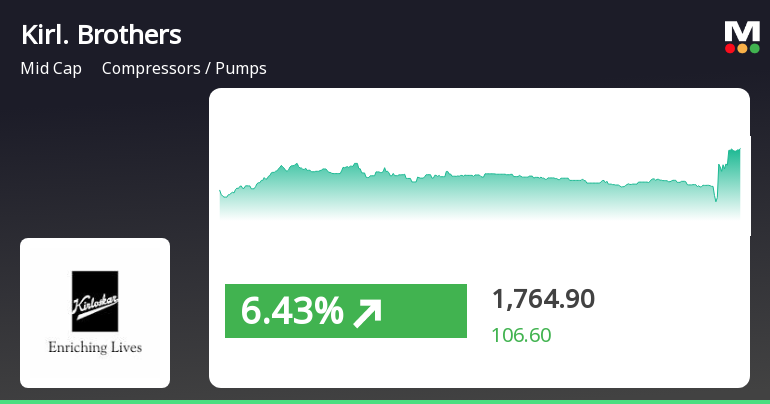

Kirloskar Brothers Faces Mixed Technical Trends Amid Strong Historical Performance

2025-04-03 08:05:23Kirloskar Brothers, a midcap player in the compressors and pumps industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1703.20, showing a slight increase from the previous close of 1697.85. Over the past year, Kirloskar Brothers has demonstrated a notable return of 54.73%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a neutral momentum. Bollinger Bands present a mixed picture, with a bearish stance on the weekly chart and a mildly bullish outlook on the monthly chart. Daily moving averages are bearish, while the KST reflects a bearish trend on the weekly scale and mildly bear...

Read More

Kirloskar Brothers Faces Technical Shift Amid Strong Financial Performance and Investor Confidence

2025-04-02 08:31:14Kirloskar Brothers, a key player in the compressors and pumps sector, has experienced a recent evaluation adjustment reflecting changes in its technical landscape. The company reported strong financial performance, with significant profit growth and high return on equity, despite being in a bearish technical range and having an elevated valuation compared to peers.

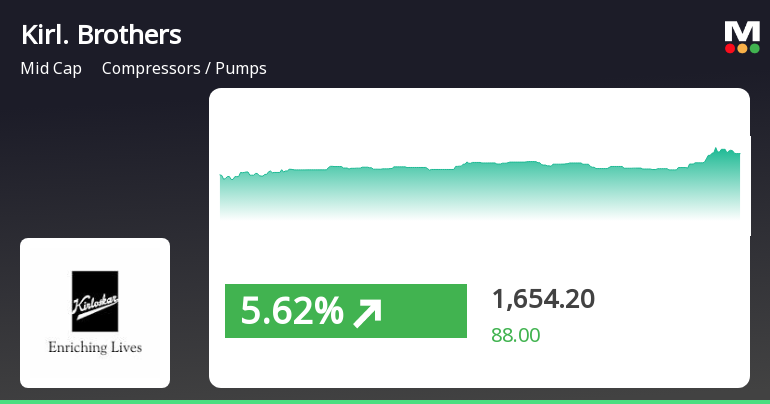

Read MoreKirloskar Brothers Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-04-02 08:08:06Kirloskar Brothers, a midcap player in the compressors and pumps industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,697.85, down from a previous close of 1,710.60. Over the past year, the stock has shown a notable return of 48.08%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a mildly bullish outlook on a monthly basis. The daily moving averages also reflect a bearish sentiment. When examining the stock's performance relative to the Sensex, Kirloskar Brothers has demonstrated resilience over longer periods, with a remarkable 476.03% return over three ...

Read MoreKirloskar Brothers Experiences Valuation Grade Change Amid Strong Stock Performance

2025-03-24 08:00:50Kirloskar Brothers, a midcap player in the compressors and pumps industry, has recently undergone a valuation adjustment. The company's current price stands at 1,745.00, reflecting a notable increase from the previous close of 1,658.30. Over the past year, Kirloskar Brothers has demonstrated significant stock performance, with a return of 69.24%, substantially outperforming the Sensex, which recorded a return of 5.87% during the same period. Key financial metrics for Kirloskar Brothers include a PE ratio of 31.84 and an EV to EBITDA ratio of 21.77. The company also boasts a robust return on capital employed (ROCE) of 37.32% and a return on equity (ROE) of 21.24%. In comparison to its peers, Kirloskar Brothers maintains a competitive position, although its valuation metrics indicate a higher relative standing within the industry. While the company has shown strong historical returns, its recent evaluation ...

Read More

Kirloskar Brothers Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 15:15:32Kirloskar Brothers has experienced notable stock activity, outperforming its sector and achieving a significant intraday high. While it shows strong short-term gains, its three-month performance indicates a decline. The company has demonstrated impressive long-term growth, with substantial increases over both three and five years.

Read More

Kirloskar Brothers Reports Strong Financial Performance and Increased Institutional Investor Confidence

2025-03-19 08:09:48Kirloskar Brothers has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25, with a notable return on equity of 15.49% and a low debt-to-equity ratio. The company reported a significant profit after tax increase and has consistently shown positive results, indicating robust market confidence.

Read MoreKirloskar Brothers Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:04:06Kirloskar Brothers, a midcap player in the compressors and pumps industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1668.90, showing a notable increase from the previous close of 1566.20. Over the past year, Kirloskar Brothers has demonstrated significant resilience, with a return of 63.10%, outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a bearish stance weekly and mildly bearish monthly. Th...

Read More

Kirloskar Brothers Experiences Notable Trend Reversal Amidst Mixed Performance Metrics

2025-03-18 13:50:27Kirloskar Brothers experienced a notable rebound on March 18, 2025, after five days of decline, with significant intraday gains. The stock has outperformed its sector and shown impressive annual growth, despite facing challenges in the short term. It is currently trading above its 5-day moving averages.

Read More

Kirloskar Brothers Shows Strong Financial Performance Amid Market Evaluation Adjustments

2025-03-17 10:36:24Kirloskar Brothers, a midcap player in the compressors and pumps sector, has recently adjusted its evaluation, reflecting strong management efficiency with a 15.49% return on equity and a low debt-to-equity ratio. The company reported a significant profit increase and robust liquidity, attracting more institutional investors.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI DP Regulations

Announcement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEIntimation under Regulation 30 of the SEBI Listing Regulations 2015

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Corporate Actions

No Upcoming Board Meetings

Kirloskar Brothers Ltd has declared 300% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available