Jubilant Ingrevia Faces Evaluation Shift Amid Mixed Financial Performance and Growth Challenges

2025-03-25 08:22:49Jubilant Ingrevia has recently experienced a change in its evaluation, reflecting a more cautious outlook amid mixed financial performance. Despite a strong annual return, the company faces long-term growth challenges, including declining net sales and operating profit. However, it maintains a solid debt management profile and reported positive Q3 FY24-25 results.

Read MoreJubilant Ingrevia Faces Mixed Technical Trends Amid Strong Yearly Performance

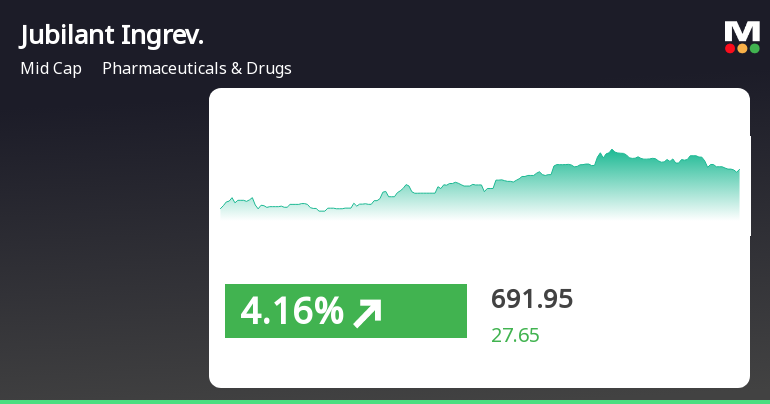

2025-03-21 08:03:08Jubilant Ingrevia, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 702.25, showing a slight increase from the previous close of 698.90. Over the past year, Jubilant Ingrevia has demonstrated a notable return of 58.45%, significantly outperforming the Sensex, which recorded a return of 5.89% in the same period. The technical summary indicates a mixed performance across various metrics. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish stance monthly. Moving averages also reflect a mildly bearish trend on a daily basis. In terms of sto...

Read MoreJubilant Ingrevia's Mixed Performance Highlights Challenges and Opportunities in Pharmaceuticals Sector

2025-03-20 18:00:49Jubilant Ingrevia Ltd, a mid-cap player in the Pharmaceuticals & Drugs industry, has shown notable activity in the stock market today. With a market capitalization of Rs 11,133.00 crore, the company has a price-to-earnings (P/E) ratio of 54.20, significantly higher than the industry average of 36.93. Over the past year, Jubilant Ingrevia has outperformed the Sensex, delivering a remarkable 58.45% return compared to the Sensex's 5.89%. In the short term, the stock has experienced a daily increase of 0.48%, although this is below the Sensex's rise of 1.19%. Weekly performance stands at 4.65%, surpassing the Sensex's 3.41%. However, the stock has faced challenges in the longer term, with a year-to-date decline of 14.71%, while the Sensex has decreased by only 2.29%. Technical indicators present a mixed picture, with the MACD showing bearish signals on a weekly basis but mildly bullish on a monthly basis. Ov...

Read More

Jubilant Ingrevia Shows Strong Debt Management Amid Long-Term Growth Concerns

2025-03-19 08:10:59Jubilant Ingrevia, a midcap player in the Pharmaceuticals & Drugs sector, recently experienced a change in evaluation. The company reported strong financial performance for the quarter ending December 2024, with impressive debt servicing capabilities and high operating profit ratios, despite facing challenges in long-term growth and modest profit increases.

Read MoreJubilant Ingrevia Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-19 08:05:04Jubilant Ingrevia, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 685.40, showing a notable increase from the previous close of 668.45. Over the past year, Jubilant Ingrevia has demonstrated a strong performance with a return of 55.86%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the company presents a mixed picture. The MACD shows bearish signals on a weekly basis while indicating a mildly bullish trend monthly. The Bollinger Bands reflect a mildly bearish stance weekly but are bullish on a monthly basis. Moving averages suggest a mildly bullish trend on a daily basis, while the KST indicates a bearish weekly trend but a bullish monthly outlook. The company's performance over various time frame...

Read More

Jubilant Ingrevia's Strong Performance Highlights Small-Cap Resilience in Pharmaceuticals Sector

2025-03-07 11:35:57Jubilant Ingrevia has demonstrated strong performance in the Pharmaceuticals & Drugs sector, gaining 6.06% on March 7, 2025, and achieving a total return of 21.68% over four consecutive days. The stock is currently above several moving averages, reflecting mixed momentum, while the broader market shows positive trends.

Read More

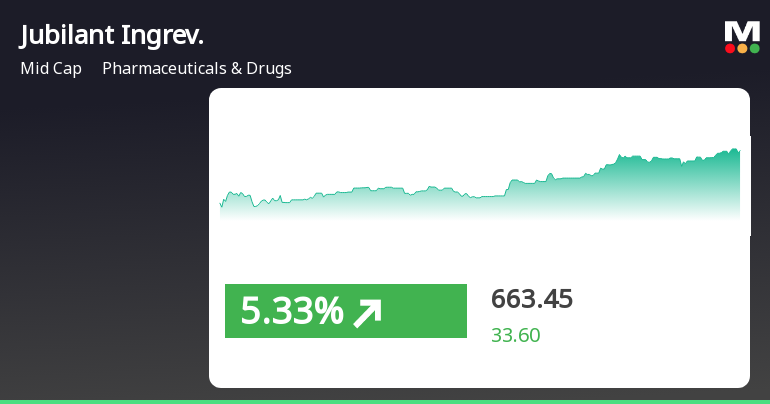

Jubilant Ingrevia's Recent Gains Highlight Mixed Trends in Pharmaceuticals Sector

2025-03-06 13:50:23Jubilant Ingrevia, a midcap in the Pharmaceuticals & Drugs sector, gained 5.28% on March 6, 2025, outperforming its sector. The stock has seen a total return of 14.53% over three days, though it remains below several long-term moving averages and has declined over the past month and year-to-date.

Read MoreJubilant Ingrevia's Technical Indicators Reflect Mixed Market Sentiment and Trends

2025-03-06 08:03:06Jubilant Ingrevia, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 629.85, showing a notable increase from the previous close of 603.30. Over the past year, Jubilant Ingrevia has demonstrated a return of 31.96%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands present a mildly bearish signal weekly but suggest bullishness on a monthly scale. Daily moving averages lean mildly bullish, contrasting with the bearish signals from the KST and Dow Th...

Read MoreJubilant Ingrevia Faces Mixed Technical Trends Amid Market Volatility

2025-03-05 08:03:33Jubilant Ingrevia, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 603.30, showing a notable change from its previous close of 579.00. Over the past week, the stock has experienced a high of 613.15 and a low of 569.70, indicating some volatility. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands indicate a bearish stance weekly, contrasting with a mildly bullish monthly perspective. Moving averages present a mildly bullish trend on a daily basis, while the KST reflects a bearish weekly trend but a bullish monthly outlook. The On-Balance Volume (OBV) and Dow Theory both indicate a mildly...

Read MoreIntimation Of Record Date For Maturity Of Commercial Paper

08-Apr-2025 | Source : BSEIntimation of Record Date for maturity of commercial paper

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliances-Certificates under Reg 74 (5) of SEBI (DP) Regulation

Announcement under Regulation 30 (LODR)-Issue of Securities

08-Apr-2025 | Source : BSEIssue of Securities

Corporate Actions

No Upcoming Board Meetings

Jubilant Ingrevia Ltd has declared 250% dividend, ex-date: 03 Feb 25

No Splits history available

No Bonus history available

No Rights history available