Julien Agro Infratech Faces Significant Volatility Amid Declining Investor Confidence

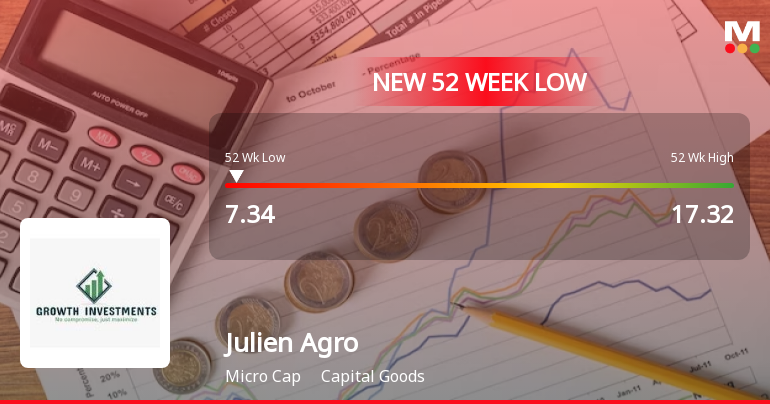

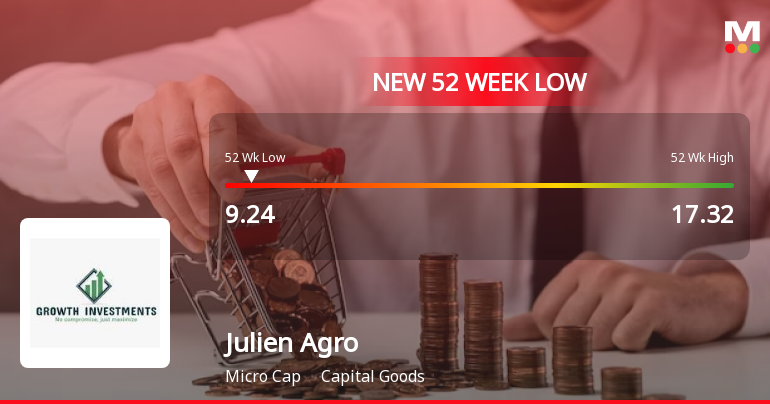

2025-03-27 10:03:41Julien Agro Infratech, a microcap in the capital goods sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has declined 45.69% over the past year, with diminishing promoter confidence and challenging financial metrics despite recent profit growth.

Read More

Julien Agro Infratech Faces Significant Volatility Amid Declining Promoter Confidence and Market Performance

2025-03-27 10:03:37Julien Agro Infratech, a microcap in the capital goods sector, has hit a new 52-week low, reflecting substantial volatility and underperformance compared to its sector. The stock has declined significantly over the past year, while promoter confidence has weakened. Despite recent profit growth, the overall sentiment remains cautious.

Read More

Julien Agro Infratech Faces Market Pressures Amid Significant Stock Volatility

2025-03-27 10:03:34Julien Agro Infratech, a microcap in the capital goods sector, has hit a new 52-week low, reflecting substantial volatility and underperformance compared to its sector. The stock has declined significantly over the past year, with recent financial metrics indicating weak returns and diminishing promoter confidence amid ongoing market challenges.

Read More

Julien Agro Infratech Faces Significant Volatility Amid Declining Stock Performance

2025-03-27 10:03:29Julien Agro Infratech, a microcap in the capital goods sector, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and has seen a substantial decline over the past year. Financial metrics indicate challenges, including low return on equity and decreasing promoter confidence.

Read More

Julien Agro Infratech Faces Significant Volatility Amidst Declining Market Confidence

2025-03-26 15:41:03Julien Agro Infratech, a microcap in the capital goods sector, has hit a new 52-week low, underperforming its sector significantly. The stock is trading below all major moving averages and has seen a substantial decline over the past year, while promoter confidence has decreased with a notable reduction in stake.

Read More

Julien Agro Infratech Faces Significant Volatility Amid Broader Market Downturn

2025-03-26 15:40:53Julien Agro Infratech, a microcap in the capital goods sector, reached a new 52-week low amid significant market volatility. The stock has declined 40.68% over the past year, contrasting with the Sensex's gains. Despite a recent profit increase, concerns about valuation and reduced promoter stake persist.

Read More

Julien Agro Infratech Hits 52-Week Low Amid Broader Market Gains and Stake Reductions

2025-03-24 14:35:21Julien Agro Infratech, a microcap in the capital goods sector, has reached a new 52-week low after recent gains. The stock has underperformed its sector significantly this year and is trading below key moving averages. Promoter confidence is declining, with a notable reduction in their stake despite recent profit growth.

Read More

Julien Agro Infratech Faces Market Challenges Amid Declining Stakeholder Confidence

2025-03-19 10:07:24Julien Agro Infratech, a microcap in the capital goods sector, is struggling with significant market challenges, nearing its 52-week low and experiencing a 15.1% decline over the past week. The company has seen a 33.06% drop in performance over the year, alongside reduced promoter confidence and unfavorable financial metrics.

Read More

Julien Agro Infratech Faces Significant Volatility Amid Broader Market Resilience

2025-03-18 11:36:33Julien Agro Infratech, a microcap in the capital goods sector, has hit a new 52-week low and has seen a significant decline over the past six days. The company's financial health is under pressure, with low return on equity and a decrease in promoter stake, contrasting with a resilient broader market.

Read MoreAnnouncement under Regulation 30 (LODR)-Raising of Funds

05-Apr-2025 | Source : BSEAllotment of 20000000(Two crores) warrants each carrying a right to subscribe to 1(one) equity share at an exercise price of Rs. 13.50/-(Rupees Thirteen and Fifty paise) only per equity share aggregating to Rs.270000000/-(Rupees Twenty Seven Crores) only for cash on receipt of 25% of the warrants subscription amount i.e. Rs. 67500000/-(Rupees Six crores and Seventy-Five lakhs) only.

Announcement under Regulation 30 (LODR)-Allotment

05-Apr-2025 | Source : BSEpursuant to the Special Resolution passed by the Shareholders of the Company on February 25 2025 through Postal Ballot and In- principal approval granted by BSE on March 25 2025 and on receipt of 25% of the issue price against 20000000 fully Convertible Equity warrants (Warrants) issued at Rs. 13.50/- aggregating to Rs. 27000000/-(Rupees Twenty-Seven crores) only which will be convertible in equal number of equity shares having face value of Rs. 5/- (Rupees Five only) each along with premium Rs. 8.50/-(Rupee Eight and Fifty paise only) the Board has allotted 20000000 Fully Convertible Equity warrants to the person(s) belonging to Non- Promoter Group category(as per the list enclosed as Annexure-I)

Board Meeting Outcome for Outcome Of Board Meeting Held On April 05 2025

05-Apr-2025 | Source : BSEPlease find enclosed herewith outcome of the board meeting

Corporate Actions

No Upcoming Board Meetings

Julien Agro Infratech Ltd has declared 1% dividend, ex-date: 07 Feb 25

Julien Agro Infratech Ltd has announced 5:10 stock split, ex-date: 08 Jan 25

No Bonus history available

No Rights history available