Kellton Tech Faces Bearish Technical Trends Amid Market Volatility and Historical Growth

2025-03-11 08:03:42Kellton Tech Solutions, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 111.95, down from a previous close of 118.80, with a notable 52-week high of 184.30 and a low of 85.10. Today's trading saw a high of 120.45 and a low of 111.10, indicating some volatility. The technical summary for Kellton Tech reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST also indicate bearish conditions, with moving averages reflecting a bearish stance on a daily basis. The Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, suggesting a lack of momentum. In terms of performance, Kellton Tech's stock return over the past week stands at 4.97...

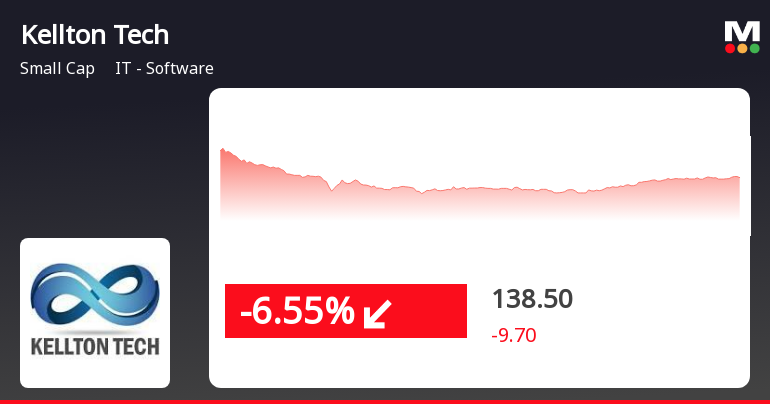

Read MoreKellton Tech Faces Stock Volatility Amid Broader Market Trends and Mixed Performance

2025-03-10 18:00:34Kellton Tech Solutions, a small-cap player in the IT software industry, has experienced significant stock activity today, with a notable decline of 5.77%. This drop contrasts with the Sensex, which saw a modest decrease of 0.29%. Over the past month, Kellton Tech's stock has faced challenges, reflecting a decline of 21.33%, while the Sensex fell by only 4.13% during the same period. Despite a positive performance over the past week, where Kellton Tech gained 4.97%, its year-to-date performance remains concerning, down 25.27% compared to the Sensex's decline of 5.15%. The company's market capitalization stands at Rs 1,130.00 crore, with a price-to-earnings ratio of 12.91, significantly lower than the industry average of 31.50. Technical indicators suggest a bearish trend, with the MACD and Bollinger Bands reflecting negative momentum. The stock's performance over longer periods shows a mixed picture, with ...

Read More

Kellton Tech Solutions Reports Strong Profit Growth Amid Long-Term Challenges

2025-02-28 18:29:35Kellton Tech Solutions has recently adjusted its evaluation, reflecting its current market position. The company reported a notable increase in net profit for Q3 FY24-25, alongside a strong debt servicing capability. However, it faces challenges in long-term growth, with modest increases in net sales and operating profit over the past five years.

Read More

Kellton Tech Solutions Faces Continued Stock Volatility Amid Broader Market Challenges

2025-01-28 10:05:32Kellton Tech Solutions has faced notable stock volatility on January 28, 2025, with a decline marking its third consecutive day of losses. The stock opened positively but quickly fell, reflecting a mixed trend in moving averages and a significant decline over the past month compared to the broader market.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Allotment Of 103331 Equity Shares Pursuant To The Employee Stock Options Granted Under ESOP Plan Of The Company.

28-Mar-2025 | Source : BSEAllotment Persuant to Exercise of Option Granted through Kellton ESOP Plan

Board Meeting Outcome- Addendum

10-Mar-2025 | Source : BSEAddendum to the Outcome of the Board Meeting

Corporate Actions

No Upcoming Board Meetings

Kellton Tech Solutions Ltd has declared 5% dividend, ex-date: 16 Sep 21

No Splits history available

Kellton Tech Solutions Ltd has announced 1:1 bonus issue, ex-date: 27 Mar 18

No Rights history available