Jupiter Wagons Ltd Sees Surge in Trading Activity Amid Positive Market Trends

2025-03-26 10:00:04Jupiter Wagons Ltd (JWL), a prominent player in the auto ancillary sector, has emerged as one of the most active stocks today, showcasing significant trading activity. The company reported a total traded volume of 3,224,563 shares, with a total traded value of approximately Rs 120.52 crores. The stock opened at Rs 363.5 and reached a day high of Rs 382.0, reflecting a notable intraday increase of 4.74%. The last traded price stood at Rs 366.75, marking a 1.18% gain for the day, outperforming its sector, which recorded a 1D return of 0.87%. Jupiter Wagons' performance metrics indicate that it is currently above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day averages. The stock's liquidity is also noteworthy, with a delivery volume of 174,500 shares on March 25, representing a 6.4% increase compared to the 5-day average delivery volume. With a market capitali...

Read MoreJupiter Wagons Faces Technical Trend Shifts Amid Market Volatility and Performance Evaluation

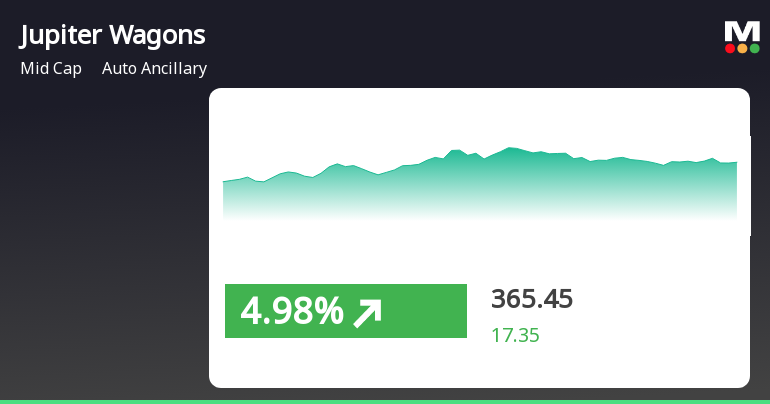

2025-03-25 08:00:26Jupiter Wagons, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 365.05, showing a notable increase from the previous close of 348.10. Over the past week, the stock has reached a high of 374.00 and a low of 353.35, indicating some volatility in trading. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands and moving averages also suggest a mildly bearish sentiment, aligning with the overall technical summary. When examining the company's performance against the Sensex, Jupiter Wagons has demonstrated significant returns over various periods. In the last week, the stock returned 25.49%, c...

Read MoreJupiter Wagons Ltd Sees Surge in Trading Volume and Investor Participation

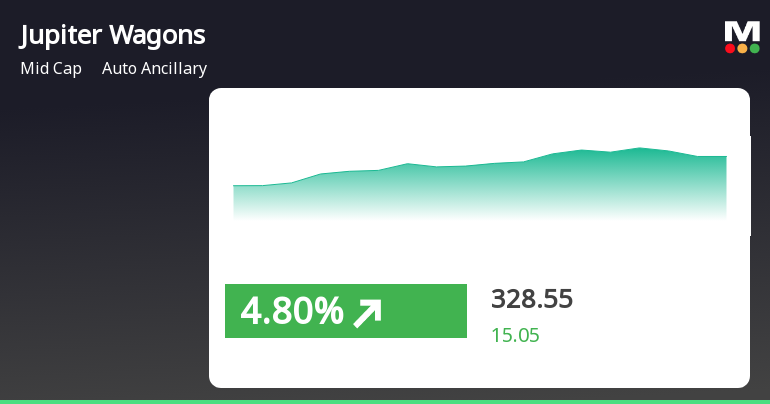

2025-03-24 10:00:04Jupiter Wagons Ltd, a mid-cap player in the auto ancillary industry, has emerged as one of the most active equities today, with a total traded volume of 5,120,864 shares and a total traded value of approximately Rs 185.69 crores. The stock opened at Rs 353.7 and reached an intraday high of Rs 371.0, reflecting a notable performance with a day’s return of 5.55%, significantly outperforming its sector, which saw a return of 1.23%. The stock has shown a positive trend, gaining for the last two consecutive days and delivering a total return of 15.95% during this period. Notably, the delivery volume surged to 31.37 lakh shares on March 21, marking an increase of 268.94% compared to the five-day average delivery volume, indicating rising investor participation. In terms of moving averages, Jupiter Wagons' stock is currently above the 5-day, 20-day, and 50-day moving averages, although it remains below the 100-d...

Read More

Jupiter Wagons Shows Resilience with Significant Gains Amidst Broader Market Trends

2025-03-24 09:45:13Jupiter Wagons, a midcap auto ancillary company, has demonstrated notable performance, gaining 6.45% on March 24, 2025, and achieving a total return of 16.09% over two days. The stock is currently above its short-term moving averages, reflecting its strength in a rising market environment.

