Kamdhenu Adjusts Valuation Grade, Signaling Competitive Position in Trading Sector

2025-03-13 08:00:12Kamdhenu, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (P/E) ratio of 14.24 and a price-to-book value of 3.23. Its enterprise value to EBITDA stands at 10.48, while the EV to EBIT is recorded at 11.35. Notably, Kamdhenu showcases a robust return on capital employed (ROCE) of 49.69% and a return on equity (ROE) of 22.67%, indicating strong operational efficiency. In comparison to its peers, Kamdhenu's valuation metrics present a more favorable outlook. For instance, Uniphos Enterprises displays a significantly higher P/E ratio, while companies like STEL Holdings and Fratelli Vineyard are categorized with higher valuation levels, reflecting their respective market positions. Despite recent stock performance challenges, including a year-to-date decline of 37.09%, Kamdhen...

Read MoreKamdhenu Adjusts Valuation Grade, Signaling Competitive Position in Trading Sector

2025-03-13 08:00:12Kamdhenu, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (P/E) ratio of 14.24 and a price-to-book value of 3.23. Its enterprise value to EBITDA stands at 10.48, while the EV to EBIT is recorded at 11.35. Notably, Kamdhenu showcases a robust return on capital employed (ROCE) of 49.69% and a return on equity (ROE) of 22.67%, indicating strong operational efficiency. In comparison to its peers, Kamdhenu's valuation metrics present a more favorable outlook. For instance, Uniphos Enterprises displays a significantly higher P/E ratio, while companies like STEL Holdings and Fratelli Vineyard are categorized with higher valuation levels, reflecting their respective market positions. Despite recent stock performance challenges, including a year-to-date decline of 37.09%, Kamdhen...

Read MoreKamdhenu Adjusts Valuation Grade, Signaling Stability Amid Competitive Landscape

2025-03-04 08:00:28Kamdhenu, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics. The company's price-to-earnings (PE) ratio stands at 13.38, while its price-to-book value is recorded at 3.03. The enterprise value to EBITDA ratio is 9.70, and the EV to EBIT ratio is noted at 10.51. Additionally, Kamdhenu's PEG ratio is 0.40, and it offers a dividend yield of 0.68%. The company's return on capital employed (ROCE) is a notable 49.69%, and its return on equity (ROE) is 22.67%, indicating strong profitability relative to its equity base. In comparison to its peers, Kamdhenu's valuation metrics present a more favorable outlook. While some competitors exhibit significantly higher PE ratios and varying levels of risk, Kamdhenu's financial performance metrics suggest a solid position within the trading sector. This evaluation adjustment highlights t...

Read More

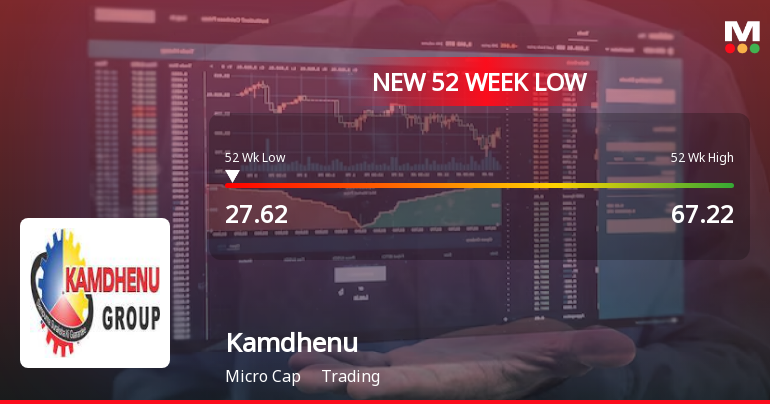

Kamdhenu Faces Sustained Downward Trend Amid Broader Trading Sector Challenges

2025-03-03 10:06:27Kamdhenu, a microcap trading company, has hit a new 52-week low, reflecting significant volatility and a sustained downward trend. The stock has underperformed its sector and experienced consecutive losses over the past three days. Its performance over the past year shows a stark decline compared to broader market trends.

Read More

Kamdhenu Hits 52-Week Low Amidst Broader Market Gains and Sector Outperformance

2025-02-28 09:36:39Kamdhenu, a microcap trading company, has reached a new 52-week low, reflecting a significant decline of 51.79% over the past year. Despite this downturn, it has outperformed its sector slightly. The stock is currently trading below its moving averages, indicating a challenging market position.

Read More

Kamdhenu Hits 52-Week Low Amid Ongoing Market Challenges and Underperformance

2025-02-27 10:05:30Kamdhenu, a microcap trading company, has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company has underperformed its sector and is currently trading below key moving averages, indicating ongoing challenges in the market.

Read More

Kamdhenu Faces Significant Volatility Amid Broader Market Challenges and Declining Performance

2025-02-18 11:54:08Kamdhenu, a microcap trading company, has hit a new 52-week low amid significant volatility, with a notable decline over the past three days. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges and a stark contrast to broader market performance over the past year.

Read More

Kamdhenu Hits 52-Week Low Amid Ongoing Downward Trend in Trading Sector

2025-02-17 09:37:44Kamdhenu, a microcap trading company, has reached a new 52-week low, reflecting a significant downturn and underperformance compared to its sector. Over the past year, the stock has declined notably, contrasting with the overall market's gains, and is trading below multiple moving averages, indicating a persistent downward trend.

Read More

Kamdhenu Faces Significant Volatility Amid Broader Trading Sector Challenges in October 2023

2025-02-14 13:35:33Kamdhenu, a microcap in the trading industry, has hit a new 52-week low, experiencing significant intraday volatility. The stock has underperformed its sector and is trading below key moving averages, reflecting a sustained downward trend. Over the past year, it has declined notably, contrasting with broader market gains.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSECopy of Newspaper publication for the Q3 & 9M FY25 unaudited Financials

Integrated Filing (Financial)

12-Feb-2025 | Source : BSEIntegrated Filing of Financials for the Quarter and nine months period ended on 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Kamdhenu Ltd has declared 20% dividend, ex-date: 31 Jul 24

Kamdhenu Ltd has announced 1:10 stock split, ex-date: 08 Jan 25

No Bonus history available

No Rights history available