Kings Infra Ventures Faces Significant Volatility Amidst Persistent Downward Trend

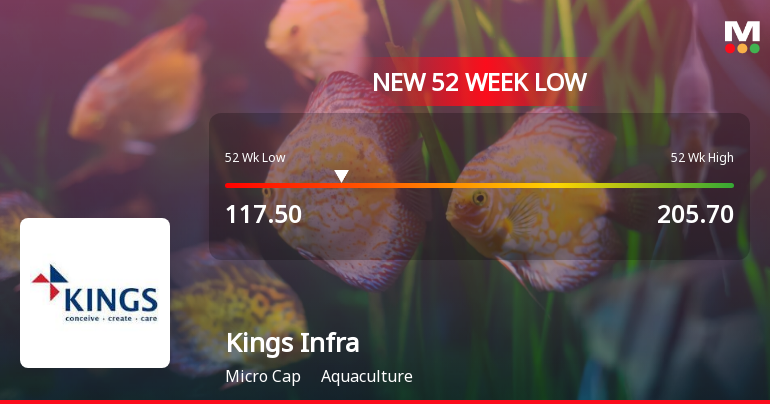

2025-03-03 09:36:23Kings Infra Ventures, a microcap in aquaculture, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and is trading below key moving averages, reflecting a persistent downward trend. Over the past year, it has declined notably compared to the broader market.

Read MoreKings Infra Ventures Faces Technical Trend Shifts Amid Market Pressures in Aquaculture Sector

2025-02-25 10:31:18Kings Infra Ventures, a microcap player in the aquaculture industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 141.20, slightly up from the previous close of 141.00. Over the past year, Kings Infra has faced challenges, with a notable decline of 26.93% compared to a modest 2.07% gain in the Sensex. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands, which are both showing bearish trends on a weekly and monthly basis. The moving averages also reflect a bearish stance, while the KST presents a mildly bullish outlook on a weekly basis but shifts to mildly bearish monthly. Despite recent fluctuations, the company has demonstrated resilience over longer periods, with impressive returns of 519.30% over five years and 2137.72% over ten years, significantly outperforming th...

Read MoreKings Infra Ventures Adjusts Valuation Amidst Competitive Aquaculture Landscape

2025-02-25 10:23:10Kings Infra Ventures, a microcap player in the aquaculture industry, has recently undergone a valuation adjustment. The company's current price stands at 142.45, reflecting a slight increase from the previous close of 141.00. Over the past year, Kings Infra has faced challenges, with a stock return of -26.29%, contrasting with a modest gain of 2.07% in the Sensex during the same period. Key financial metrics for Kings Infra include a PE ratio of 28.46 and an EV to EBITDA ratio of 16.43, indicating its market positioning within the sector. The company also boasts a return on capital employed (ROCE) of 22.81% and a return on equity (ROE) of 15.11%, showcasing its operational efficiency. In comparison to its peers, Kings Infra's valuation metrics present a mixed picture. While it maintains a fair valuation, competitors like Apex Frozen Foods and Coastal Corporation are positioned more attractively, albeit wi...

Read More

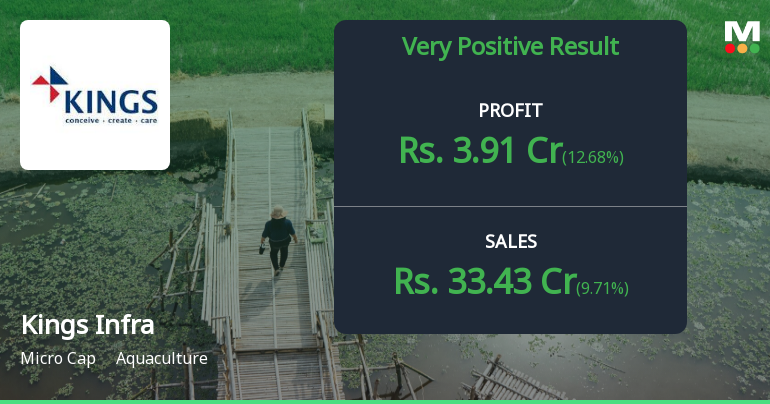

Kings Infra Ventures Reports Record High Sales and Profitability in December 2024 Results

2025-02-13 10:18:20Kings Infra Ventures has announced its financial results for the quarter ending December 2024, showcasing record net sales of Rs 33.43 crore and peak operating profit of Rs 6.74 crore. Profit before tax and profit after tax also reached new highs, while earnings per share increased to Rs 1.60.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSEPRESS RELEASE

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSERegulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025.

Outcome Of Investor Meeting Held On March 27 2025.

27-Mar-2025 | Source : BSEOutcome of Investor Meeting held on March 272025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available