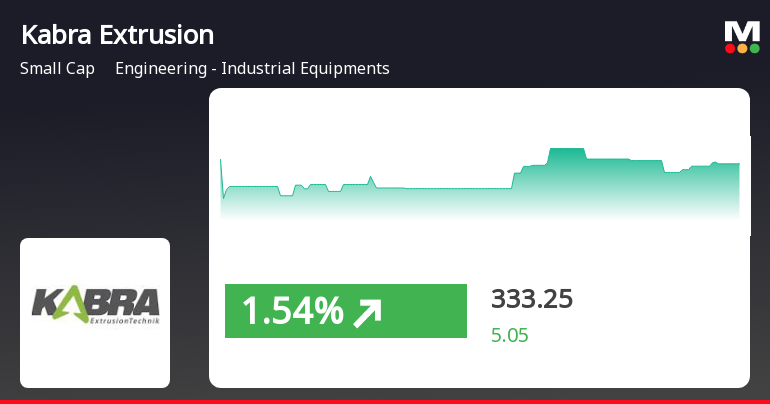

Kabra Extrusion Technik Adjusts Valuation Grade, Signaling Resilience in Competitive Sector

2025-03-24 08:00:24Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 27.96 and an EV to EBITDA ratio of 16.18, indicating a competitive position within its industry. Its PEG ratio stands at 0.58, suggesting a favorable growth outlook relative to its earnings. In terms of financial performance, Kabra Extrusion has reported a return on capital employed (ROCE) of 9.54% and a return on equity (ROE) of 7.95%. The company also offers a dividend yield of 1.09%, which adds to its appeal among investors seeking income. When compared to its peers, Kabra Extrusion's valuation metrics present a more attractive profile. For instance, while some competitors like Bondada Engineering and Enviro Infra are categorized as very expensive, Kabra...

Read MoreKabra Extrusion Technik Adjusts Valuation Amid Competitive Market Landscape

2025-03-18 08:00:31Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings ratio of 25.51 and a price-to-book value of 2.23, indicating its market positioning relative to its assets. The enterprise value to EBITDA stands at 14.82, while the EV to EBIT is recorded at 20.17, reflecting its operational efficiency. In terms of profitability, Kabra Extrusion shows a return on capital employed (ROCE) of 9.54% and a return on equity (ROE) of 7.95%. The PEG ratio, a measure of growth relative to earnings, is notably low at 0.53, suggesting potential for future growth relative to its earnings. When compared to its peers, Kabra Extrusion's valuation metrics present a competitive edge. While some competitors are categorized as very expensive, Kabra maintains a more favorable position, particularly i...

Read MoreKabra Extrusion Technik Faces Bearish Technical Trends Amid Market Fluctuations

2025-03-12 08:01:10Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 325.75, slightly down from the previous close of 328.20. Over the past year, Kabra Extrusion has experienced a stock return of -2.92%, contrasting with a modest gain of 0.82% in the Sensex. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance, and moving averages confirm this trend on a daily basis. The KST presents a mixed picture, being bearish weekly but bullish monthly, indicating some volatility in performance. In terms of stock performance, Kabra Extrusion has faced challenges, particularly over the last month with a return ...

Read MoreKabra Extrusion Technik Faces Stock Volatility Amid Broader Market Trends

2025-03-11 18:00:18Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has experienced notable fluctuations in its stock performance recently. With a market capitalization of Rs 1,145.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 28.23, which is below the industry average of 35.04. Over the past year, Kabra Extrusion Technik's stock has declined by 2.92%, contrasting with the Sensex's modest gain of 0.82%. In the short term, the stock has seen a decrease of 0.75% today, while the Sensex has dipped only 0.02%. Looking at broader trends, the stock has faced a significant downturn of 40.99% year-to-date, compared to the Sensex's decline of 5.17%. Technical indicators suggest a bearish sentiment in the weekly and monthly outlooks, with moving averages and Bollinger Bands reflecting a similar trend. However, the stock has shown a remarkable 459.23% increase o...

