Jyoti Resins Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-02 08:05:19Jyoti Resins and Adhesives, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1260.10, showing a slight increase from the previous close of 1224.80. Over the past year, the stock has experienced a decline of 14.14%, contrasting with a modest gain of 2.72% in the Sensex during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Bollinger Bands and moving averages also indicate a mildly bearish trend, highlighting some caution in the stock's performance. The KST presents a mixed picture, with a mildly bullish weekly reading but a bearish monthly outlook. Despite recent fluctuations, Jyoti Resins has demonstrated resilience over longer periods, with a remarkable 3309.36% retur...

Read MoreJyoti Resins Faces Technical Trend Shifts Amid Market Volatility and Bearish Indicators

2025-03-27 08:01:48Jyoti Resins and Adhesives, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1240.05, down from a previous close of 1266.00, with a 52-week high of 1,635.00 and a low of 1,148.00. Today's trading saw a high of 1278.80 and a low of 1240.05, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance weekly, with moving averages indicating a similar trend. The KST presents a mildly bullish outlook weekly but shifts to mildly bearish on a monthly basis. Notably, the Dow Theory indicates no trend on a weekly basis, while the monthly view is mildly bearish. In terms of performance, Jyoti Resins has shown varied re...

Read MoreJyoti Resins Faces Technical Trend Shifts Amid Market Volatility and Mixed Indicators

2025-03-24 08:01:20Jyoti Resins and Adhesives, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1265.30, showing a notable shift from its previous close of 1232.05. Over the past week, the stock reached a high of 1289.00 and a low of 1228.05, indicating some volatility. In terms of technical indicators, the MACD suggests a bearish stance on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands and moving averages also reflect a mildly bearish trend, aligning with the overall technical summary. The KST indicates a bearish trend on a weekly basis, while Dow Theory presents a mildly bullish outlook for the week but shifts to mildly bearish on a monthly basis. When comparing the stock's perfor...

Read More

Jyoti Resins Hits 52-Week Low Amid Ongoing Market Struggles and Declining Performance

2025-03-03 10:06:47Jyoti Resins and Adhesives, a small-cap chemicals company, has reached a new 52-week low, reflecting a significant decline over recent days. The stock has underperformed its sector and is trading below multiple moving averages, indicating ongoing challenges in its market performance over the past year.

Read More

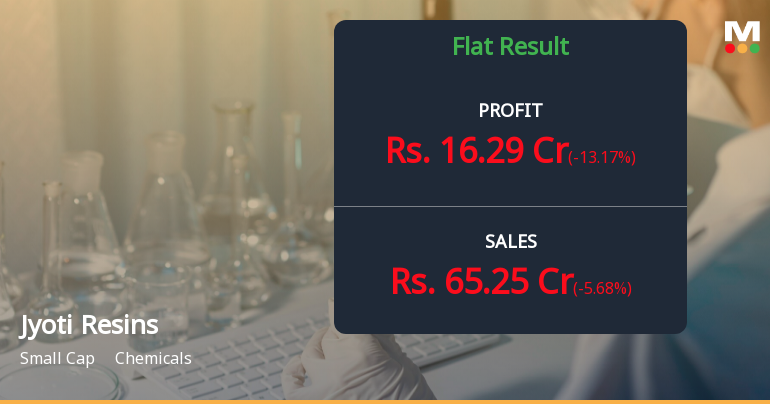

Jyoti Resins Reports Record PAT and EPS for Q3 FY24-25, Indicating Financial Strength

2025-01-30 20:01:39Jyoti Resins and Adhesives has reported strong financial results for the quarter ending December 2024, with a Profit After Tax of Rs 19.06 crore and Earnings per Share of Rs 15.88, both representing the highest figures in the last five quarters, indicating improved profitability and financial health.

Read More

Jyoti Resins Hits 52-Week Low Amid Broader Chemicals Sector Decline

2025-01-28 12:05:17Jyoti Resins and Adhesives has reached a new 52-week low, continuing a downward trend with a 5.85% decline over three days. The stock is trading below all key moving averages, reflecting persistent bearish sentiment, while the broader chemicals sector has also faced challenges amid a fluctuating market.

Read More

Jyoti Resins Hits 52-Week Low Amid Broader Chemicals Sector Decline

2025-01-27 10:05:28Jyoti Resins and Adhesives has reached a new 52-week low, reflecting a significant decline over the past two days. The stock is trading below multiple moving averages, indicating a sustained downward trend. Over the past year, the company has underperformed compared to the broader market, facing ongoing challenges.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSETrading Window of the company will remain closed for all Insiders Directors Promoters and Designated Persons of the company from Tuesday 01st April 2025 till the expiry of 48 hours after the declaration of the Audited Financial Results for the Fourth Quarter and Year Ended on 31st March 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

22-Mar-2025 | Source : BSEThe Management of the Company is having a meeting with Analyst/Investor Meet on 25.03.2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

19-Mar-2025 | Source : BSEONE ON ONE MEETING WITH ANALYST/INSTITUTIONAL INVESTOR ON 19.03.2025.

Corporate Actions

No Upcoming Board Meetings

Jyoti Resins and Adhesives Ltd has declared 90% dividend, ex-date: 23 Sep 24

No Splits history available

Jyoti Resins and Adhesives Ltd has announced 2:1 bonus issue, ex-date: 08 Sep 22

No Rights history available