KPT Industries Experiences Valuation Grade Change Amid Strong Financial Performance Metrics

2025-04-02 08:00:32KPT Industries, a microcap player in the engineering sector, has recently undergone a valuation adjustment, reflecting a more favorable assessment of its financial metrics. The company currently boasts a price-to-earnings (P/E) ratio of 20.78 and an impressive return on capital employed (ROCE) of 22.91%. Additionally, its return on equity (ROE) stands at 23.30%, indicating strong profitability relative to shareholder equity. In terms of valuation metrics, KPT Industries shows a price-to-book value of 4.84 and an enterprise value to EBITDA ratio of 12.75, which positions it competitively within its industry. The company's PEG ratio of 0.48 suggests a potentially attractive growth profile compared to its earnings. When compared to its peers, KPT Industries demonstrates a more favorable valuation profile, particularly in terms of its P/E and EV/EBITDA ratios, which are significantly lower than those of sever...

Read MoreKPT Industries Ltd Experiences Surge with 8.84% Gain Amid Strong Buying Activity

2025-03-20 14:20:04KPT Industries Ltd is currently witnessing significant buying activity, with the stock surging by 8.84% today, notably outperforming the Sensex, which rose by just 1.17%. Over the past week, KPT Industries has shown remarkable strength, gaining 63.46%, while the Sensex increased by only 3.39%. This trend of consecutive gains is evident, as the stock has risen for the last five days, accumulating a total return of 66.73% during this period. In terms of price performance, KPT Industries reached an intraday high of Rs 934.95, reflecting a 7.71% increase. The stock's current price is above its 5-day, 20-day, and 50-day moving averages, indicating short-term bullish momentum, although it remains below the 100-day and 200-day moving averages. Several factors may be contributing to the heightened buying pressure, including positive market sentiment in the engineering sector and potential developments within the ...

Read MoreKPT Industries Ltd Experiences Surge with 18.64% Daily Gain Amid Strong Buying Activity

2025-03-18 12:20:05KPT Industries Ltd is witnessing significant buying activity, with the stock surging by 18.64% today, notably outperforming the Sensex, which rose by just 1.16%. Over the past week, KPT Industries has recorded a remarkable 37.54% increase, while the Sensex managed only a 1.25% gain. This trend is further highlighted by the stock's performance over the last three days, where it has achieved consecutive gains totaling 44.58%. The stock opened with a gap up of 5.3% today and reached an intraday high of Rs 809, reflecting an increase of 18.48%. The volatility has been pronounced, with an intraday fluctuation of 5.89%. Despite this strong performance, KPT Industries has shown mixed results over longer periods, with a year-to-date decline of 16.90% compared to the Sensex's drop of 3.98%. Factors contributing to the current buying pressure may include positive sentiment in the engineering sector, which has gaine...

Read MoreKPT Industries Ltd Experiences Surge Amid Strong Buying Activity and Market Volatility

2025-03-17 11:55:04KPT Industries Ltd is currently witnessing significant buying activity, with the stock surging by 15.94% today, markedly outperforming the Sensex, which only gained 0.42%. This strong performance follows a two-day consecutive gain, where the stock has appreciated by 23.19%. The stock reached an intraday high of Rs 682.8, reflecting an increase of 18.14% during the trading session. In terms of volatility, KPT Industries has experienced high fluctuations today, with an intraday volatility of 8.57%. Despite this recent uptick, the stock's performance over the past month shows a decline of 4.00%, contrasting with the Sensex's slight drop of 2.45%. Over the longer term, KPT Industries has demonstrated remarkable growth, with a three-year performance of 397.11% and a five-year performance of 1618.21%, significantly outpacing the Sensex. The current buying pressure may be attributed to various factors, including...

