Kiri Industries Shows Mixed Technical Trends Amid Strong Market Performance

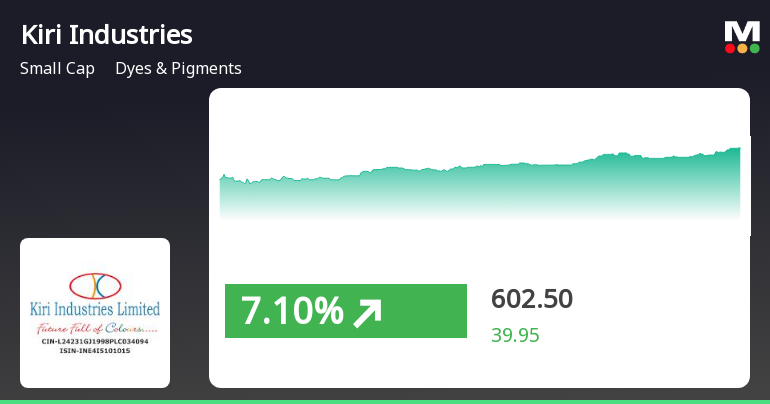

2025-04-03 08:01:22Kiri Industries, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 641.20, showing a notable increase from the previous close of 612.20. Over the past year, Kiri Industries has demonstrated impressive performance, with a return of 88.56%, significantly outpacing the Sensex's return of 3.67% during the same period. In terms of technical indicators, the stock exhibits a mixed picture. The MACD shows a bullish trend on a monthly basis, while the weekly indicator leans mildly bearish. The Bollinger Bands indicate a bullish stance for both weekly and monthly assessments, suggesting potential volatility within an upward trend. Daily moving averages also reflect a bullish sentiment, while the On-Balance Volume (OBV) is bullish on a weekly basis, indicating positive trading volume trends. Kiri ...

Read MoreKiri Industries Shows Mixed Technical Trends Amid Strong Yearly Performance Resilience

2025-04-02 08:02:18Kiri Industries, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 612.20, showing a decline from the previous close of 622.90. Over the past year, Kiri Industries has demonstrated significant resilience, with a return of 85.94%, notably outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish monthly. Bollinger Bands reflect a mildly bullish stance for both weekly and monthly assessments. Moving averages indicate a bullish trend on a daily basis, suggesting some short-term strength. In terms of stock performance, Kiri Industries has experienced fluctuations, with a 52-week high of 699.00 and a low of 280.00....

Read MoreKiri Industries Shows Mixed Technical Trends Amid Strong Performance and Market Adaptation

2025-03-26 08:00:57Kiri Industries, a small-cap player in the dyes and pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 644.10, showing a notable increase from its previous close of 625.65. Over the past year, Kiri Industries has demonstrated impressive performance, achieving a 100% return compared to the Sensex's 7.12%. The company's technical indicators present a mixed picture. While the MACD shows a mildly bearish trend on a weekly basis, it is bullish on a monthly scale. The Bollinger Bands indicate a bullish stance for both weekly and monthly periods, suggesting a potential for upward movement. Daily moving averages also reflect a bullish trend, while the KST shows a mildly bearish weekly trend but is bullish monthly. In terms of returns, Kiri Industries has outperformed the Sensex across various time frames, including a remarkabl...

Read MoreKiri Industries Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-25 08:01:16Kiri Industries, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 625.65, showing a notable increase from the previous close of 608.70. Over the past year, Kiri Industries has demonstrated impressive performance, with a return of 94.27%, significantly outpacing the Sensex's 7.07% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD shows a mildly bearish trend on a weekly basis, while it remains bullish on a monthly scale. The Bollinger Bands indicate a bullish stance for both weekly and monthly assessments, suggesting some volatility in price movements. Moving averages on a daily basis also reflect a bullish sentiment, while the KST presents a mildly bearish view weekly but bullish monthly. Kiri Industries has shown resilience with a...

Read MoreKiri Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:00:57Kiri Industries, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 608.00, showing a notable increase from its previous close of 575.65. Over the past year, Kiri Industries has demonstrated impressive performance, with a return of 85.25%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The MACD shows a bullish trend on a monthly basis, while the weekly indicator leans mildly bearish. The Bollinger Bands indicate bullish momentum on both weekly and monthly scales, suggesting a positive outlook in terms of volatility and price movement. Additionally, moving averages on a daily basis reflect bullish sentiment, while the KST shows a bullish trend monthly but mildly bearish...

