Kirloskar Ferrous Industries Adjusts Valuation Amid Declining Profitability Metrics

2025-03-27 08:04:29Kirloskar Ferrous Industries has recently experienced a change in its valuation grade, reflecting its current market standing amid key financial metrics. The company reports a PE ratio of 33.97 and a price-to-book value of 2.39, alongside notable returns on capital employed and equity, despite recent profitability challenges.

Read MoreKirloskar Ferrous Industries Adjusts Valuation Amid Competitive Steel Industry Landscape

2025-03-27 08:00:11Kirloskar Ferrous Industries has recently undergone a valuation adjustment, reflecting its current financial standing within the steel and iron industry. The company's price-to-earnings ratio stands at 33.97, while its price-to-book value is recorded at 2.39. Other key metrics include an EV to EBIT ratio of 20.12 and an EV to EBITDA ratio of 12.81, indicating its operational efficiency relative to its enterprise value. In terms of profitability, Kirloskar Ferrous showcases a return on capital employed (ROCE) of 11.27% and a return on equity (ROE) of 8.55%. The company also offers a dividend yield of 0.62%, which may appeal to certain investors. When compared to its peers, Kirloskar Ferrous Industries is positioned in a competitive landscape. Ratnamani Metals and Sarda Energy also reflect expensive valuations, while Jindal Saw presents a more attractive valuation profile. Notably, Kirloskar's performance o...

Read More

Kirloskar Ferrous Industries Adjusts Valuation Amidst Market Challenges and Financial Metrics

2025-03-20 08:04:08Kirloskar Ferrous Industries has recently experienced a change in its evaluation, highlighting a shift in its financial standing. Key metrics, including a Price to Earnings ratio of 36.71 and a Return on Capital Employed of 11.27%, indicate the company's premium valuation and operational efficiency amid a challenging financial quarter.

Read MoreKirloskar Ferrous Industries Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-20 08:00:09Kirloskar Ferrous Industries has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the steel, sponge iron, and pig iron industry. The company's price-to-earnings ratio stands at 36.71, while its price-to-book value is recorded at 2.58. Additionally, the enterprise value to EBITDA ratio is 13.70, and the enterprise value to EBIT is 21.51. The company also shows a return on capital employed of 11.27% and a return on equity of 8.55%. In comparison to its peers, Kirloskar Ferrous Industries maintains a higher valuation profile, particularly in terms of its price-to-earnings ratio, which is notably above that of Sarda Energy and Ratnamani Metals. While Jindal Saw presents a more attractive valuation, Kirloskar Ferrous's metrics indicate a robust market position. The company's recent stock performance has shown a significant return over the past three ...

Read More

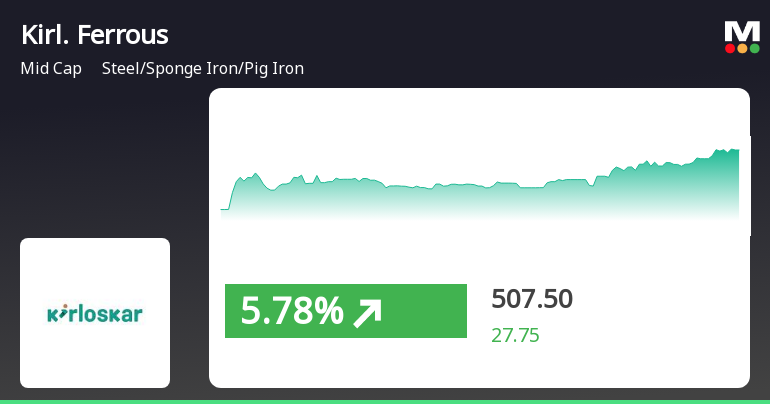

Kirloskar Ferrous Industries Shows Short-Term Gains Amid Mixed Long-Term Trends

2025-03-19 11:30:20Kirloskar Ferrous Industries has demonstrated notable activity, achieving consecutive gains over five days and outperforming its sector. While currently positioned above its short-term moving averages, it remains below longer-term averages. The broader market shows mixed signals, with small-cap stocks leading amid a bearish trend for the Sensex.

Read More

Kirloskar Ferrous Faces Financial Challenges Amidst Strong Management Efficiency and Growth Potential

2025-03-10 08:03:35Kirloskar Ferrous Industries has recently adjusted its evaluation, reflecting challenges in financial performance for the quarter ending December 2024. Key indicators showed declines, including profit metrics and an operating profit to interest ratio. Despite a strong management efficiency and growth potential, the stock has underperformed compared to the broader market.

Read MoreKirloskar Ferrous Industries Adjusts Valuation Grade Amid Competitive Steel Market Dynamics

2025-03-10 08:00:13Kirloskar Ferrous Industries has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the steel, sponge iron, and pig iron industry. The company's price-to-earnings ratio stands at 33.33, while its price-to-book value is recorded at 2.34. Additionally, the enterprise value to EBITDA ratio is 12.60, and the EV to EBIT ratio is 19.79, indicating a robust operational performance. In terms of returns, Kirloskar Ferrous has shown a notable performance over the long term, with a three-year return of 152.34% and a five-year return of 617.70%. However, year-to-date, the stock has experienced a decline of 25.81%, contrasting with the Sensex's performance, which has seen a decrease of 4.87% in the same period. When compared to its peers, Kirloskar Ferrous maintains a competitive position, although it is categorized as expensive relative to others in the sect...

Read More

Kirloskar Ferrous Hits 52-Week Low Amid Broader Market Decline and Small-Cap Gains

2025-03-04 10:42:40Kirloskar Ferrous Industries has hit a new 52-week low, continuing a downward trend with a notable decline over the past two days. The stock has underperformed its sector and the broader market, which is also experiencing losses. Despite financial challenges, the company shows strong management efficiency metrics.

Read More

Kirloskar Ferrous Industries Faces Challenges Amidst Declining Stock Performance and Market Positioning

2025-03-03 14:20:40Kirloskar Ferrous Industries has reached a new 52-week low, reflecting a challenging year with a significant decline in performance compared to the broader market. The stock is trading below its moving averages, indicating ongoing struggles within the competitive steel sector and prompting scrutiny of its operational strategies.

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Directorate

31-Mar-2025 | Source : BSECessation of a Director

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window from 1 April 2025 to 14 May 2025

Announcement under Regulation 30 (LODR)-Resignation of Director

18-Mar-2025 | Source : BSEResignation of a Director

Corporate Actions

No Upcoming Board Meetings

Kirloskar Ferrous Industries Ltd has declared 60% dividend, ex-date: 14 Feb 25

No Splits history available

No Bonus history available

Kirloskar Ferrous Industries Ltd has announced 9:10 rights issue, ex-date: 19 Dec 06