Kalyani Investment Company Shows Mixed Technical Trends Amid Market Volatility

2025-04-03 08:02:39Kalyani Investment Company, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,430.00, showing a notable increase from the previous close of 4,235.00. Over the past week, Kalyani Investment has demonstrated a strong performance with a return of 7.52%, significantly outperforming the Sensex, which recorded a decline of 0.87%. In terms of technical indicators, the company's MACD and KST metrics indicate a bearish trend on a weekly basis, while the monthly outlook shows a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish trend for both weekly and monthly assessments. Notably, the stock's 52-week high stands at 8,211.50, while the low is recorded at 3,445.95, showcasing the volatility in its price movements. Kalyani Investment's performance over various time frames reveal...

Read MoreKalyani Investment Company Adjusts Valuation Grade Amid Strong Market Performance

2025-04-03 08:00:17Kalyani Investment Company, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 4,430.00, reflecting a notable increase from the previous close of 4,235.00. Over the past year, Kalyani has demonstrated a stock return of 18.99%, significantly outperforming the Sensex, which returned 3.67% in the same period. Key financial metrics for Kalyani include a price-to-earnings (PE) ratio of 25.77 and an EV to EBITDA ratio of 24.90. The company's price to book value is notably low at 0.18, indicating potential undervaluation relative to its assets. Additionally, Kalyani's PEG ratio stands at 0.53, suggesting a favorable growth outlook compared to its earnings. In comparison to its peers, Kalyani Investment Company maintains a competitive position. While some competitors exhibit higher valuation metric...

Read MoreKalyani Investment Company Faces Technical Trend Shifts Amid Market Volatility

2025-03-26 08:01:53Kalyani Investment Company, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 4,306.60, showing a notable decline from the previous close of 4,510.00. Over the past year, Kalyani Investment has experienced a 52-week high of 8,211.50 and a low of 3,445.95, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bearish trends, while the monthly metrics show a mildly bearish outlook. The daily moving averages also reflect a bearish sentiment. The KST and OBV indicators present a mixed picture, with weekly readings indicating bearishness and monthly readings leaning towards a mildly bearish stance. When comparing the company's performance to the Sensex, Kalyani Investment has shown a str...

Read MoreKalyani Investment Company Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:02:13Kalyani Investment Company, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,510.00, showing a notable increase from the previous close of 4,353.10. Over the past week, Kalyani Investment has demonstrated a strong performance, with a return of 22.38%, significantly outpacing the Sensex's 5.14% return during the same period. In terms of technical indicators, the company's MACD and KST metrics indicate a bearish stance on a weekly basis, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious market environment. Notably, the stock's 52-week high stands at 8,211.50, while the low is recorded at 3,445.95, highlighting the volatility and potential for recovery. Kalyani Investment's performanc...

Read More

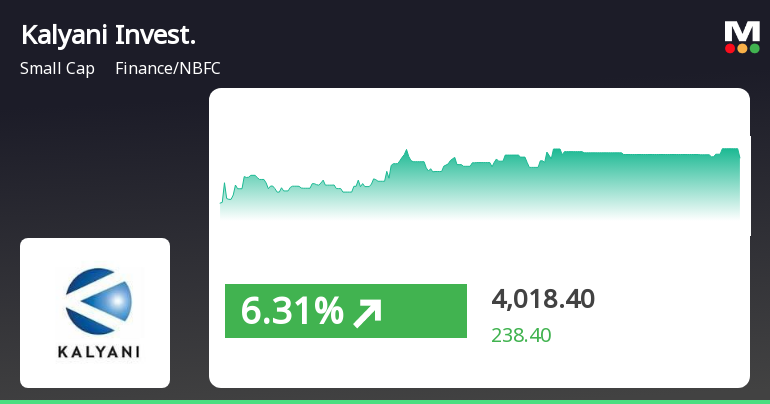

Kalyani Investment Company Shows Short-Term Gains Amid Mixed Long-Term Momentum

2025-03-19 13:15:21Kalyani Investment Company has experienced notable activity, with a recent increase of 7.14% and a total rise of 9.14% over two days. While the stock is above its short-term moving averages, it remains below longer-term averages, reflecting mixed momentum. The broader market shows positive trends, particularly in mid-cap stocks.

