Juniper Hotels Faces Mixed Technical Indicators Amid Market Volatility and Challenges

2025-04-02 08:10:45Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 258.65, has shown a notable fluctuation in its performance metrics. Over the past week, the stock returned -3.49%, underperforming the Sensex, which recorded a -2.55% return. In the one-month period, however, Juniper Hotels managed a slight gain of 1.04%, contrasting with the Sensex's 3.86% increase. The company's technical indicators present a mixed picture. The MACD on a weekly basis indicates a mildly bullish trend, while the daily moving averages suggest a bearish sentiment. The Bollinger Bands also reflect a mildly bearish stance on a weekly basis. Notably, the stock has experienced significant volatility, with a 52-week high of 538.00 and a low of 224.50. In terms of longer-term performance, Juniper Hotels has fa...

Read MoreJuniper Hotels Faces Bearish Technical Trends Amid Market Volatility and Declining Performance

2025-03-28 08:04:16Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 247.65, down from a previous close of 260.35, with a notable 52-week high of 538.00 and a low of 224.50. Today's trading saw a high of 258.80 and a low of 242.90, indicating some volatility. The technical summary for Juniper Hotels reveals a bearish sentiment across several indicators. The MACD and Bollinger Bands are both signaling bearish trends on a weekly basis, while moving averages also reflect a bearish stance. The On-Balance Volume (OBV) shows a mildly bearish trend, suggesting a cautious outlook among market participants. In terms of performance, Juniper Hotels has faced challenges compared to the Sensex. Over the past week, the stock has returned -9.37%, while the Sensex has gained 1.65%. Year-to-date, ...

Read More

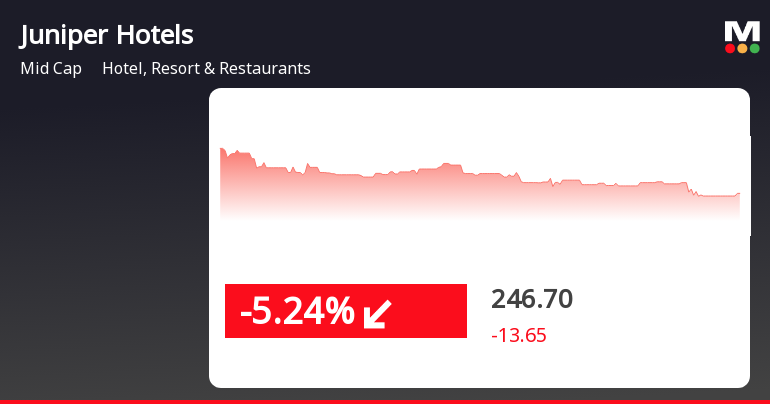

Juniper Hotels Faces Significant Stock Decline Amid Broader Market Resilience

2025-03-27 12:50:27Juniper Hotels has faced a notable decline, with shares dropping significantly today and underperforming against the broader market. Over the past four days, the stock has seen a cumulative decline, trading below key moving averages, while the Sensex has shown resilience and positive momentum.

Read More

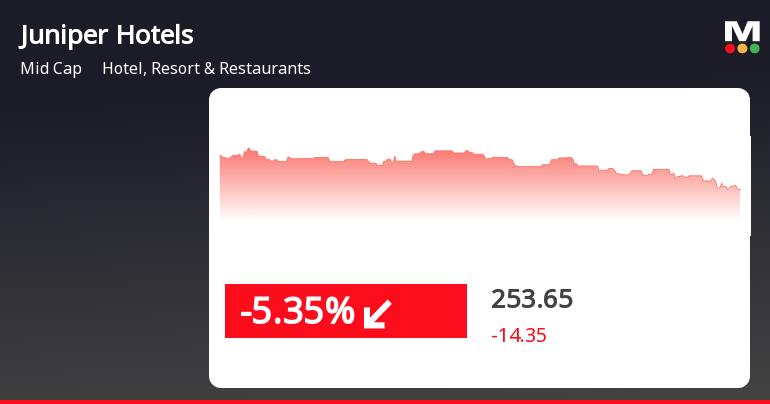

Juniper Hotels Faces Significant Stock Decline Amid Broader Market Challenges

2025-03-26 14:50:27Juniper Hotels has faced a notable decline, with shares dropping significantly and underperforming its sector. The stock has shown a cumulative loss over three days and is trading below key moving averages. In the broader market, the Sensex has experienced a slight downturn but remains resilient overall.

