KMC Speciality Hospitals Adjusts Valuation Amidst Competitive Healthcare Landscape

2025-04-03 08:00:11KMC Speciality Hospitals, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment. The company's current price stands at 66.24, reflecting a notable increase from the previous close of 62.38. Over the past year, KMC has faced challenges, with a stock return of -23.98%, contrasting with a 3.67% gain in the Sensex. Key financial metrics for KMC include a PE ratio of 45.03 and an EV to EBITDA ratio of 21.88, which position it within a competitive landscape. In comparison to its peers, KMC's valuation metrics reveal a diverse range of performance. For instance, Yatharth Hospital and Thyrocare Technologies also maintain fair valuations, with PE ratios of 32.2 and 43.48, respectively. Meanwhile, Artemis Medicare and Krsnaa Diagnostics stand out with more attractive valuations, showcasing a broader spectrum of financial health within the industry. KMC's retu...

Read More

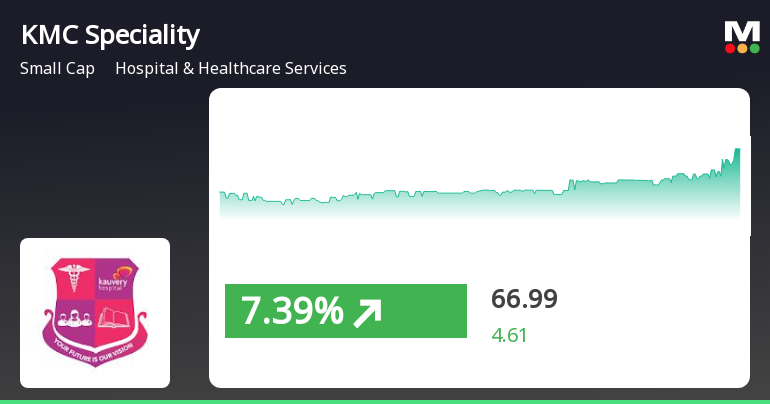

KMC Speciality Hospitals Shows Short-Term Gains Amid Broader Market Momentum

2025-04-02 15:30:17KMC Speciality Hospitals has seen a significant rise in its stock price, outperforming its sector and achieving consecutive gains over two days. The stock is currently above its short-term moving averages but below longer-term ones. Meanwhile, the broader market, including mid-cap stocks, is experiencing positive momentum.

Read More

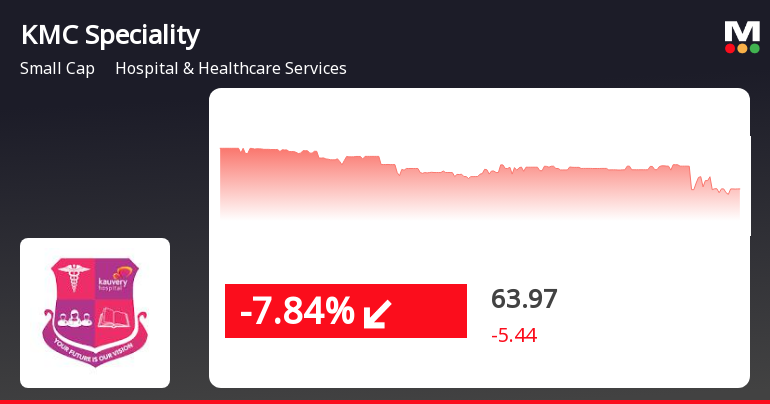

KMC Speciality Hospitals Faces Financial Struggles Amid Broader Market Challenges

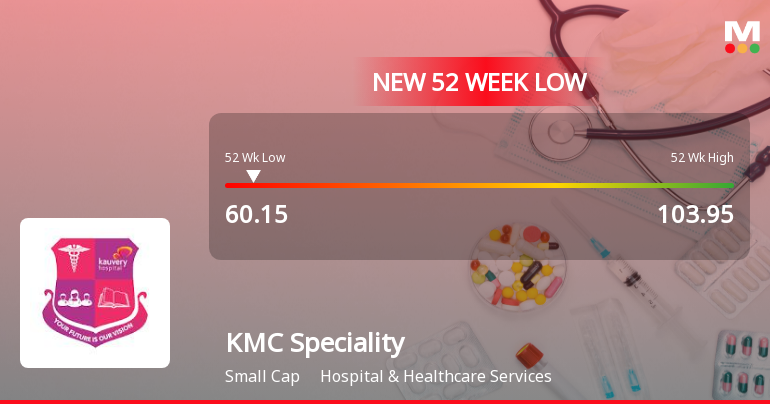

2025-03-13 13:35:33KMC Speciality Hospitals has reached a new 52-week low, reflecting a downward trend with a notable decline over the past four days. The company's financial performance shows stagnation in operating profit growth and a significant drop in profit after tax, alongside dwindling cash reserves and low return on capital employed.