Read MoreKalyani Investment Company Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-10 08:00:24Kalyani Investment Company, a small-cap player in the finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 4,134.05, reflecting a slight increase from the previous close of 4,082.75. Over the past year, Kalyani's stock has shown a return of -2.19%, contrasting with a modest gain of 0.29% in the Sensex. Key financial metrics for Kalyani include a PE ratio of 24.05 and an EV to EBITDA ratio of 23.03, indicating its market positioning within the industry. The company's price to book value is notably low at 0.17, while its PEG ratio stands at 0.49, suggesting a potentially favorable growth outlook relative to its earnings. In comparison to its peers, Kalyani Investment Company presents a competitive valuation landscape. For instance, while MAS Financial Services and Paisalo Digital also hold attractive valuations, other companies like Indus Infotech are pos...

Read More

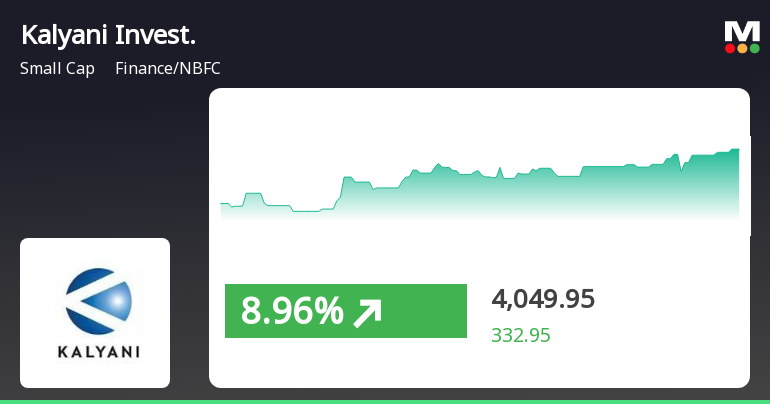

Kalyani Investment Company Surges Amid Broader Market Volatility and Small-Cap Strength

2025-03-06 11:35:18Kalyani Investment Company has demonstrated notable performance, gaining 8.28% on March 6, 2025, and outperforming its sector. The stock has shown positive momentum with an 11.4% cumulative return over three days, while small-cap stocks lead the market despite a slight decline in the broader indices.

Read MoreKalyani Investment Company Experiences Valuation Grade Change Amid Competitive Market Landscape

2025-02-24 12:56:52Kalyani Investment Company, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 3940.10, reflecting a notable shift from its previous close of 4014.40. Over the past year, Kalyani has experienced a stock return of -4.26%, contrasting with a 1.92% return from the Sensex. Key financial metrics reveal a PE ratio of 23.35 and an EV to EBITDA of 22.27, indicating a competitive positioning within its industry. The company's price to book value is notably low at 0.17, while its PEG ratio stands at 0.48, suggesting potential for growth relative to its earnings. However, the return on capital employed (ROCE) and return on equity (ROE) are relatively modest at 0.69% and 0.74%, respectively. In comparison to its peers, Kalyani Investment's valuation reflects a more attractive stance than some competito...

Read MoreKalyani Investment Faces Significant Volatility Amid Broader Market Challenges

2025-02-10 10:50:06Kalyani Investment Company, a small-cap player in the finance and non-banking financial company (NBFC) sector, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 5.44%, reflecting a broader trend of underperformance, as it lagged behind its sector by 1.95%. Over the past three days, Kalyani Investment has seen a cumulative decline of 5.69%, indicating a challenging period for the company. Intraday trading saw the stock reach a low of Rs 4444.1, further emphasizing its downward trajectory. Additionally, Kalyani Investment is currently trading below its key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, which may signal ongoing weakness in its market position. In terms of performance metrics, Kalyani Investment Company has recorded a 1-day decline of 3.30%, compared to a 0.79% drop in the Sensex. Over the past mont...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2025 | Source : BSEAnnouncement U/R 30 of SEBI LODR-Newspaper Publication

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available