Kirloskar Electric Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:01:26Kirloskar Electric Company, a microcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 136.60, slightly up from the previous close of 135.90. Over the past year, Kirloskar Electric has demonstrated notable performance, with a return of 24.98%, significantly outpacing the Sensex's 7.07% return in the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators reflect a mildly bearish stance. The moving averages on a daily basis also indicate a bearish trend. The Bollinger Bands and the Dow Theory present a mixed picture, with some metrics leaning towards a mildly bearish outlook. Despite the recent technical trend adjustment, Kirloskar Electric has shown impressive long-term returns, particularly over three and five years, w...

Read MoreKirloskar Electric Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:01:09Kirloskar Electric Company, a player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 134.55, showing a notable increase from the previous close of 119.80. Over the past year, Kirloskar Electric has demonstrated a stock return of 25.28%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands and KST also reflect a mildly bearish trend on a monthly basis. However, the Dow Theory indicates a mildly bullish stance on a weekly basis, suggesting some underlying strength. The company's performance over various time frames high...

Read More

Kirloskar Electric Reports Mixed Financial Results Amidst Debt Reduction and Declining Profitability in December'24

2025-02-12 15:47:43Kirloskar Electric Company has released its financial results for the quarter ending December 2024, showcasing a mix of improvements and challenges. The company achieved its lowest Debt-Equity Ratio in recent periods, while facing declines in Profit After Tax and net sales, indicating a complex financial landscape.

Read More

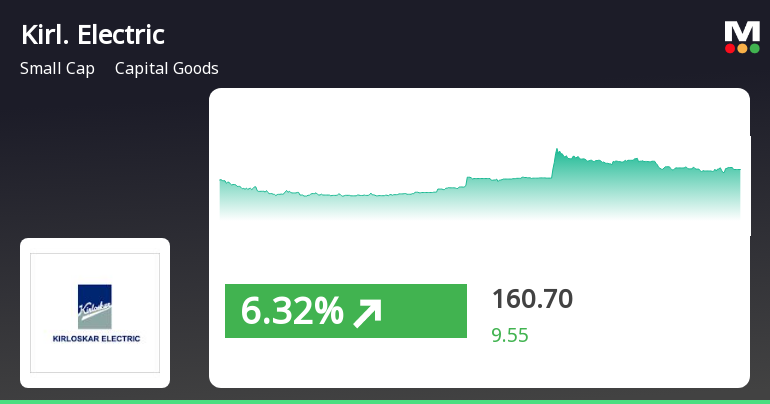

Kirloskar Electric Stock Surges Amid Market Volatility, Signaling Potential Trend Reversal

2025-01-28 13:30:13Kirloskar Electric Company saw a notable increase in its stock price on January 28, 2025, outperforming the broader market. The stock experienced high volatility during trading, reaching an intraday high while also showing a decline. Despite recent gains, it remains below its moving averages over various time frames.

Read More

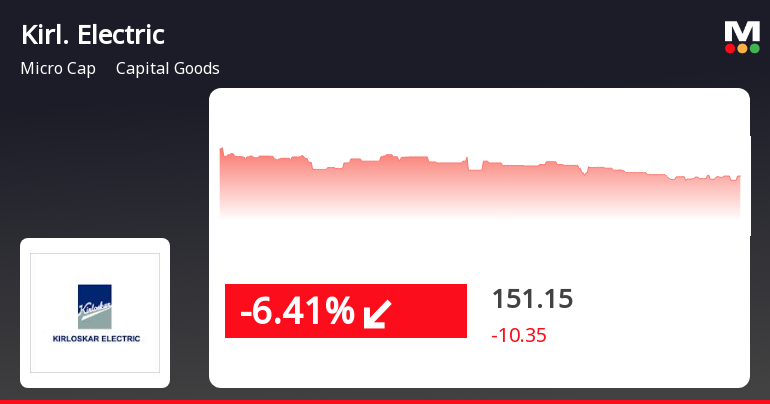

Kirloskar Electric Faces Significant Stock Volatility Amid Broader Market Challenges

2025-01-27 15:45:13Kirloskar Electric Company has faced notable stock volatility, experiencing a significant decline today and underperforming its sector. The stock has dropped 10.89% over the past two days and 15.48% in the last month, indicating ongoing challenges in a competitive market environment.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation on closure of trading window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

25-Mar-2025 | Source : BSEThe Company has intimated the exchange on newspaper publication.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

24-Mar-2025 | Source : BSEPlease find enclosed notice of postal ballot.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available