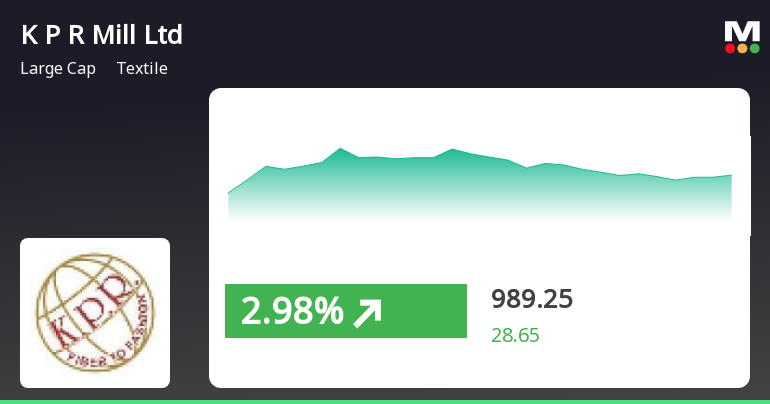

K P R Mill's Strong Performance Highlights Resilience in Textile Sector Amid Market Volatility

2025-04-03 09:30:31K P R Mill has demonstrated strong performance in the textile sector, gaining 4.89% on April 3, 2025, and achieving a total return of 13.12% over two days. The stock is trading above all key moving averages and has shown significant growth over the past month and five years.

Read More

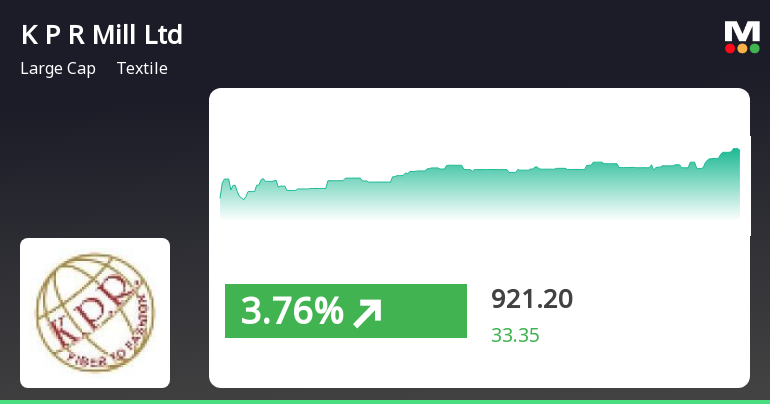

K P R Mill Shows Signs of Trend Reversal Amid Broader Market Gains

2025-04-02 13:15:21K P R Mill, a key player in the textile sector, experienced a notable increase on April 2, 2025, following a series of declines. The stock's performance is mixed in relation to various moving averages, while the broader market indices, including the Sensex, continue to rise.

Read More

K P R Mill Faces Short-Term Challenges Amid Long-Term Growth Trajectory

2025-03-28 15:35:23K P R Mill, a key player in the textile sector, faced a decline on March 28, 2025, marking its second consecutive day of losses. Despite recent challenges, the stock has shown significant long-term growth, outperforming the broader market over the past five years.

Read More

K P R Mill Ltd Shows Strong Fundamentals Amid Mildly Bearish Market Sentiment

2025-03-18 08:13:47K P R Mill Ltd, a key player in the textile sector, has recently seen an evaluation adjustment reflecting its market position. The company showcases strong fundamentals, with a notable Return on Equity of 21.33% and a low Debt to Equity ratio of 0.05, indicating sound financial management.

Read More

K P R Mill Faces Potential Trend Reversal Amid Mixed Market Signals

2025-03-17 12:45:20K P R Mill, a key player in the textile sector, saw a decline on March 17, 2025, following a four-day gain streak. The stock's performance has been mixed, with a year-to-date drop contrasting with significant long-term growth. Meanwhile, the broader market, led by mid-cap stocks, showed resilience.

Read MoreK P R Mill's Stock Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-12 08:01:15K P R Mill Ltd, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 885.40, showing a notable increase from the previous close of 864.80. Over the past year, K P R Mill has demonstrated resilience, achieving a return of 14.16%, significantly outperforming the Sensex, which recorded a return of 0.82% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. Moving averages reflect a bearish sentiment in the short term, while the Dow Theory suggests a mildly bullish trend over the weekly period. K P R Mill's performance over various time frames highlights its strong historical returns, particu...

Read More

K P R Mill Adjusts Valuation Amid Flat Financial Performance and Strong Fundamentals

2025-03-11 08:13:23K P R Mill Ltd, a key player in the textile sector with a market cap of Rs 29,560 crore, has recently seen a change in its evaluation. The company reported flat Q3 FY24-25 performance, with annual sales of Rs 6,315.62 crore and a return on equity of 17.3%.

Read MoreK P R Mill's Technical Indicators Signal Mixed Market Sentiment Amid Strong Historical Returns

2025-03-11 08:02:24K P R Mill Ltd, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 864.80, showing a slight increase from the previous close of 861.70. Over the past year, K P R Mill has demonstrated resilience with a return of 8.78%, outperforming the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the weekly MACD and KST suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, indicating bearish conditions on a weekly basis but bullish on a monthly scale. The daily moving averages also reflect bearish tendencies, contributing to the overall technical summary. K P R Mill's performance over various time frames highlights its strong historical returns, particularly over the last five years, where ...

Read MoreK P R Mill's Technical Indicators Signal Mixed Market Sentiment Amid Strong Historical Returns

2025-03-11 08:02:24K P R Mill Ltd, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 864.80, showing a slight increase from the previous close of 861.70. Over the past year, K P R Mill has demonstrated resilience with a return of 8.78%, outperforming the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the weekly MACD and KST suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, indicating bearish conditions on a weekly basis but bullish on a monthly scale. The daily moving averages also reflect bearish tendencies, contributing to the overall technical summary. K P R Mill's performance over various time frames highlights its strong historical returns, particularly over the last five years, where ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEWe are enclosing the Certificate dated 02nd April 2025 issued by the Registrar and Share Transfer Agent of the Company M/s. NSDL Database Management Limited confirming the Compliance under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEPursuant to the SEBI(PIT) Regulations 2015 (as amended) the Trading Window for dealing in the Equity Shares of the Company will be closed for all its Directors Designated Persons Connected Persons and their immediate relatives with effect from 1st April 2025 till the expiry of 48 hours after declaration of Audited Financial Results of the Company for the Quarter / year ending 31st March 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Mar-2025 | Source : BSEFurther to our Intimation dated 20.03.2025 regarding Postal Ballot we hereby inform you that the Company has completed the dispatch of Postal Ballot Notice by e-mail to all the eligible Shareholders of the Company on Thursday March 20 2025. An advertisement in this regard has been released in the following newspapers on Saturday March 22 2025: a) Financial Express - English b) Makkal Kural - Tamil Copy of the published newspaper advertisement is sent as attachment. This is also available on the website of the Company : www.kprmilllimited.com. This is for your kind information and records.

Corporate Actions

No Upcoming Board Meetings

K P R Mill Ltd has declared 250% dividend, ex-date: 07 Feb 25

K P R Mill Ltd has announced 1:5 stock split, ex-date: 24 Sep 21

No Bonus history available

No Rights history available