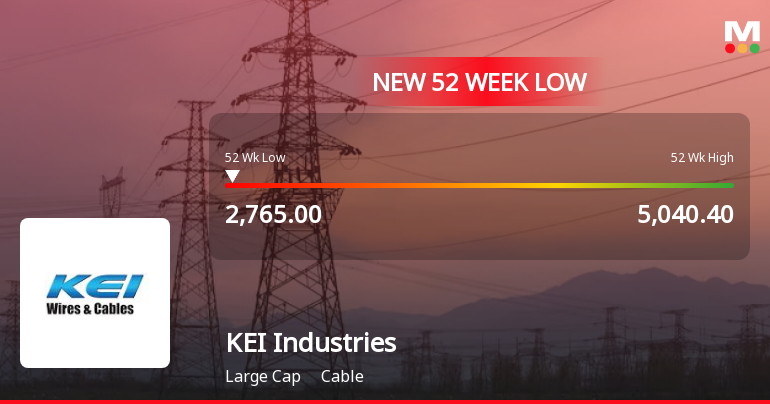

KEI Industries Faces Significant Volatility Amidst Bearish Trading Trends and High Valuation Concerns

2025-04-02 10:35:33KEI Industries has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock is trading below key moving averages and has declined significantly over the past year. Financial metrics show concerns in ROCE and cash reserves, while institutional holdings remain strong.

Read MoreKEI Industries Sees Significant Surge in Open Interest Amid Increased Trading Activity

2025-03-21 15:00:06KEI Industries Ltd, a prominent player in the cable industry, has experienced a significant increase in open interest today. The latest open interest stands at 64,102 contracts, reflecting a rise of 6,519 contracts or 11.32% from the previous open interest of 57,583. This uptick comes alongside a trading volume of 129,959 contracts, indicating heightened activity in the stock. In terms of price performance, KEI Industries is currently trading at Rs 2,890, which is 4.64% away from its 52-week low of Rs 2,762.25. The stock has shown resilience, outperforming its sector by 2.14% today, with an intraday high of Rs 2,936.75, marking a 3.37% increase. However, it is important to note that KEI Industries is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Additionally, the stock has seen a remarkable rise in delivery volume, which surged by 1,733.01% compared to the 5-day average, r...

Read MoreKEI Industries Sees Surge in Trading Activity Amid Mixed Market Conditions

2025-03-21 14:00:06KEI Industries Ltd, a prominent player in the cable industry, has emerged as one of the most active equities today, with a total traded volume of 2,354,811 shares and a total traded value of approximately Rs 68.19 crores. The stock opened at Rs 2,892.00 and reached an intraday high of Rs 2,936.75, reflecting a 3.37% increase during the trading session. However, it also recorded a day low of Rs 2,853.00, closing at Rs 2,887.00. Despite today's activity, KEI Industries is currently trading below its key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. The stock is also close to its 52-week low, sitting just 4.44% above Rs 2,762.25. Notably, the stock has outperformed its sector by 1.9%, while the broader market, represented by the Sensex, saw a 0.60% increase. Investor participation has notably risen, with a delivery volume of 28.56 lakh shares on March 20, marking a stag...

Read MoreSurge in Open Interest Signals Increased Market Activity for KEI Industries

2025-03-21 14:00:06KEI Industries Ltd, a prominent player in the cable industry, has experienced a significant increase in open interest today. The latest open interest stands at 65,242 contracts, reflecting a rise of 7,659 contracts or 13.3% from the previous open interest of 57,583. This surge coincides with a trading volume of 121,823 contracts, indicating heightened activity in the stock. In terms of price performance, KEI Industries closed the day 4.44% away from its 52-week low of Rs 2,762.25, having reached an intraday high of Rs 2,936.75, marking a 3.37% increase. Despite this positive movement, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging trend in the short to medium term. Additionally, the stock has seen a remarkable rise in delivery volume, with 28.56 lakh shares delivered on March 20, reflecting a staggering increase of 1,733.01% c...

Read MoreKEI Industries has emerged as one of the most active stock calls today amid rising options trading.

2025-03-21 14:00:04KEI Industries Ltd, a prominent player in the cable industry, has emerged as one of the most active stocks today, particularly in the options market. The company’s call options, set to expire on March 27, 2025, have seen significant trading activity, with 22,477 contracts exchanged at a turnover of approximately Rs 1,779.30 lakhs. The strike price for these options is set at Rs 3,000, while the underlying stock is currently valued at Rs 2,888.10. Open interest stands at 6,236 contracts, indicating a robust interest in these options. In terms of price performance, KEI Industries is currently trading close to its 52-week low, just 4.44% above Rs 2,762.25. Today, the stock outperformed its sector by 1.9%, reaching an intraday high of Rs 2,936.75, reflecting a 3.37% increase. However, it is noteworthy that KEI Industries is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesti...

