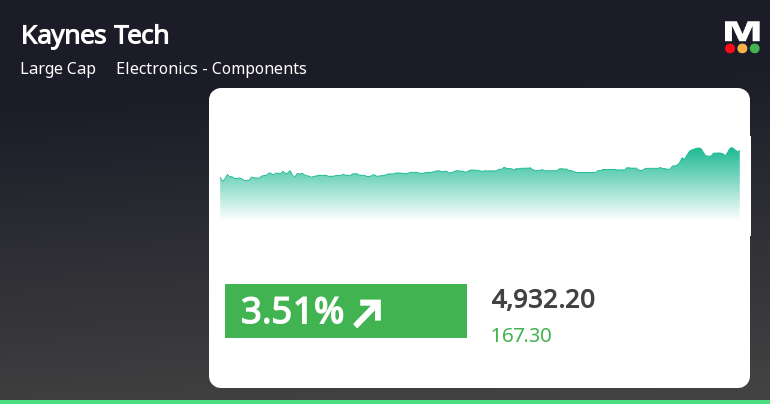

Kaynes Technology Shows Positive Momentum Amid Broader Market Gains and Sector Volatility

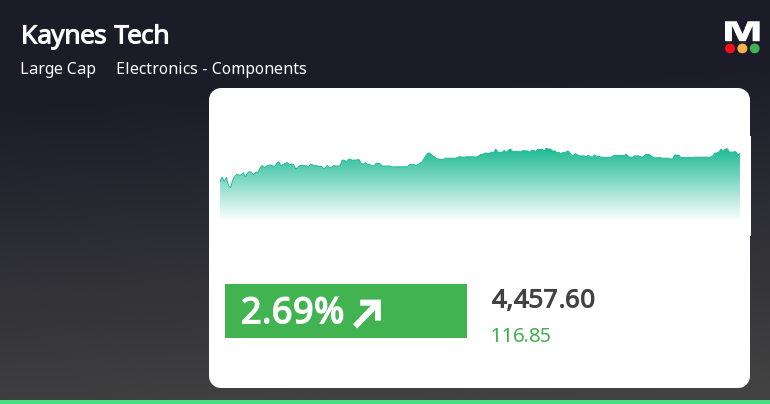

2025-04-02 12:50:24Kaynes Technology India has demonstrated significant activity, gaining 3.24% on April 2, 2025, and outperforming its sector. The stock has shown a cumulative increase of 3.75% over two days, while its year-to-date performance reflects a decline of 33.20%, contrasting with an annual gain of 78.08%.

Read More

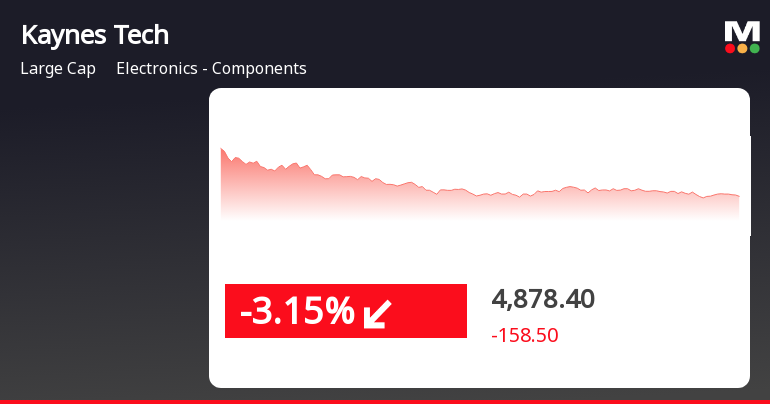

Kaynes Technology Faces Potential Trend Reversal Amid Broader Market Resilience

2025-03-25 11:35:27Kaynes Technology India saw a decline on March 25, 2025, following a six-day gain streak. The stock's performance metrics indicate mixed signals, as it underperformed its sector. Meanwhile, the broader market, represented by the Sensex, has shown resilience with notable gains over the past three weeks.

Read More

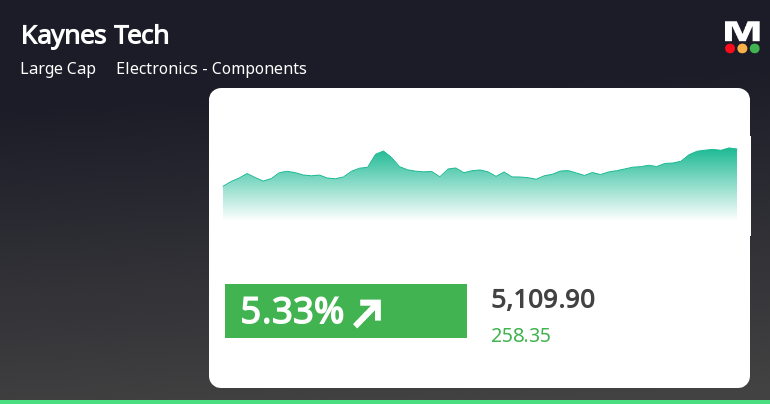

Kaynes Technology Shows Strong Recovery Amid Broader Market Gains and Sector Outperformance

2025-03-24 09:50:29Kaynes Technology India has demonstrated strong performance, gaining 3.55% on March 24, 2025, and achieving an 18.45% return over six consecutive days. The stock reached an intraday high of Rs 5,115 and is currently above several short-term moving averages, despite recent challenges. Its one-year performance shows a notable increase of 78.52%.

