Kerala Ayurveda Ltd Sees Strong Buying Activity, Reaches Intraday High Amid Market Rebound

2025-04-02 13:40:06Kerala Ayurveda Ltd is witnessing significant buying activity, marking a notable performance in the pharmaceuticals and drugs sector. Today, the stock surged by 5.06%, significantly outperforming the Sensex, which recorded a modest gain of 0.62%. This uptick comes after a challenging period, as the stock had experienced six consecutive days of decline prior to this rebound. In terms of weekly performance, Kerala Ayurveda has increased by 0.69%, while the Sensex has dipped by 1.03%. Over the past month, the stock has shown a gain of 3.25%, although it lags behind the Sensex's 4.51% increase. Year-to-date, Kerala Ayurveda is down 18.00%, compared to the Sensex's decline of 2.10%. However, its long-term performance remains robust, with a remarkable 350.53% increase over three years and an impressive 832.95% rise over five years. Today's trading saw the stock reach an intraday high of Rs 362.45, indicating st...

Read More

Kerala Ayurveda Faces Evaluation Shift Amid Mixed Technical Indicators and Weak Fundamentals

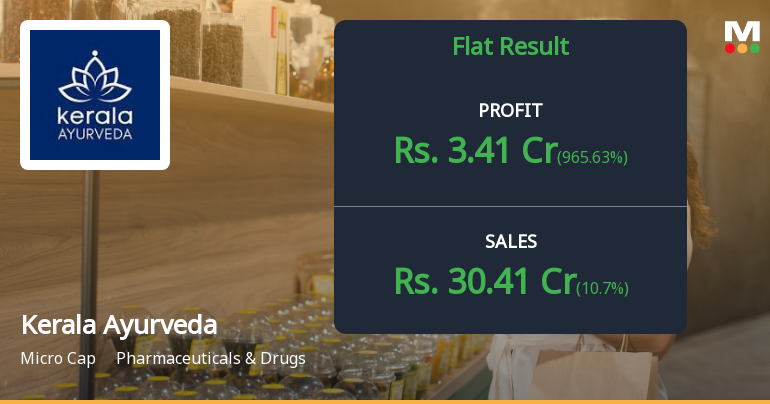

2025-04-02 08:08:02Kerala Ayurveda, a microcap in the Pharmaceuticals & Drugs sector, has experienced a recent evaluation adjustment reflecting a shift in its technical landscape. The company reported flat performance for the quarter ending December 2024, with a notable operating loss and weak long-term fundamentals, amid mixed technical indicators.

Read MoreKerala Ayurveda Ltd Achieves Notable Gains Amid Strong Buying Activity and Market Outperformance

2025-03-24 09:35:23Kerala Ayurveda Ltd is currently witnessing significant buying activity, with the stock showing a notable performance against the broader market. Today, the stock has gained 2.88%, outperforming the Sensex, which rose by only 0.53%. Over the past week, Kerala Ayurveda has recorded a robust increase of 11.14%, compared to the Sensex's 4.23%. The stock's performance over the last month is particularly impressive, with a rise of 19.84% against the Sensex's 3.84%. The stock has been on a positive trajectory, marking consecutive gains for the last two days, accumulating a total return of 10.35% during this period. It opened today with a gap up of 4.99% at Rs 408.3 and reached an intraday high of Rs 408.3, maintaining this price throughout the trading session. Kerala Ayurveda's strong performance can be attributed to its consistent trading above key moving averages, including the 5-day, 20-day, 50-day, 100-day...

Read MoreKerala Ayurveda Ltd Achieves Notable Gains Amid Strong Market Demand and Bullish Trend

2025-03-21 09:35:21Kerala Ayurveda Ltd is currently witnessing significant buying activity, with the stock showing a robust performance against the broader market. Today, it has recorded a gain of 5.11%, significantly outperforming the Sensex, which only increased by 0.06%. Over the past week, Kerala Ayurveda has risen by 8.03%, compared to the Sensex's 3.47% gain, and its one-month performance stands at an impressive 12.69% against the Sensex's 1.43%. The stock opened with a gap up of 2.41% today and reached an intraday high of Rs 388.9. This upward momentum is notable, especially as Kerala Ayurveda has consistently traded above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong bullish trend. In terms of longer-term performance, Kerala Ayurveda has shown remarkable resilience, with a one-year increase of 44.41% compared to the Sensex's 5.16%. Over three years, the stock has surged by 443....

Read MoreKerala Ayurveda Ltd Faces Selling Pressure Amid Significant Stock Price Decline

2025-03-20 12:40:08Kerala Ayurveda Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline of 5.00% in its stock price, contrasting sharply with the Sensex, which has gained 0.73% on the same day. This marks a reversal after four consecutive days of gains, indicating a shift in market sentiment. Over the past week, Kerala Ayurveda's performance has been relatively stable, with a slight increase of 0.36%, but this is overshadowed by the Sensex's 2.94% rise. In the longer term, the stock has shown mixed results; while it has gained 40.86% over the past year, it has also seen a year-to-date decline of 18.26%, compared to the Sensex's modest drop of 2.74%. The stock opened today with a gap up of 3.77%, reaching an intraday high of Rs 394.65 before falling to a low of Rs 363, reflecting a day of volatility. Despite being above its 5-day, 20-da...

Read More

Kerala Ayurveda Faces Financial Challenges Amidst Declining Profitability and High Debt Burden

2025-03-11 08:04:20Kerala Ayurveda, a microcap in the Pharmaceuticals & Drugs sector, has recently experienced a score adjustment reflecting its financial challenges. The company reported flat performance with an operating loss and high debt levels, while its profit after tax showed a significant decline. Despite these issues, the stock has outperformed the BSE 500 over the past year.

Read More

Kerala Ayurveda Faces Financial Challenges Amid Declining Profitability and High Debt Burden

2025-03-05 08:02:21Kerala Ayurveda, a microcap in the Pharmaceuticals & Drugs sector, recently experienced a financial evaluation adjustment amid flat performance and an operating loss for the December 2024 quarter. The company faces challenges, including a high debt burden and declining operating profit over five years, raising concerns about its long-term viability.

Read More

Kerala Ayurveda Reports Record Sales Amid Declining Profitability Challenges in December 2024

2025-02-15 14:04:09Kerala Ayurveda has reported its highest quarterly net sales at Rs 31.13 crore, reflecting consistent growth. However, the company faces challenges with a significant decline in profit after tax, alongside lower operating profit and profit before tax, indicating difficulties in operational efficiency and financial management.

Read More

Kerala Ayurveda Reports 693.48% Net Profit Surge Amid Long-Term Challenges

2025-02-03 18:23:36Kerala Ayurveda, a microcap in the Pharmaceuticals & Drugs sector, has recently seen a change in evaluation following strong Q2 FY24-25 financial results, including a notable increase in net profit and record net sales. However, long-term growth challenges persist, reflected in modest historical growth rates and a high debt profile.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Cessation

20-Mar-2025 | Source : BSECessation - Company Secretary

Announcement under Regulation 30 (LODR)-Change in Management

20-Mar-2025 | Source : BSEAppointment of Non Executive Director

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available