KDDL Ltd Experiences Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:03:14KDDL Ltd, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 3168.00, down from the previous close of 3224.00. Over the past year, KDDL has demonstrated a notable stock return of 31.90%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary reveals a mixed picture. The MACD indicates a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) shows a bearish signal weekly, with no signal on a monthly basis. Bollinger Bands reflect a mildly bullish stance for both weekly and monthly evaluations, suggesting some volatility in price movements. KDDL's moving averages indicate a mildly bearish trend on a daily basis, while the KST presents a mildly bullish outlook weekly b...

Read MoreKDDL Ltd's Technical Indicators Signal Evolving Market Position Amidst Volatility

2025-03-21 08:00:59KDDL Ltd, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,128.00, showing a notable increase from the previous close of 3,097.05. Over the past year, KDDL has demonstrated strong performance, with a return of 27.08%, significantly outpacing the Sensex's return of 5.89% during the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis while remaining mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents a bearish stance weekly, yet lacks a clear signal monthly. Bollinger Bands reflect bullish trends in both weekly and monthly assessments, suggesting volatility may be favorable in the near term. KDDL's performance metrics reveal a 52-week high of 3,801.50 and a low of 2,048.60, indicating substantial ...

Read More

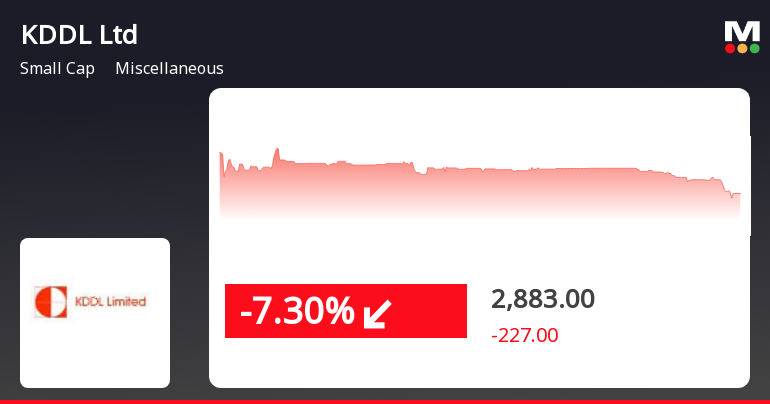

KDDL Ltd Faces Volatility Amidst Broader Market Challenges and Recent Gains

2025-02-25 15:35:15KDDL Ltd, a small-cap company in the miscellaneous sector, saw its shares decline significantly today after six days of gains. Despite this downturn, the stock remains above its moving averages and has shown an 18.32% increase over the past month, contrasting with broader market trends.

Read More

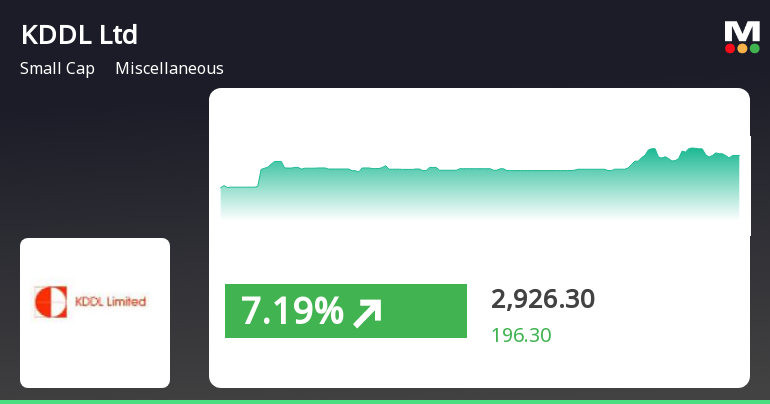

KDDL Ltd Shows Strong Market Position Amidst High Volatility and Active Trading

2025-02-21 11:50:13KDDL Ltd has experienced notable trading activity, gaining 7.18% on February 21, 2025, and outperforming its sector significantly. The stock reached an intraday high of Rs 2980, with high volatility and a 40.02% return over the past five days, indicating strong investor interest and market positioning.

Read More

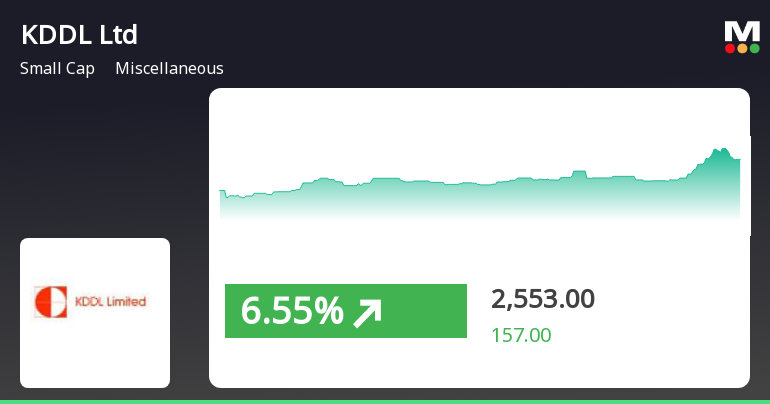

KDDL Outperforms Sector Amid Market Volatility, Showing Strong Short-Term Gains

2025-02-20 14:35:13KDDL, a small-cap company in the miscellaneous sector, experienced notable trading activity on February 20, 2025, with a significant intraday high and a strong performance relative to its sector. Despite recent volatility and mixed signals from moving averages, it has shown a consistent upward trend over the past four days.

