Johnson Controls-Hitachi Faces Mixed Technical Indicators Amid Market Evaluation Shift

2025-04-02 08:03:30Johnson Controls-Hitachi Air Conditioning India, a player in the air conditioning industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1,755.20, down from the previous close of 1,785.00. Over the past year, the stock has shown significant resilience, achieving a return of 72.28%, contrasting sharply with the Sensex's modest gain of 2.72% during the same period. In terms of technical metrics, the MACD indicates a mixed outlook, with weekly readings showing mild bullishness while monthly indicators lean towards a bearish stance. The Bollinger Bands present a bearish signal on a weekly basis, while moving averages suggest a mildly bearish trend. Notably, the KST remains bullish on a monthly basis, indicating some underlying strength. When comparing the company's performance to the Sensex, it is evident that Johnson ...

Read More

Johnson Controls-Hitachi Faces Financial Challenges Amid Mixed Performance Indicators

2025-04-02 08:03:12Johnson Controls-Hitachi Air Condition has experienced a recent evaluation adjustment, reflecting shifts in its financial metrics and market position. While the company has shown positive quarterly results, long-term profitability and debt servicing capabilities raise concerns, indicating a complex financial landscape amid mixed performance indicators.

Read MoreJohnson Controls-Hitachi Air Conditioning Faces Mixed Technical Trends Amid Market Evaluation Changes

2025-03-27 08:01:12Johnson Controls-Hitachi Air Conditioning India, a small-cap player in the air conditioning industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,775.00, showing a slight increase from the previous close of 1,761.45. Over the past year, the stock has demonstrated significant resilience, with a return of 79.68%, notably outperforming the Sensex, which recorded a return of 6.65% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective indicates a mildly bearish trend. The Bollinger Bands reflect a sideways movement on a weekly basis, contrasting with a bullish stance on a monthly scale. The KST and OBV metrics are also leaning towards a bullish outlook, indicating positive momentum in the stock's performance. Despite some fluctuations, Johnson Contr...

Read MoreJohnson Controls-Hitachi Air Conditioning India Shows Mixed Technical Trends Amid Market Volatility

2025-03-26 08:01:40Johnson Controls-Hitachi Air Conditioning India has recently undergone an evaluation revision, reflecting shifts in its technical indicators. The company, operating within the small-cap air conditioning sector, has shown a mixed performance across various metrics. Currently priced at 1,761.45, the stock has experienced fluctuations, with a previous close of 1,821.55. Over the past year, it reached a high of 2,620.95 and a low of 950.00. Today's trading saw a high of 1,822.30 and a low of 1,751.05, indicating volatility in its market performance. In terms of technical indicators, the MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly evaluations. Bollinger Bands indicate a bearish stance weekly, contrasting with a bullish outlook monthly. Moving averages reflect a m...

Read MoreJohnson Controls-Hitachi Air Conditioning Shows Mixed Technical Trends Amid Strong Performance

2025-03-25 08:01:57Johnson Controls-Hitachi Air Conditioning India, a small-cap player in the air conditioning industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1821.55, slightly down from the previous close of 1830.00. Over the past year, the company has demonstrated a significant return of 84.32%, outperforming the Sensex, which recorded a return of 7.07% during the same period. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective indicates a mildly bearish stance. The Bollinger Bands reflect a mildly bullish trend on a weekly basis and a bullish outlook monthly. The KST also supports a mildly bullish trend weekly, with a bullish indication monthly. However, moving averages on a daily basis suggest a mildly bearish trend. Despite the mixed signals from various technical indicators, the co...

Read MoreJohnson Controls-Hitachi Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-21 08:01:05Johnson Controls-Hitachi Air Conditioning India, a small-cap player in the air conditioning industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1,830.35, slightly down from the previous close of 1,843.40. Over the past year, the stock has shown significant resilience, achieving a remarkable return of 87.19%, compared to a modest 5.89% return from the Sensex. In terms of technical indicators, the MACD shows a mixed picture with weekly readings leaning mildly bullish while monthly indicators suggest a bearish trend. The Relative Strength Index (RSI) remains neutral on both weekly and monthly scales, indicating a lack of strong momentum. Bollinger Bands reflect a bullish sentiment on both timeframes, while moving averages indicate a mildly bearish stance on a daily basis. The On-Balance Volume (OBV) suggests bullish activit...