Read More

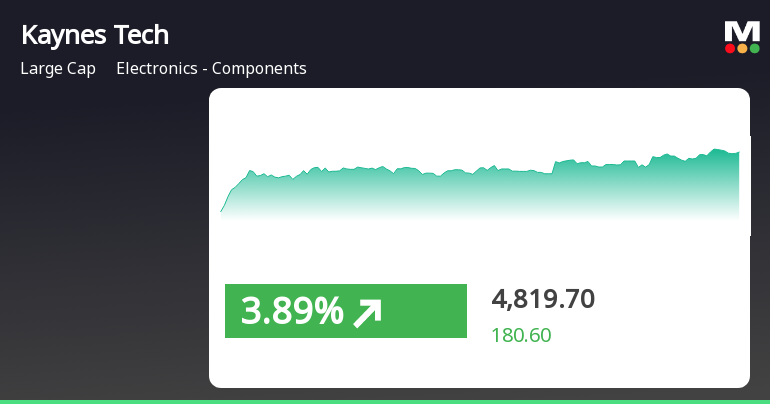

Kaynes Technology Shows Strong Short-Term Gains Amid Mixed Long-Term Momentum

2025-03-21 11:35:28Kaynes Technology India has shown strong short-term performance, gaining 3.72% today and accumulating a total return of 13.17% over the past five days. The stock is currently above its 5-day and 20-day moving averages, while the broader market, led by small-cap stocks, has also rebounded.

Read MoreKaynes Technology Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:05:11Kaynes Technology India, a prominent player in the electronics components industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 4,499.10, has shown notable fluctuations, with a 52-week high of 7,824.95 and a low of 2,425.00. In terms of technical indicators, the MACD on a weekly basis remains bearish, while the moving averages also indicate a bearish trend. The Bollinger Bands present a mildly bearish outlook on a weekly basis, contrasting with a bullish stance on a monthly scale. The On-Balance Volume (OBV) shows a mildly bearish trend monthly, while the Dow Theory indicates no significant trend in both weekly and monthly assessments. When comparing the company's performance to the Sensex, Kaynes Technology has demonstrated a strong return over the past year, with a 72.89% increase, significantly outpacing the Sensex's 3.51% return. Ov...

Read More

Kaynes Technology Shows Short-Term Gains Amid Mixed Long-Term Momentum in Electronics Sector

2025-03-18 13:20:27Kaynes Technology India has experienced positive momentum, gaining over the past two days and outperforming its sector. The stock reached an intraday high, showing mixed performance against longer-term moving averages. In the broader market, the Sensex has also risen, while Kaynes has faced challenges in recent months.

Read More

Kaynes Technology Adjusts Valuation Amid Flat Financial Performance and Market Trends

2025-03-18 08:24:44Kaynes Technology India has recently experienced a change in its evaluation, reflecting a detailed analysis of its financial performance and market standing. In Q3 FY24-25, the company reported strong annual growth in net sales and operating profit, while maintaining a low debt-to-equity ratio and high institutional holdings.

Read MoreKaynes Technology Faces Mixed Technical Trends Amid Strong Yearly Performance

2025-03-18 08:04:46Kaynes Technology India, a prominent player in the electronics components sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 4,340.75, showing a notable increase from the previous close of 4,241.30. Over the past year, Kaynes Technology has demonstrated a robust performance with a return of 63.15%, significantly outperforming the Sensex, which recorded a return of just 2.10% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, while the monthly outlook remains sideways. The On-Balance Volume (OBV) shows a mildly bearish trend monthly, suggesting a cautious market sentiment. Despite the recent evaluation adjustment, Kaynes Technology's performance over variou...

Read MoreKaynes Technology Faces Technical Trend Shifts Amid Strong Yearly Performance

2025-03-17 08:01:37Kaynes Technology India, a prominent player in the electronics components sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company’s current stock price stands at 4,241.30, down from the previous close of 4,335.90. Over the past year, Kaynes Technology has demonstrated a notable return of 52.79%, significantly outperforming the Sensex, which recorded a return of 1.47% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the moving averages also reflect a bearish sentiment. The Bollinger Bands present a mixed picture, showing bearish tendencies weekly but bullish on a monthly scale. The On-Balance Volume (OBV) suggests a mildly bearish outlook, consistent across both weekly and monthly assessments. Despite the recent challenges, Kaynes Technology has shown resilience, particularly over the ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

General Announcement

29-Mar-2025 | Source : BSEGeneral Announcement

Board Meeting Outcome for Outcome Of The Board Meeting Dated March 29 2025

29-Mar-2025 | Source : BSEOutcome of the Board Meeting dated March 29 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available