Kay Power & Paper Faces Severe Decline Amidst Financial Health Concerns

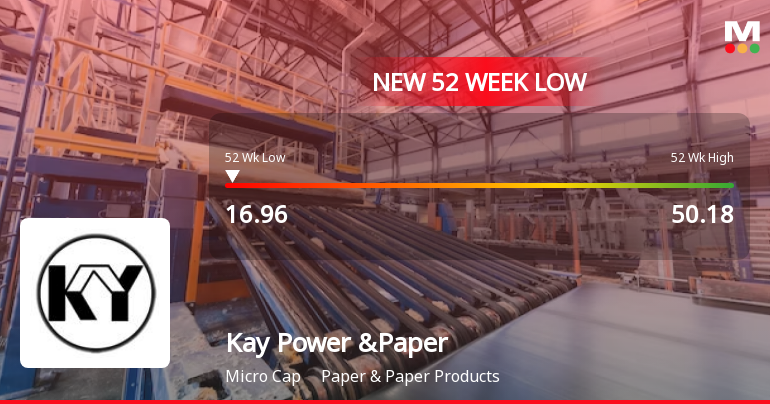

2025-04-03 09:39:19Kay Power & Paper, a microcap in the Paper & Paper Products sector, has hit a new 52-week low, reflecting significant volatility and a 67.90% decline over the past year. The company faces financial challenges, including a high debt-to-equity ratio and negative EBITDA, indicating struggles with profitability.

Read MoreKay Power & Paper Faces Intense Selling Pressure Amid Significant Price Declines

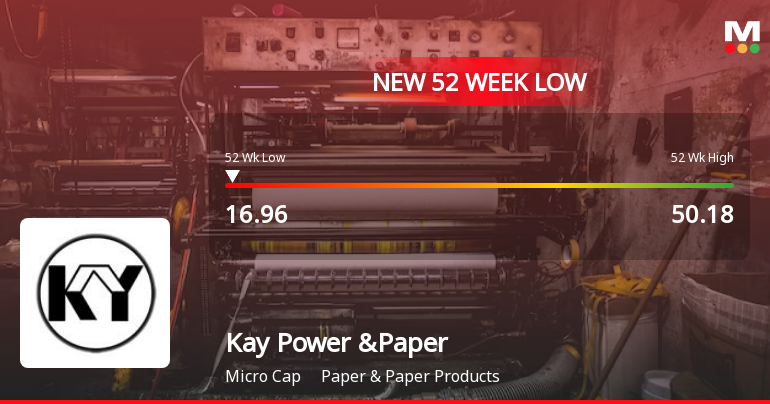

2025-04-03 09:35:23Kay Power & Paper Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with a 9.95% drop in its share price, marking a new 52-week low of Rs. 13.75. This performance starkly contrasts with the Sensex, which has only decreased by 0.58% on the same day. Over the past week, Kay Power & Paper has seen a staggering 39.56% decline, while the Sensex has only fallen by 1.85%. The stock's performance over the last month is equally concerning, with a 44.80% drop compared to a 4.22% increase in the Sensex. This trend of consecutive losses extends to five days, during which the stock has plummeted by 46.08%. The stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent downward trend. Contributing factors to this selling pressure may include broader market conditions and sec...

Read MoreKay Power & Paper Faces Intense Selling Pressure Amid Significant Price Declines

2025-04-02 09:35:33Kay Power & Paper Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with a one-day performance of -9.96%, starkly contrasting with the Sensex's modest gain of 0.54%. Over the past week, Kay Power & Paper has plummeted by 40.12%, while the Sensex has only dipped by 1.11%. The stock has now recorded consecutive losses for four days, resulting in a staggering 39.88% drop during this period. Today, it opened with a gap down of 5.54% and reached a new 52-week low of Rs. 15.28, reflecting a day’s low of -9.91%. In terms of longer-term performance, Kay Power & Paper has seen a decline of 65.07% over the past year, while the Sensex has gained 3.42%. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent downward trend. The significant selling pressu...