Read More

KPT Industries Faces Significant Volatility Amid Broader Market Pressures

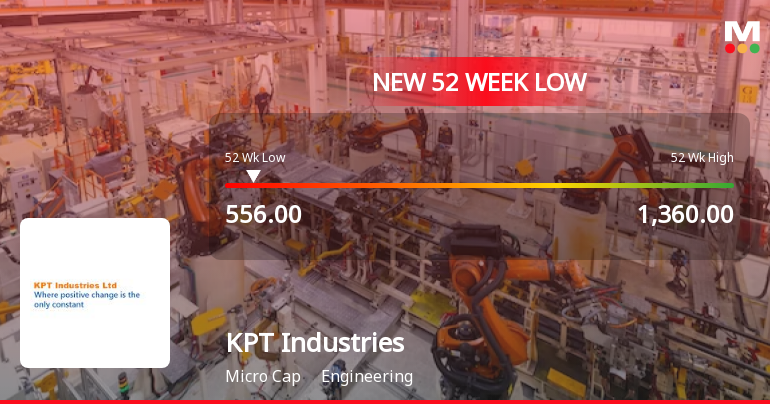

2025-03-12 11:05:15KPT Industries, a microcap engineering firm, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and exhibited a significant decline over the past week. Despite stagnant sales growth, the company maintains a strong return on capital employed, reflecting management efficiency.

Read More

KPT Industries Hits 52-Week Low Amidst Declining Stock Performance and Volatility

2025-03-11 10:35:46KPT Industries, a microcap engineering firm, has reached a new 52-week low, experiencing a notable decline over the past four days. The stock is currently trading below multiple moving averages, reflecting a bearish trend. Despite challenges, it maintains a high return on capital employed and an attractive valuation.

Read More

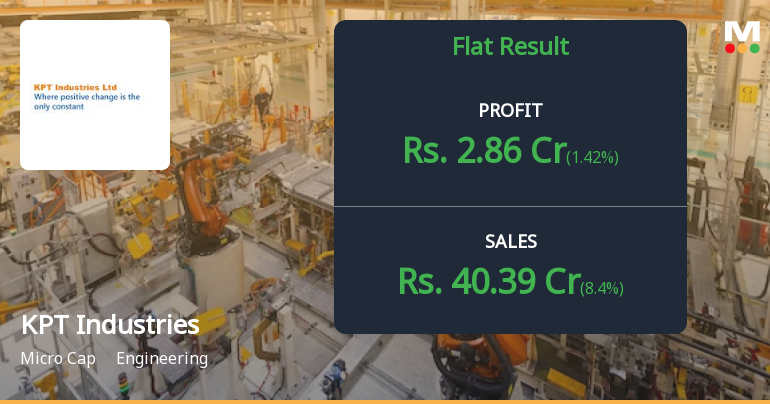

KPT Industries Reports Flat Q3 FY24-25 Results Amid Positive PAT Growth

2025-02-07 17:21:49KPT Industries has announced its financial results for the quarter ending February 2025, showing flat performance for Q3 FY24-25. However, the company reported a 29.69% year-on-year growth in Profit After Tax for the nine-month period, indicating some underlying strengths amid broader challenges in the engineering sector.

Read More

KPT Industries Reports Strong Q2 FY24-25 Growth Amid Bearish Market Sentiment

2025-01-28 18:43:37KPT Industries, a microcap engineering firm, has recently adjusted its evaluation amid positive financial results for Q2 FY24-25. The company reported significant growth in net sales and operating profit over five years, alongside strong management efficiency and profitability metrics, despite current bearish market sentiment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of SEBI (Depositories & Participants) Regulations 2018 we are enclosing herewith the Certificate issued by M/s. MUFG Intime India Private Limited RTA for the quarter ended on 31st March 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEAs per the Code of Conduct of the Company under the SEBI (Prohibition of Insider Trading) Regulations 2015 as amended we hereby inform you that Trading Window closing period for Connected Persons is from 01st April 2025 till completion of 48 hours after the audited financial results for the quarter and year ended on 31st March 2025 are submitted to BSE Ltd.

Response In Respect Of Clarification On Price Movement.

20-Mar-2025 | Source : BSEWe have noted the significant movement in the price of our security listed at your exchange in recent past.. This is to inform you that there were/are no events or information pursuant to Regulation 30 of SEBI (LODR) Regulations 2015 which has taken place that will have bearing on the operation/performance of the company which also includes price sensitive information other than those which are already disclosed to stock exchange from time to time. We have no other information to provide other than which is stated above.

Corporate Actions

No Upcoming Board Meetings

KPT Industries Ltd has declared 50% dividend, ex-date: 01 Aug 24

KPT Industries Ltd has announced 5:10 stock split, ex-date: 14 Feb 08

No Bonus history available

No Rights history available