Read MoreKEI Industries Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-21 13:00:04KEI Industries Ltd, a prominent player in the cable industry, has experienced a significant increase in open interest today, signaling heightened trading activity. The latest open interest stands at 65,335 contracts, reflecting a rise of 7,752 contracts or 13.46% from the previous open interest of 57,583. The trading volume for the day reached 113,615 contracts, indicating robust market engagement. In terms of price performance, KEI Industries is currently trading close to its 52-week low, just 4.09% above the low of Rs 2,762.25. The stock touched an intraday high of Rs 2,936.75, marking a 3.37% increase for the day. Notably, KEI Industries has outperformed its sector, achieving a 1.82% return compared to the sector's 0.30% and the Sensex's 0.81% return. Despite trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, the stock has seen a remarkable surge in delivery volume, which in...

Read MoreKEI Industries Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-21 12:00:04KEI Industries Ltd, a prominent player in the cable industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 66,040 contracts, up from the previous 57,583, marking a change of 8,457 contracts or a 14.69% increase. The trading volume for the day reached 105,021 contracts, indicating robust market engagement. In terms of price performance, KEI Industries closed the day at Rs 2,870, which is approximately 3.66% away from its 52-week low of Rs 2,762.25. The stock outperformed its sector by 0.75%, with an intraday high of Rs 2,936.75, reflecting a gain of 3.37% during the trading session. However, it is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Additionally, the stock has seen a remarkable rise in delivery volume, with 28.56 lakh shares delivered on March 20, representing a ...

Read MoreSurge in Open Interest Signals Increased Trading Activity for KEI Industries

2025-03-21 11:00:04KEI Industries Ltd, a prominent player in the cable industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 65,445 contracts, marking a rise of 7,862 contracts or 13.65% from the previous open interest of 57,583. The trading volume for the day reached 92,898 contracts, indicating robust market engagement. In terms of price performance, KEI Industries is currently trading close to its 52-week low, just 4.13% away from Rs 2,762.25. The stock saw an intraday high of Rs 2,936.75, representing a gain of 3.37% for the day. Despite this uptick, KEI Industries is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging trend in the short to medium term. Additionally, the stock has shown a notable increase in delivery volume, with 28.56 lakh shares delivered on March 20, reflec...

Read MoreKEI Industries Ltd has emerged as one of the most active stock puts today amid heightened market volatility.

2025-03-20 12:00:04KEI Industries Ltd, a prominent player in the cable industry, has emerged as one of the most active stocks in the options market today, particularly in put options. The company’s stock, currently valued at Rs 2805.65, has seen significant activity in its put options with multiple strike prices set for expiry on March 27, 2025. Notably, the put option with a strike price of Rs 2800 recorded the highest trading volume, with 11,992 contracts traded and a premium turnover of Rs 51.78 lakhs. Other active puts include those with strike prices of Rs 2700, Rs 2900, and Rs 3000, which saw 9,523, 8,799, and 9,194 contracts traded, respectively, contributing to premium turnovers of Rs 39.48 lakhs, Rs 39.61 lakhs, and Rs 42.82 lakhs. Today, KEI Industries has underperformed its sector by 8.91%, hitting a new 52-week low of Rs 2762.25, reflecting a one-day return of -13.96%. The stock opened with a gap down of 3.9% a...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate of Demat / Remat of shares under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended on 31.03.2025.

Disclosure Under Regulations 31 (4) Of SEBI (Substantial Acquisition Of Shares & Takeovers) Regulations 2011.

04-Apr-2025 | Source : BSEDisclosure under Regulation 31 (4) of SEBI ( Substantial Acquisition of Shares & Takeovers) Regulations 2011.

Cautionary Email Received From The BSE Regarding Delay In Intimation To Stock Exchanges

03-Apr-2025 | Source : BSEWe would like to inform that the company has received cautionary email from BSE limited regarding delay in intimation to stock exchange w.r.t re-appointment of independent director of the company on 08.01.2024. It is worthwhile to mention here that the company had already submitted its reply through email on 11.01.2024 in response to NSE email dated 11.01.2024 and in our reply to NSE we submitted that delay of 39 minutes in uploading the outcome of meeting was due to the technical glitch faced at our end.

Corporate Actions

No Upcoming Board Meetings

KEI Industries Ltd has declared 200% dividend, ex-date: 27 Jan 25

KEI Industries Ltd has announced 2:10 stock split, ex-date: 21 Dec 06

No Bonus history available

No Rights history available