Read MoreJohnson Controls-Hitachi Air Conditioning Shows Mixed Technical Trends Amid Market Volatility

2025-03-18 08:01:34Johnson Controls-Hitachi Air Conditioning India has recently undergone an evaluation revision, reflecting notable shifts in its technical indicators. The company operates within the small-cap air conditioning sector and has shown a current price of 1,838.55, slightly above its previous close of 1,824.40. Over the past year, the stock has reached a high of 2,620.95 and a low of 950.00, indicating significant volatility. In terms of technical metrics, the MACD indicates a mildly bullish trend on a weekly basis and a bullish stance monthly. Bollinger Bands also reflect bullish conditions for both weekly and monthly assessments. However, moving averages present a mildly bearish outlook on a daily basis, while the KST shows a bearish trend weekly but bullish monthly. The On-Balance Volume (OBV) suggests no trend weekly, yet a bullish sentiment monthly. When comparing the company's performance to the Sensex, Jo...

Read More

Johnson Controls-Hitachi Air Conditioning Reports Strong Sales Amid Ongoing Financial Challenges

2025-03-18 08:01:29Johnson Controls-Hitachi Air Condition has recently experienced a change in its evaluation, reflecting its financial performance and market conditions. The company reported a 44.09% increase in net sales for Q3 FY24-25 and has shown consistent positive results over the last four quarters, despite facing long-term challenges.

Read More

Johnson Controls-Hitachi Air Conditioning Stock Shows Strong Short-Term Gains Amid Mixed Market Trends

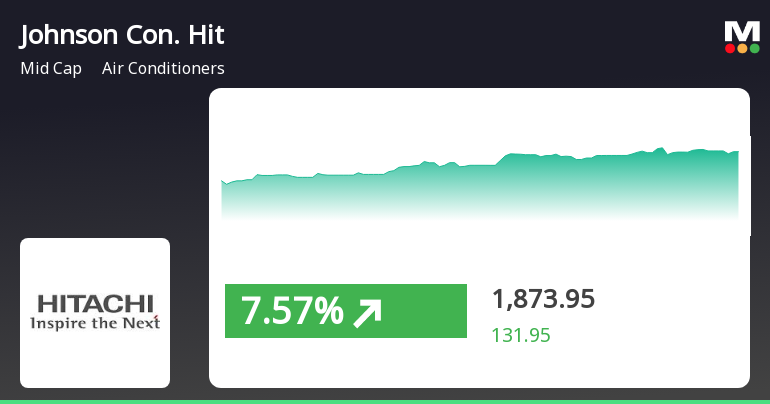

2025-03-13 10:15:15Johnson Controls-Hitachi Air Conditioning in India has shown strong performance, gaining 7.04% on March 13, 2025, and outperforming its sector. The stock has risen consecutively over two days, reaching an intraday high of Rs 1836. It is positioned above several short-term moving averages but below longer-term ones.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

03-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Johnson Controls-Hitachi Air Conditioning India Ltd |

| 2 | CIN NO. | L29300GJ1984PLC007470 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY

EmailId: parag.dave@jci-hitachi.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: rishi.mehta@jci-hitachi.com

Date: 03/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Disclosure Under Regulation 30 Of LODR

21-Mar-2025 | Source : BSEDisclosure under Regulation 30 of LODR is attached.

Financial Results For The Quarter Ended 31St December 2024 Is Attached.

18-Mar-2025 | Source : BSEFinancial Results for the quarter ended 31st December 2024 is attached.

Corporate Actions

No Upcoming Board Meetings

Johnson Controls-Hitachi Air Condition. India Ltd has declared 15% dividend, ex-date: 08 Aug 19

No Splits history available

No Bonus history available

Johnson Controls-Hitachi Air Condition. India Ltd has announced 1:5 rights issue, ex-date: 05 Mar 13