Read More

Kiri Industries Shows Strong Resilience Amid Broader Market Challenges

2025-03-11 15:15:16Kiri Industries, a small-cap company in the Dyes & Pigments sector, experienced notable trading activity on March 11, 2025, outperforming the broader market. The stock is currently above key moving averages and has shown strong performance over various timeframes, including a significant one-year increase.

Read More

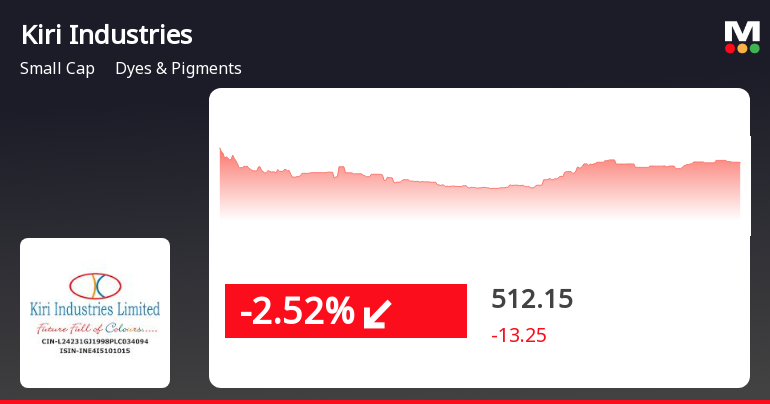

Kiri Industries Faces Continued Stock Decline Amid Broader Market Challenges

2025-03-03 11:50:17Kiri Industries, a small-cap company in the Dyes & Pigments sector, has faced notable volatility, experiencing a decline for four consecutive days. The stock has underperformed compared to its sector and the broader market, with significant losses over the past month and challenging short-term trends indicated by moving averages.

Read More

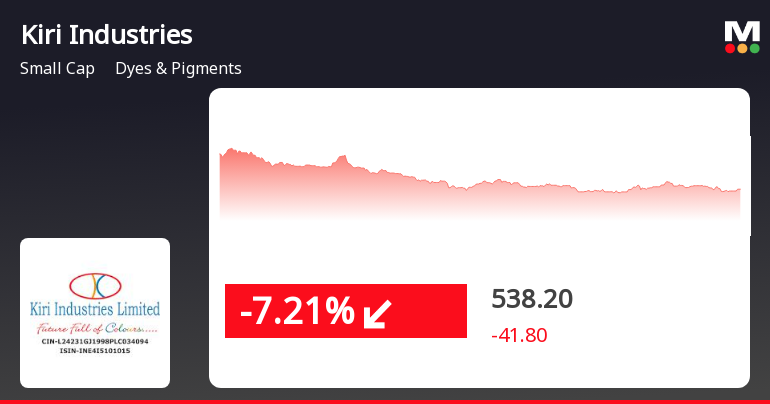

Kiri Industries Faces Significant Stock Decline Amidst Market Volatility in February 2025

2025-02-14 13:45:22Kiri Industries, a small-cap company in the Dyes & Pigments sector, has seen a notable decline in stock performance, dropping 7.68% today. The stock has faced consecutive losses, high volatility, and is currently positioned below several key moving averages, indicating challenges in the current market environment.

Read More

Kiri Industries Reports Mixed Financial Results, Highlighting Profit Growth Amid Sales Decline in December'24

2025-02-13 17:20:58Kiri Industries has reported its financial results for the quarter ending December 2024, showcasing a notable increase in Profit After Tax and Earnings per Share, both reaching five-quarter highs. However, challenges persist with declines in Profit Before Tax and net sales, alongside a rising debt-equity ratio.

Read MoreAnnouncement under Regulation 30 (LODR)-Acquisition

29-Mar-2025 | Source : BSEIntimation for incorporation of wholly owned subsidiary company.

Closure of Trading Window

25-Mar-2025 | Source : BSEEnclosed herewith Intimation of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Investor Presentation

19-Mar-2025 | Source : BSEEnclosed herewith the Investor Presentation-March 2025.

Corporate Actions

No Upcoming Board Meetings

Kiri Industries Ltd has declared 5% dividend, ex-date: 17 Sep 20

No Splits history available

No Bonus history available

No Rights history available