Read MoreKay Power & Paper Faces Intense Selling Pressure Amid Significant Price Declines

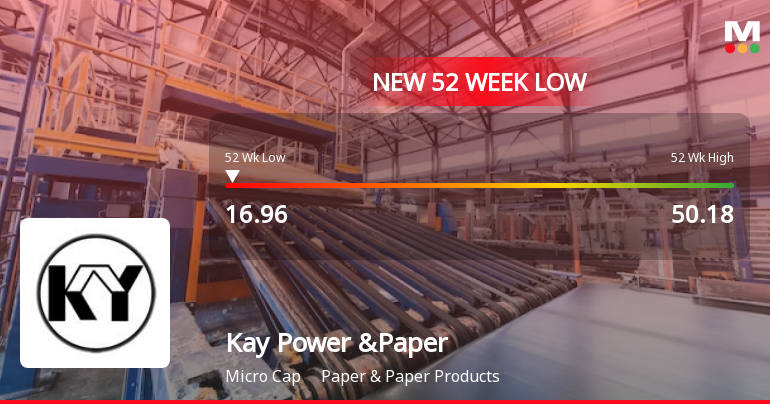

2025-04-01 14:15:14Kay Power & Paper Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past three days, with a staggering decline of 33.49% during this period. Today, the stock plummeted by 19.51%, significantly underperforming the Sensex, which fell by just 1.78%. Over the past week, Kay Power & Paper has seen a decline of 31.08%, while the Sensex has only decreased by 2.54%. The stock's performance over the last month is particularly concerning, with a drop of 36.62% compared to a 3.88% increase in the Sensex. Year-to-date, the stock is down 54.03%, contrasting sharply with the Sensex's decline of 2.69%. Today, Kay Power & Paper hit a new 52-week low of Rs. 16.96, following a volatile trading session that saw an intraday high of Rs. 24.8. The stock is currently trading below all key moving averages, indicating a bearis...

Read More

Kay Power & Paper Faces Significant Volatility Amid Broader Market Challenges

2025-04-01 11:58:06Kay Power & Paper, a microcap in the Paper & Paper Products sector, has hit a new 52-week low amid significant volatility, underperforming its sector and experiencing a notable decline over recent days. The company's financial health is concerning, marked by a high debt-to-equity ratio and negative EBITDA.

Read More

Kay Power & Paper Faces Significant Volatility Amid Broader Market Pressures

2025-04-01 11:58:05Kay Power & Paper, a microcap in the Paper & Paper Products sector, hit a new 52-week low today after significant volatility. The company has faced a 59.89% decline over the past year, with troubling financial metrics, including a high debt-to-equity ratio and plummeting operating profit.

Read More

Kay Power & Paper Faces Market Challenges Amid Significant Stock Volatility and Decline

2025-04-01 11:58:02Kay Power & Paper, a microcap in the Paper & Paper Products sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and experienced a notable decline over the past year, compounded by high debt levels and weak growth metrics, raising concerns about its financial health.

Read More

Kay Power & Paper Faces Severe Volatility Amidst Deteriorating Financial Metrics

2025-04-01 11:58:01Kay Power & Paper, a microcap in the Paper & Paper Products sector, has faced significant volatility, reaching a new 52-week low. The stock has declined sharply over the past three days and year, with concerning financial metrics, including a high debt-to-equity ratio and negative EBITDA, raising questions about its profitability and growth potential.

Read More

Kay Power & Paper Faces Financial Strain Amidst Continued Stock Decline and High Debt Levels

2025-03-17 10:12:01Kay Power & Paper has reached a new 52-week low, continuing a downward trend with a significant annual decline. The company faces financial challenges, including a high debt-to-equity ratio and negative EBITDA, while its operating profit has drastically decreased over five years, indicating weak growth prospects.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIn accordance with the SEBI (Prohibition of Insider Trading) Regulations 2015 the Trading Window period shall be closed from 1st April 2025 and end 48 hours after the declaration and publication of financial results of the Company for the fourth quarter and financial year ending March 31st 2025 become generally available information

Intimation Regarding Change Of Name Of Companys Registrar And Transfer Agents.

01-Mar-2025 | Source : BSEPursuant to Regulation 30 of SEBI (LODR) Regulations 2015 We hereby informed that our Registrar and Transfer Agents -Link Intime India Private Limited on December 31 2024 informed the company that consequent upon the acquisition of Link group by Mitsubhishi UFJ Trust & Banking Corporation LIIPL will now be known as MUFG Intime India Private Limited. The change of name effective December 31 2024. A copy of certificate of Incorporation pursuant to change of name is enclosed herewith Accordingly the name of our Registrar and Transfer Agents now be MUFG Intime India Private Limited. We request you to take note and update your records appropriately .

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSEPursuant to regulation 30 of SEBI (LODR) Regulation 2015 we are submitting the paper cutting of publication dated 13th February 2025 the Un-audited financial results for the third quarter and nine months ended 31st December 2024 published in daily Gramodhaar a Marathi newspaper (Regional Language) where the registered office of the listed entity is situated.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available