Read More

Kabra Extrusion Faces Significant Volatility Amidst Broader Sector Declines

2025-03-10 15:30:26Kabra Extrusion Technik, a small-cap engineering firm, faced notable volatility today, with its stock price dropping significantly after an initial gain. The company has underperformed its sector and the broader market over various time frames, indicating ongoing challenges despite past growth.

Read MoreKabra Extrusion Technik Shows Mixed Technical Trends Amidst Market Volatility

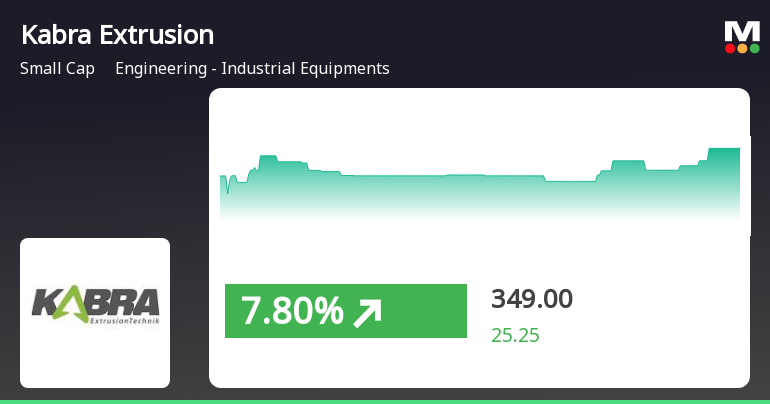

2025-03-06 08:01:01Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 348.15, showing a notable increase from the previous close of 323.75. Over the past year, the stock has experienced a high of 588.00 and a low of 290.25, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, suggesting a lack of momentum. Bollinger Bands also indicate a mildly bearish trend on a weekly and monthly basis. However, daily moving averages present a mildly bullish perspective, hinting at short-term strength. When comparing Kabra Extrusion's performance to the Sensex, the stock has faced challenges, particu...

Read More

Kabra Extrusion Technik Shows Potential Trend Reversal Amid Broader Market Gains

2025-03-05 13:45:18Kabra Extrusion Technik experienced a notable increase today, breaking a six-day decline. The stock outperformed its sector, although it remains below key moving averages. Meanwhile, the broader market saw gains, particularly in small-cap stocks, despite lingering challenges for the Sensex and its moving averages.

Read More

Kabra Extrusion Technik Faces Financial Challenges Amid Market Evaluation Adjustment

2025-02-28 18:27:02Kabra Extrusion Technik, a small-cap engineering firm, has experienced a recent evaluation adjustment following a detailed analysis of its financial performance and market standing. The company reported a decline in net sales and low cash reserves, raising concerns about its long-term growth amidst a challenging competitive environment.

Read MoreKabra Extrusion Technik Experiences Valuation Grade Change Amid Competitive Market Landscape

2025-02-28 08:00:22Kabra Extrusion Technik, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 348.70, reflecting a notable decline from its previous close of 367.10. Over the past year, Kabra has experienced a stock return of -4.90%, contrasting with a 2.08% return from the Sensex, indicating a lag in performance relative to the broader market. Key financial metrics for Kabra Extrusion include a PE ratio of 30.22 and an EV to EBITDA ratio of 17.43, which position the company competitively within its industry. The PEG ratio of 0.63 suggests a favorable growth outlook compared to its earnings. Additionally, the company boasts a dividend yield of 1.00% and a return on capital employed (ROCE) of 9.54%. In comparison to its peers, Kabra's valuation metrics appear attractive, especially when juxtaposed with companies like Bon...

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

05-Apr-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) - Credit Rating

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate Under Reg. 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and year ended 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Kabra Extrusion Technik Ltd has declared 70% dividend, ex-date: 12 Jul 24

Kabra Extrusion Technik Ltd has announced 5:10 stock split, ex-date: 17 May 10

Kabra Extrusion Technik Ltd has announced 1:1 bonus issue, ex-date: 06 Sep 10

No Rights history available