Read MoreKMC Speciality Hospitals Adjusts Valuation Amid Competitive Healthcare Landscape Dynamics

2025-03-12 08:00:09KMC Speciality Hospitals, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment. The company's current price stands at 63.98, reflecting a notable decline from its previous close of 66.82. Over the past year, KMC has experienced a stock return of -25.85%, contrasting sharply with a modest gain of 0.82% in the Sensex. Key financial metrics for KMC reveal a PE ratio of 43.49 and an EV to EBITDA ratio of 21.19, indicating a premium valuation relative to some peers. For instance, Thyrocare Technologies has a PE ratio of 41.79, while Yatharth Hospital boasts a significantly lower PE of 28.04, highlighting a competitive landscape within the industry. KMC's return on capital employed (ROCE) is reported at 15.85%, and its return on equity (ROE) stands at 15.69%, suggesting solid operational efficiency. In comparison to its peers, KMC's valuation metrics pos...

Read More

KMC Speciality Hospitals Faces Significant Stock Volatility Amid Declining Financial Performance

2025-03-11 10:06:28KMC Speciality Hospitals has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined significantly over the past two days and has reported a one-year drop in value. Recent financial results show a substantial decrease in profit after tax, raising concerns about its performance.

Read MoreKMC Speciality Hospitals Adjusts Valuation Amidst Competitive Healthcare Sector Landscape

2025-03-04 08:00:26KMC Speciality Hospitals, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment. The company's current price stands at 65.79, with a previous close of 66.45. Over the past year, KMC has experienced a stock return of -27.74%, contrasting with a modest -0.98% return from the Sensex. Key financial metrics for KMC reveal a PE ratio of 44.72 and an EV to EBITDA ratio of 21.75, indicating a robust valuation relative to its peers. The company's return on capital employed (ROCE) is reported at 15.85%, while the return on equity (ROE) stands at 15.69%. These figures suggest a solid operational performance, although the stock has faced challenges in the short term. In comparison to its peers, KMC's valuation metrics highlight a competitive position within the industry. For instance, Thyrocare Technologies holds a PE ratio of 39.99, while Yatharth Hospital boa...

Read More

KMC Speciality Hospitals Faces Challenges Amidst Significant Stock Decline and Market Underperformance

2025-03-03 14:20:27KMC Speciality Hospitals has reached a new 52-week low, reflecting a significant decline over the past week and year. The stock has consistently underperformed compared to the broader Hospital & Healthcare Services sector and has struggled to maintain levels above key moving averages, indicating ongoing market challenges.

Read More

KMC Speciality Hospitals Faces Increased Market Challenges Amid Stock Volatility

2025-02-28 13:00:16KMC Speciality Hospitals (India) has faced notable stock volatility, hitting a 52-week low amid a challenging market. Over four days, the stock has dropped significantly, underperforming its sector. Currently, it trades below key moving averages, indicating bearish sentiment as the company navigates a competitive healthcare environment.

Read More

KMC Speciality Hospitals Faces Sustained Downward Trend Amid Sector Underperformance

2025-02-28 11:05:13KMC Speciality Hospitals has faced notable volatility, hitting a 52-week low of Rs. 65 and trailing its sector significantly. The stock has dropped consecutively over four days, with a year-to-date decline of 28.48%, contrasting with the Sensex's gains. It is also trading below key moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed copy of the certificate dated April 02 2025 received from our RTA - M/s Cameo Corporate Services Limited for the quarter ended March 31 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation on Closure of Trading Window

Shareholder Meeting / Postal Ballot-Scrutinizers Report

24-Mar-2025 | Source : BSEIntimation of Postal Ballot Results

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

KMC Speciality Hospitals (India) Ltd has announced 12:1 rights issue, ex-date: 06 Jan 11