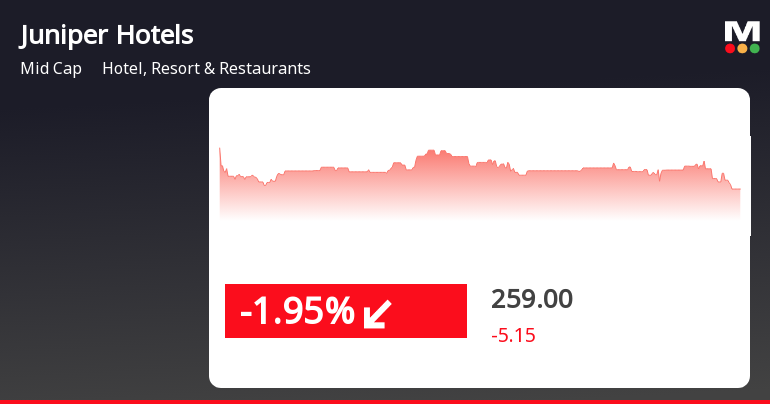

Read MoreJuniper Hotels Faces Mixed Technical Signals Amidst Market Volatility and Declining Performance

2025-03-26 08:05:15Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 268.00, down from a previous close of 271.65, with a notable 52-week high of 538.00 and a low of 224.50. Today's trading saw a high of 279.40 and a low of 268.00, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the moving averages indicate a bearish stance. The Bollinger Bands present a bearish outlook on a weekly basis, and the KST is also bearish. The On-Balance Volume (OBV) reflects a mildly bullish trend weekly but shifts to mildly bearish on a monthly scale. In terms of performance, Juniper Hotels has faced challenges compared to the Sensex. Over the past year, the stock has declined by 46.86%, ...

Read MoreJuniper Hotels Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-21 08:03:29Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 273.25, down from a previous close of 282.80, with a notable 52-week high of 538.00 and a low of 224.50. Today's trading saw a high of 286.50 and a low of 271.25, indicating some volatility. The technical summary for Juniper Hotels reveals a bearish sentiment across several indicators. The MACD and KST metrics are both bearish on a weekly basis, while the moving averages also reflect a bearish trend. The Bollinger Bands indicate a mildly bearish stance on a weekly basis, and the On-Balance Volume shows a mildly bullish trend in the short term but shifts to mildly bearish over the monthly perspective. In terms of performance, Juniper Hotels has shown a mixed return profile compared to the Sensex. Over the past wee...

Read MoreJuniper Hotels Shows Short-Term Resilience Amid Mixed Technical Indicators

2025-03-20 08:04:24Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 282.80, showing a notable increase from the previous close of 275.45. Over the past week, the stock has demonstrated a return of 7.06%, significantly outperforming the Sensex, which returned 1.92% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show no clear trend. The Relative Strength Index (RSI) for the weekly timeframe indicates no signal, suggesting a period of consolidation. Bollinger Bands and moving averages also reflect a mildly bearish sentiment on a daily basis. Looking at the broader performance, Juniper Hotels has faced challenges over the past year, with a return of -38.16%, contrasting sharply with the Sensex's gain of 4.77%. How...

Read MoreJuniper Hotels Opens Strong with 7.36% Gain Amid Market Volatility

2025-03-18 09:50:23Juniper Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has shown significant activity today, opening with a gain of 7.36%. The stock reached an intraday high of Rs 285, reflecting a notable increase in volatility with an intraday fluctuation of 5.67%. Over the past two days, Juniper Hotels has demonstrated a positive trend, accumulating returns of 4.63%. In terms of performance metrics, Juniper Hotels has outperformed the Sensex today, with a 1-day gain of 2.09% compared to the Sensex's 0.81%. Over the past month, the stock has surged by 15.42%, contrasting sharply with the Sensex's decline of 1.57%. When examining moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages. The broader sector of Hotel, Resort & Restaurants has also seen positive movement, gaining 2.43% today. Overall, Juniper Hotels continu...

Read More

Juniper Hotels Faces Turbulent Market Conditions Amid Broader Industry Challenges

2025-03-12 13:35:26Juniper Hotels has faced a notable decline in its stock performance, significantly underperforming the broader market. The stock has shown mixed trends in moving averages and has experienced a substantial drop over the past three months and year, reflecting challenges within the hotel and restaurant industry.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find enclosed certificate under Regulation 74(5) 0f SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEPlease find the letter enclosed for Closure of Trading Window

Announcement under Regulation 30 (LODR)-Updates on Acquisition

18-Mar-2025 | Source : BSEPlease refer the attached letter

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available