Read More

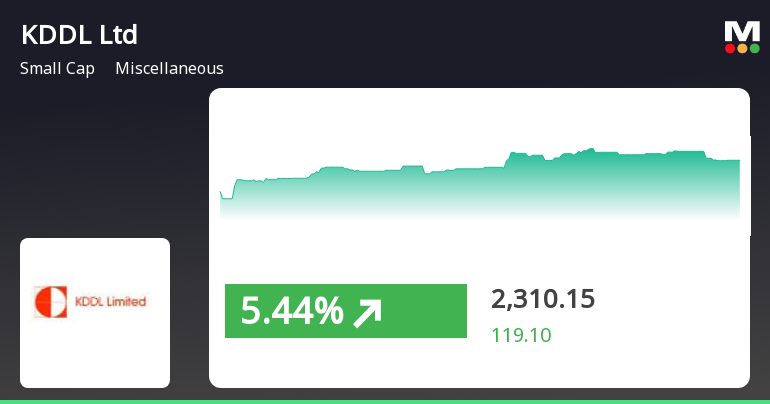

KDDL Experiences Significant Intraday Volatility Amid Broader Market Trends

2025-02-19 12:15:13KDDL, a small-cap company in the miscellaneous sector, experienced notable trading activity on February 19, 2025, with a significant intraday price range and volatility. Despite recent gains, the stock has declined over the past month, contrasting with the broader market's performance.

Read More

KDDL Ltd Reports Strong December 2024 Results Amid Rising Costs and Growth Challenges

2025-02-14 21:17:47KDDL Ltd has announced its financial results for the quarter ending December 2024, showcasing significant growth in net sales, operating profit, and earnings per share, all reaching their highest levels in five quarters. However, the company also experienced increased interest expenses, reflecting a mixed financial landscape.

Read More

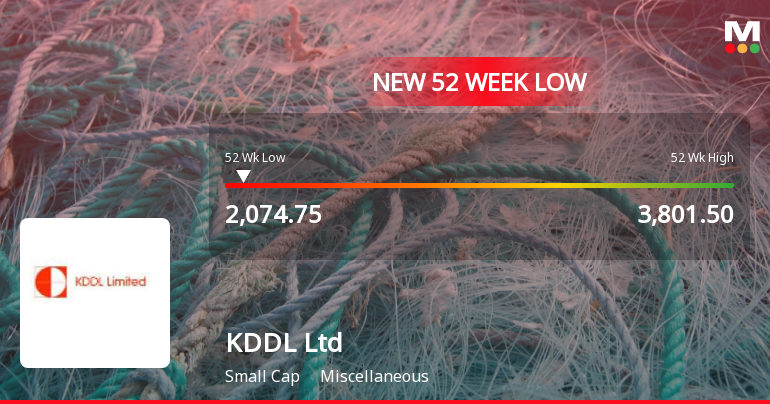

KDDL Ltd Faces Significant Volatility Amid Broader Market Trends in October 2023

2025-02-14 09:35:22KDDL Ltd, a small-cap company in the miscellaneous sector, is facing significant challenges, trading near its 52-week low and underperforming its sector. The stock has declined for seven consecutive days, with notable intraday volatility and a year-over-year drop, contrasting sharply with broader market gains.

Read More

KDDL Ltd Faces Significant Volatility Amid Broader Market Declines and Underperformance

2025-02-12 10:05:28KDDL Ltd has faced significant volatility, hitting a new 52-week low and experiencing a notable decline over the past week. The stock has underperformed compared to its sector and is trading below key moving averages, indicating ongoing challenges in the current market environment.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEIntimation

Announcement under Regulation 30 (LODR)-Acquisition

20-Mar-2025 | Source : BSEIncorporation of Subsidiary Company

Announcement under Regulation 30 (LODR)-Acquisition

18-Mar-2025 | Source : BSEIntimation for the acquisition of Shares by wholly owned Subsidiary Company

Corporate Actions

No Upcoming Board Meetings

KDDL Ltd has declared 40% dividend, ex-date: 27 Aug 24

No Splits history available

No Bonus history available

KDDL Ltd has announced 7:75 rights issue, ex-date: 30 Mar 21