows a decline of 32.75%, contrasting ...

Read More

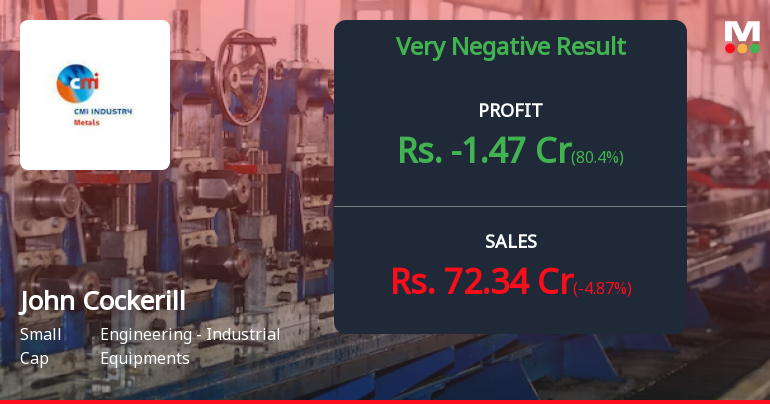

John Cockerill India Reports Declining Financial Results Amid Ongoing Sales Challenges

2025-02-21 15:31:22John Cockerill India has announced its financial results for the quarter ending December 2024, revealing significant declines in key metrics. Net sales reached Rs 72.34 crore, while profit before tax and profit after tax were reported at Rs -2.93 crore and Rs -1.47 crore, respectively, indicating ongoing challenges for the company.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

02-Apr-2025 | Source : BSEPursuant to the provisions of Regulation 30 read with Schedule III Part A Para A (3) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please be informed that CARE Ratings Limited has revised the ratings of the Company : Facilities : Long Term / Short Term facilities Rating : CARE BBB; Stable / CARE A3+ Rating Action : Downgraded from CARE BBB+ / CARE A2 The reasons for downward revision in credit rating as provided by CARE Ratings Limited is given in the attached letter.

Closure of Trading Window

27-Mar-2025 | Source : BSEIn terms of Companys Code for prevention of Insider Trading the trading window for dealing in the equity shares of the Company has been closed from April 1 2025 till 48 (Forty Eight) hours after the conclusion of the meeting of the Board of Directors to be held for the purpose of considering the Unaudited Financial Results of the Company for the quarter ending March 31 2025. The date of the meeting of the Board of Directors to consider and approve the Unaudited Financial Results for the quarter ending March 31 2025 will be intimated in due course.

Information Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

20-Mar-2025 | Source : BSEIn compliance with Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 and in continuation to our letter dated January 12 2024 about the Arbitration proceeding against Mr. Sanjay Kamalakar Navare an ex-employee we wish to inform you about an update on the said matter / litigation. This is to inform you that in relation to the said arbitration matter between the Company and Mr. Sanjay Kamalakar Navare the parties have amicably settled all of their disputes in accordance with the consent terms dated March 19 2025. The consent terms have been submitted before the Ld. Sole Arbitrator Adv. Sandeep Parikh who has passed the consent award dated March 19 2025. Requisite details are enclosed herewith as Annexure 1.

Corporate Actions

No Upcoming Board Meetings

John Cockerill India Ltd has declared 70% dividend, ex-date: 06 May 24

No Splits history available

No Bonus history available

No Rights history available