Kamat Hotels Shows Resilience Amid Mixed Technical Indicators and Market Volatility

2025-04-03 08:00:45Kamat Hotels (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 285.20, showing a slight increase from the previous close of 282.35. Over the past year, Kamat Hotels has demonstrated notable resilience, with a year-to-date return of 22.85%, significantly outperforming the Sensex, which has seen a decline of 1.95% during the same period. The technical summary indicates a generally positive outlook, with various indicators such as MACD and moving averages signaling bullish trends. However, some metrics like the KST and OBV present a mixed picture, suggesting a nuanced market position. The stock has experienced a 52-week high of 353.40 and a low of 176.00, highlighting its volatility. In terms of returns, Kamat Hotels has shown remarkable performance over longer period...

Read More

Kamat Hotels Shows Positive Financial Trends Amid Market Sentiment Shift

2025-04-02 08:10:56Kamat Hotels (India) has recently experienced an evaluation adjustment reflecting changes in its financial metrics. The company shows a positive technical outlook, supported by key indicators, while its valuation metrics highlight an attractive position within the industry. Despite challenges, Kamat Hotels has demonstrated consistent growth in operating profit.

Read MoreKamat Hotels Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:01:31Kamat Hotels (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 282.35, slightly down from the previous close of 287.00. Over the past year, Kamat Hotels has shown a stock return of 7.50%, outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bullish signals on both weekly and monthly charts, while the Bollinger Bands reflect a mildly bullish stance. However, the KST presents a mildly bearish outlook on a monthly basis, suggesting some caution in the longer term. The moving averages indicate a bullish trend on a daily basis, which may reflect short-term momentum. In terms of returns, Kamat Hotels has demonstrated significant growth over the longer t...

Read More

Kamat Hotels Adjusts Valuation Amid Strong Profit Growth and Rising Debt Concerns

2025-03-26 08:03:20Kamat Hotels (India) has recently experienced a valuation grade adjustment, reflecting strong financial performance with a 63.94% operating profit growth for the quarter ending December 2024. The company reported record net sales and demonstrated effective capital utilization, although it faces challenges related to its debt levels.

Read MoreKamat Hotels Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-03-26 08:00:09Kamat Hotels (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone a valuation adjustment. The company's financial metrics reflect a PE ratio of 25.43 and an EV to EBITDA of 10.84, indicating a competitive position within its sector. Notably, Kamat Hotels has demonstrated a return on capital employed (ROCE) of 15.06% and a return on equity (ROE) of 8.26%, showcasing its operational efficiency. In comparison to its peers, Kamat Hotels stands out with a favorable PEG ratio of 0.00, while other companies in the industry exhibit varying valuation metrics. For instance, HLV has a PE ratio of 32.34, and Viceroy Hotels, categorized as very expensive, has a PE of 11.6. Additionally, Asian Hotels (N) and Mac Charles (I) are noted as risky due to their loss-making status. Kamat Hotels' stock performance has also been noteworthy, with a year-to-date return of 34.65%, signif...

Read More

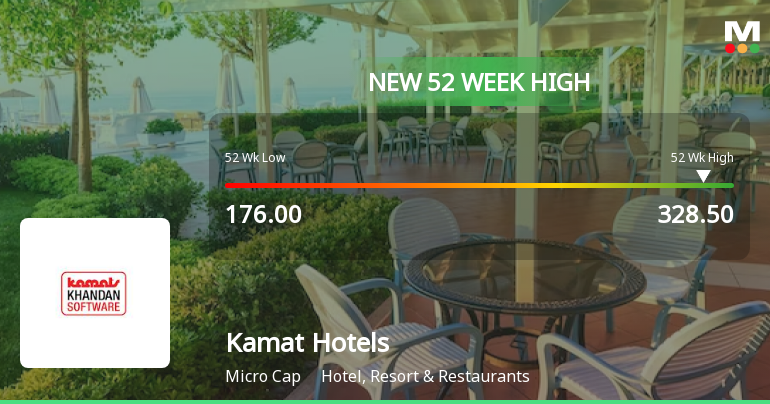

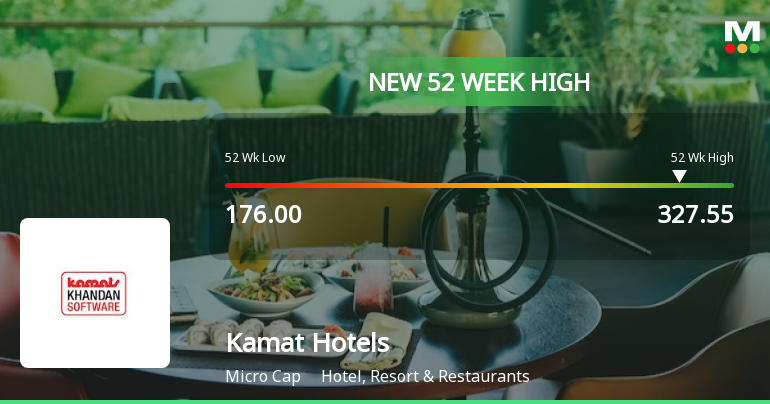

Kamat Hotels Achieves 52-Week High Amid Strong Financial Performance and Challenges Ahead

2025-03-18 09:38:38Kamat Hotels (India) has reached a new 52-week high, reflecting strong performance with a notable increase in operating profit and net sales. The company has outperformed its sector and delivered significant returns over the past year, although it faces challenges related to its debt levels.

Read More

Kamat Hotels Achieves 52-Week High Amid Strong Financial Performance and Market Resilience

2025-03-17 10:05:44Kamat Hotels (India) has achieved a new 52-week high in its stock price, reflecting strong market performance. The company reported a 63.94% increase in operating profit for the December quarter, with net sales reaching Rs. 110.89 crore, showcasing operational efficiency and resilience in the competitive hospitality sector.

Read More

Kamat Hotels Achieves 52-Week High Amid Strong Financial Performance and Market Resilience

2025-03-13 10:35:14Kamat Hotels (India) has reached a new 52-week high, reflecting strong performance in the Hotel, Resort & Restaurants industry. The company reported significant operating profit growth and impressive annual returns, outperforming the Sensex. Despite challenges, it maintains a solid financial position and bullish trading indicators.

Read More

Kamat Hotels Achieves 52-Week High Amid Strong Financial Performance and Market Resilience

2025-03-12 10:05:13Kamat Hotels (India) has reached a new 52-week high, reflecting a positive market sentiment. The company reported a 63.94% growth in operating profit and strong financial metrics, while also outperforming the BSE 500 over the past three years. However, it faces challenges with a high debt-to-EBITDA ratio.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate pursuant to Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018

Revised Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received revised Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for Vithal V. Kamat

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

27-Mar-2025 | Source : BSEIntimation of Schedule of Analyst / Institutional Investor Meet with Ananta Capital

Corporate Actions

No Upcoming Board Meetings

Kamat Hotels (India) Ltd has declared 12% dividend, ex-date: 11 Sep 09

No Splits history available

No Bonus history available

No Rights history available