KSE Experiences Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-02 08:03:12KSE, a microcap company operating in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1973.00, showing a slight increase from the previous close of 1933.40. Over the past year, KSE has demonstrated a notable return of 19.01%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD and KST are both bearish, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, indicating a lack of strong momentum in either direction. Additionally, Bollinger Bands and moving averages reflect bearish tendencies on a daily basis. KSE's performance over various time frames reveals a mixed picture. While the stock has faced challenges in...

Read MoreKSE Stock Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:01:10KSE, a microcap company operating in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1933.40, showing a notable increase from the previous close of 1907.75. Over the past year, KSE has demonstrated a return of 20.41%, significantly outperforming the Sensex, which recorded a return of 5.11% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bearish monthly trend. Daily moving averages also reflect a bearish sentiment, while the KST shows a mixed picture with a bearish weekly and bullish monthly outlook. Dow Theory suggests a mildly bullish trend...

Read MoreKSE Faces Technical Trend Shifts Amid Market Evaluation Revision and Bearish Indicators

2025-02-25 10:29:27KSE, a microcap company operating in the refined oil and vanaspati industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1955.00, down from a previous close of 1989.00, with a notable 52-week high of 2,990.00 and a low of 1,550.00. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on a weekly basis, while the monthly outlook shows a mildly bearish trend in some areas. The moving averages also reflect a bearish stance, suggesting a cautious market environment for KSE. In terms of performance, KSE's stock return over the past year stands at 9.77%, outperforming the Sensex, which recorded a return of 2.08% in the same period. However, the year-to-date performance shows a decline of 17.20% for KSE, compared to a 4.45% drop in the Sensex. Over a longer horizon, KSE has dem...

Read More

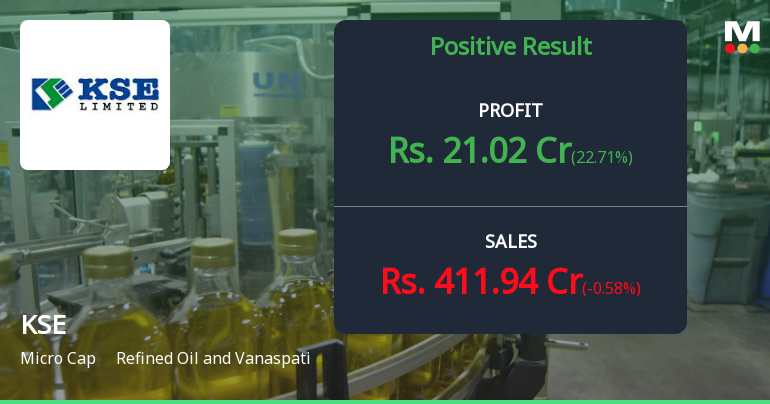

KSE Reports Strong Financial Results for December 2024, Indicating Growth Potential

2025-02-13 10:17:39KSE, a microcap company in the refined oil and vanaspati sector, has reported its financial results for the quarter ending December 2024, showing significant growth in key metrics. Profit Before Tax reached Rs 26.12 crore, while Profit After Tax was Rs 21.00 crore, alongside an improved Operating Profit Margin of 6.88%.

Read More

KSE Reports Strong Q2 FY24-25 Growth Amid Long-Term Challenges and Cautious Outlook

2025-02-04 18:34:20KSE, a microcap company in the refined oil and vanaspati sector, has recently adjusted its evaluation, reflecting strong financial performance in Q2 FY24-25. The company reported significant growth in profit metrics and maintains a low debt-to-equity ratio, although it faces challenges for long-term growth amid cautious institutional interest.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEEnclosing herewith the certificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

03-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | KSE Ltd- |

| 2 | CIN NO. | L15331KL1963PLC002028 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 23.93 |

| 4 | Highest Credit Rating during the previous FY | A- |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: srividya@kselimited.com

Designation: Chief Financial Officer

EmailId: nallamuthu.senthilkumar@kselimited.com

Date: 03/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Disclosure Under Regulation 31(4) Of The SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011 For The Financial Year Ended On March 31 2025

02-Apr-2025 | Source : BSEAttaching herewith the disclosure under regulation 31(4)

Corporate Actions

No Upcoming Board Meetings

KSE Ltd has declared 300% dividend, ex-date: 18 Feb 25

No Splits history available

No Bonus history available

No Rights history available