Read MoreJupiter Wagons Ltd Sees Surge in Trading Volume Amid Notable Market Activity

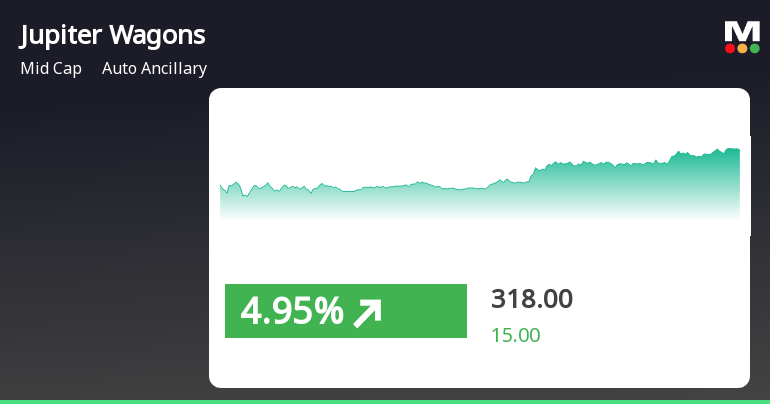

2025-03-21 14:00:04Jupiter Wagons Ltd, a prominent player in the auto ancillary industry, has emerged as one of the most active stocks today, with a total traded volume of approximately 27 million shares and a total traded value of around Rs 94.56 crore. The stock opened at Rs 313.9 and reached an intraday high of Rs 362.8, reflecting a significant increase of 15.73% from its previous close of Rs 313.5. The stock's performance today has outpaced its sector by 9.53%, showcasing its strong market position. Jupiter Wagons has traded within a wide range of Rs 50.75, indicating notable volatility. The weighted average price suggests that more volume was traded closer to the lower end of this range. Additionally, the stock is currently above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Investor participation has also seen a rise, with delivery volume increasing ...

Read MoreJupiter Wagons Ltd Sees Surge in Trading Activity and Performance Metrics

2025-03-21 14:00:04Jupiter Wagons Ltd (JWL), a prominent player in the auto ancillary sector, has emerged as one of the most active equities today, showcasing significant trading activity. The stock recorded a total traded volume of 26,966,452 shares, with a total traded value of approximately Rs 94.1 crore. Opening at Rs 313.9, JWL reached an intraday high of Rs 362.8, reflecting a notable increase of 15.73% from its previous close of Rs 313.5. The stock also experienced a wide trading range of Rs 50.75 throughout the day. In terms of performance, Jupiter Wagons outperformed its sector by 9.53%, with a one-day return of 10.61%, while the sector and Sensex reported returns of 1.35% and 0.60%, respectively. The stock's liquidity remains robust, with a delivery volume of 9.52 lakh shares on March 20, marking a 22.63% increase compared to the five-day average delivery volume. Additionally, JWL's weighted average price indicates...

Read More

Jupiter Wagons Shows Resilience Amid Market Fluctuations and High Volatility

2025-03-21 09:30:14Jupiter Wagons, a midcap auto ancillary company, has shown notable activity with a significant intraday performance. The stock reached an intraday high and demonstrated high volatility. While it is above some short-term moving averages, it remains below longer-term averages, reflecting mixed trends amid broader market fluctuations.

Read More

Jupiter Wagons Shows Signs of Momentum Amid Broader Midcap Market Gains

2025-03-19 13:00:16Jupiter Wagons, a midcap auto ancillary company, has experienced significant gains recently, outperforming its sector. The stock has shown consecutive increases over two days and reached an intraday high. Despite past challenges, its recent performance suggests a potential shift in market momentum amid broader positive trends.

Read More

Jupiter Wagons Faces Decline Amid Broader Market Challenges and Mixed Performance Indicators

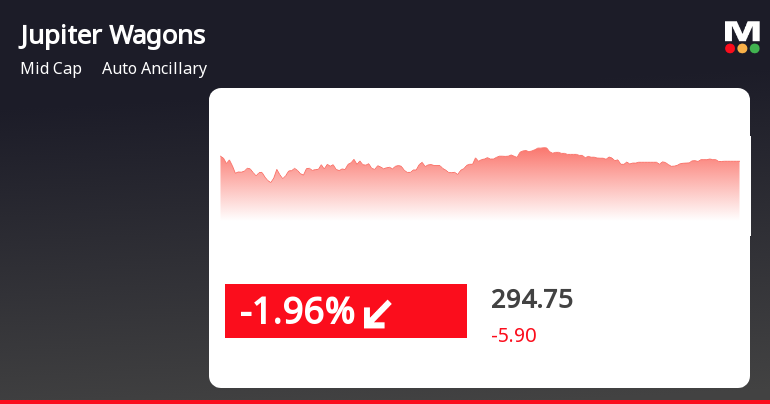

2025-03-10 15:30:14Jupiter Wagons, an auto ancillary company, saw a decline on March 10, 2025, ending a four-day gain streak. The stock's performance is mixed against various moving averages. The broader market also faced challenges, with the Sensex experiencing a notable drop after an initial rise.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Jupiter Wagons Ltd |

| 2 | CIN NO. | L28100MP1979PLC049375 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 5.35 |

| 4 | Highest Credit Rating during the previous FY | AA- |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY AND COMPLIANCE OFFICER

EmailId: cs@jupiterwagons.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: sanjiv.keshri@jupiterwagons.com

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find the enclosed Reconciliation of share Capital Audit Report for the quarter ended 31.03.2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEPlease find the enclosed compliance certificate for the quarter ended 31.03.2025.

Corporate Actions

No Upcoming Board Meetings

Jupiter Wagons Ltd has declared 10% dividend, ex-date: 07 Oct 24

No Splits history available

No Bonus history available

No Rights history available