Jupiter Life Line Hospitals Shows Mixed Technical Trends Amid Strong Market Performance

2025-04-01 08:03:42Jupiter Life Line Hospitals, a midcap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1584.00, showing a notable increase from the previous close of 1555.75. Over the past year, the stock has demonstrated a robust performance with a return of 32.24%, significantly outpacing the Sensex, which recorded a return of 5.11% in the same period. In terms of technical indicators, the Moving Averages signal a bullish trend on a daily basis, while the Bollinger Bands indicate a mildly bullish stance on a weekly basis. However, the MACD and KST metrics suggest a mildly bearish outlook on a weekly basis, indicating mixed signals in the short term. The On-Balance Volume (OBV) shows a bullish trend on a monthly scale, while the Dow Theory reflects a bullish trend on a weekly basis. The company's pe...

Read More

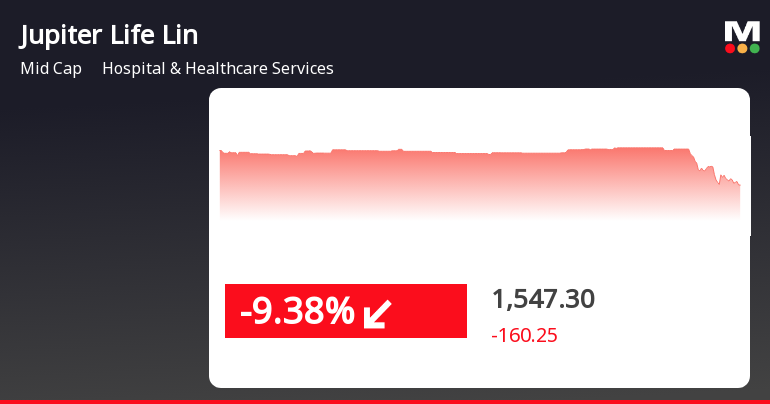

Jupiter Life Line Hospitals Faces Volatility Amidst Strong Long-Term Performance Trends

2025-03-27 14:35:35Jupiter Life Line Hospitals faced notable volatility on March 27, 2025, with a significant decline following a nine-day gain streak. Despite today's downturn, the stock has shown resilience over the past month and year, outperforming the sector and maintaining a position above key moving averages. The broader market is also recovering.

Read More

Jupiter Life Line Hospitals Shows Strong Financial Growth and Operational Efficiency

2025-03-27 08:13:21Jupiter Life Line Hospitals has recently adjusted its evaluation, highlighting changes in performance indicators. The company reported Q3 FY24-25 net sales of Rs 643.22 crore, a 20.05% increase, and achieved a high operating profit margin of 23.39%. Strong institutional holdings reflect confidence in its fundamentals.

Read MoreJupiter Life Line Hospitals Shows Strong Technical Trends Amid Market Dynamics

2025-03-27 08:04:10Jupiter Life Line Hospitals, a midcap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1707.55, showing a slight increase from the previous close of 1693.35. Over the past year, the stock has demonstrated a notable performance, with a return of 44.94%, significantly outpacing the Sensex's return of 6.65% during the same period. In terms of technical indicators, the weekly MACD and Dow Theory signal a bullish trend, while the daily moving averages also reflect a positive outlook. The On-Balance Volume (OBV) indicates bullish momentum, suggesting strong buying interest. However, the weekly KST remains mildly bearish, indicating some caution in the market. The stock has experienced a 52-week high of 1,759.00 and a low of 1,069.45, with today's trading reaching a high of 1750.00 and a low...

Read More

Jupiter Life Line Hospitals Achieves 52-Week High Amid Strong Market Performance

2025-03-25 09:44:40Jupiter Life Line Hospitals has achieved a new 52-week high stock price of Rs. 1722.8, following a strong performance with a notable increase over the past eight days. The company has significantly outperformed its sector and delivered impressive returns over the past year, highlighting its strong position in the healthcare market.

Read More

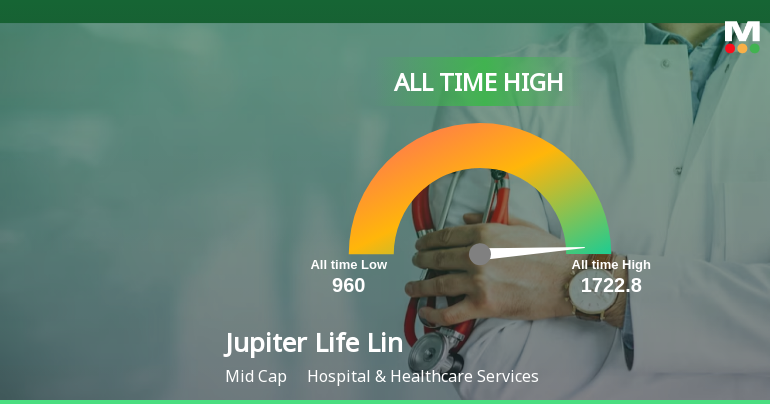

Jupiter Life Line Hospitals Stock Reaches All-Time High, Signaling Strong Market Confidence

2025-03-25 09:33:25Jupiter Life Line Hospitals has reached an all-time high stock price of Rs. 1722.8, reflecting strong performance in the Hospital & Healthcare Services sector. The stock has shown significant gains over the past week and year, outperforming the broader market indices and indicating a robust upward trend.

Read More

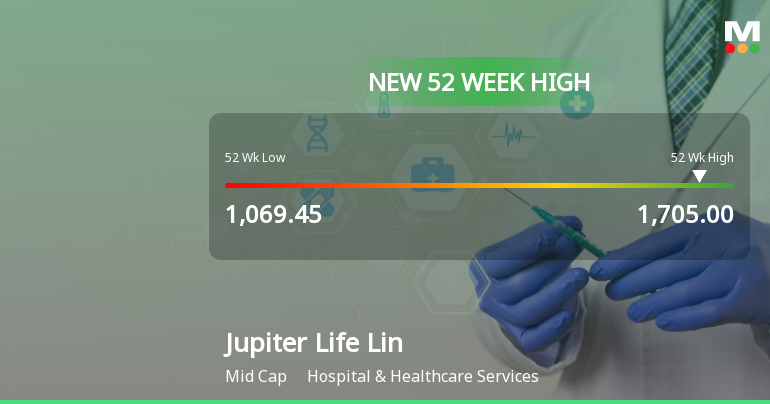

Jupiter Life Line Hospitals Achieves 52-Week High Amid Strong Market Activity

2025-03-24 09:42:59Jupiter Life Line Hospitals' stock reached a new 52-week high of Rs. 1705, following a six-day gain streak. The stock is trading above multiple moving averages, indicating strong performance. In the broader market, the Sensex opened higher, with small-cap stocks showing notable gains over recent weeks.

Read MoreJupiter Life Line Hospitals Shows Mixed Technical Trends Amid Strong Performance Surge

2025-03-18 08:04:49Jupiter Life Line Hospitals, a midcap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,524.55, showing a notable increase from the previous close of 1,499.75. Over the past week, the stock has demonstrated a return of 1.98%, significantly outperforming the Sensex, which recorded a mere 0.07% return during the same period. In terms of performance metrics, Jupiter Life Line Hospitals has achieved a 36.58% return over the past year, while the Sensex has only seen a 2.10% increase. This strong performance is particularly noteworthy given the broader market trends, as the stock has also managed to deliver a positive return of 2.44% over the last month, contrasting with a decline of 2.40% in the Sensex. The technical summary indicates mixed signals, with the Moving Averages showing a mild...

Read MoreJupiter Life Line Hospitals Adjusts Valuation Amid Competitive Healthcare Landscape

2025-03-13 08:00:56Jupiter Life Line Hospitals has recently undergone a valuation adjustment, reflecting its current standing in the Hospital & Healthcare Services industry. The company's price-to-earnings ratio stands at 50.82, while its price-to-book value is noted at 7.76. Other key financial metrics include an EV to EBIT ratio of 41.70 and an EV to EBITDA ratio of 34.19, indicating a robust operational performance. In terms of returns, Jupiter Life Line Hospitals has shown a year-to-date performance of -3.95%, which is slightly better than the Sensex's decline of -5.26% over the same period. Over the past year, the company has outperformed the Sensex, achieving a return of 21.97% compared to the index's modest gain of 0.49%. When compared to its peers, Jupiter Life Line Hospitals presents a competitive valuation landscape. For instance, Dr. Agarwal's Healthcare and Vijaya Diagnostics are positioned at higher valuation l...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Apr-2025 | Source : BSEPursuant to the Regulation 30 (6) read with Schedule III (Part A) (15) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform you that the officials of the Company will be attending the investor conference on April 10 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March31 2025

Execution Of Loan Agreement

24-Mar-2025 | Source : BSEJupiter Life Line Hospitals Limited (JLHL/Company) and Jupiter Hospitals Projects Private Limited material subsidiary of the Company has entered into Loan Agreement with HDFC Bank Limited.

Corporate Actions

No Upcoming Board Meetings

Jupiter Life Line Hospitals Ltd has declared 10% dividend, ex-date: 02 Aug 24

No Splits history available

No Bonus history available

No Rights history available