L G Balakrishnan & Bros Faces Market Sentiment Shift Amid Financial Metric Adjustments

2025-04-02 08:31:01L G Balakrishnan & Bros, a small-cap engineering firm, has experienced a recent evaluation adjustment reflecting changes in its financial metrics. Key indicators suggest shifts in market sentiment, while the company maintains strong operational efficiency and financial stability, despite recent trends in investor participation and flat quarterly performance.

Read MoreL G Balakrishnan & Bros Adjusts Valuation Grade Amid Strong Financial Metrics

2025-04-02 08:02:11L G Balakrishnan & Bros, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics. The company boasts a price-to-earnings (P/E) ratio of 14.30 and an impressive return on capital employed (ROCE) of 22.93%. Additionally, its return on equity (ROE) stands at 15.17%, indicating effective management of shareholder funds. In terms of valuation metrics, L G Balakrishnan's enterprise value to EBITDA ratio is 8.57, while its price to book value is recorded at 2.19. The company also offers a dividend yield of 1.44%, which adds to its appeal among investors. When compared to its peers, L G Balakrishnan demonstrates a more favorable valuation profile, particularly in terms of P/E and enterprise value to EBITDA ratios. Many competitors in the sector are positioned at significantly higher valuation levels, highlightin...

Read MoreL G Balakrishnan & Bros Faces Technical Trend Shift Amid Market Volatility

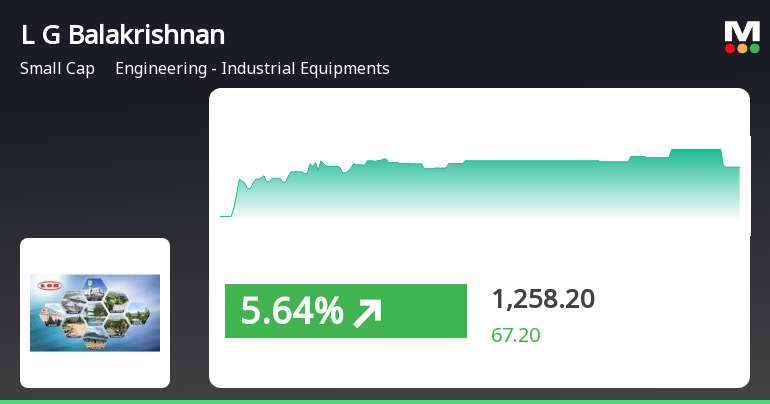

2025-03-27 08:03:03L G Balakrishnan & Bros, a small-cap player in the engineering and industrial equipment sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1212.10, down from a previous close of 1242.95. Over the past year, the stock has experienced a high of 1,575.00 and a low of 1,129.30, indicating notable volatility. The technical summary reveals a bearish sentiment across several indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly assessments. Moving averages indicate a bearish trend on a daily basis, and the KST aligns with this sentiment, showing bearish on a weekly level and mildly bearish monthly. In terms of performance, L G Balakrishnan has faced challenges compared to the Sensex. Over the past week, the stock returned -2.88%, whil...

Read More

L G Balakrishnan & Bros Faces Market Challenges Amid Strong Management Efficiency

2025-03-25 08:20:42L G Balakrishnan & Bros, a small-cap engineering firm, has experienced a recent evaluation adjustment reflecting changes in its technical indicators and market position. Despite a strong return on equity and low debt, the company faces challenges in long-term growth and a decline in institutional investor participation.

Read MoreL G Balakrishnan & Bros Experiences Technical Trend Adjustments Amid Market Resilience

2025-03-19 08:04:00L G Balakrishnan & Bros, a small-cap player in the engineering and industrial equipment sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1240.60, reflecting a notable increase from the previous close of 1191.00. Over the past year, the stock has reached a high of 1,575.00 and a low of 1,123.00, indicating a degree of volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) currently presents no signal for both weekly and monthly assessments. Bollinger Bands and KST also indicate a mildly bearish trend monthly, while the Dow Theory suggests a mildly bullish outlook on both weekly and monthly fronts. The On-Balance Volume (OBV) reflects a bullish stance on a monthly basis, although it shows no trend weekly. When comparing the company...

Read More

L G Balakrishnan & Bros Shows Strong Relative Performance Amid Sector Gains

2025-03-18 12:35:28L G Balakrishnan & Bros, a small-cap engineering firm, experienced notable activity, outperforming its sector. The stock is currently above several moving averages, indicating a mixed trend. Over the past three years, it has achieved a substantial return, significantly exceeding the broader market's performance.

Read More

L G Balakrishnan & Bros Faces Evaluation Adjustment Amid Mixed Financial Indicators

2025-03-18 08:19:46L G Balakrishnan & Bros, a small-cap engineering firm, recently experienced a grade adjustment reflecting its financial performance and market trends. The company reported flat Q3 FY24-25 results, with a 9.54% annual sales growth over five years, while facing challenges in capital efficiency and declining institutional investor stakes.

Read MoreL G Balakrishnan & Bros Experiences Technical Trend Adjustments Amid Mixed Performance

2025-03-18 08:03:22L G Balakrishnan & Bros, a small-cap player in the engineering and industrial equipment sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1,191.00, slightly down from the previous close of 1,199.00. Over the past year, the stock has experienced a high of 1,575.00 and a low of 1,123.00, indicating some volatility in its performance. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a bearish sentiment for both weekly and monthly assessments. Moving averages indicate a bearish trend on a daily basis, and the KST aligns with this bearish sentiment on a weekly level, though it is mildly bearish monthly. The Dow Theory presents a mildly bullish perspective on both weekly and monthly fronts, while the On-Balance Volume shows no trend weekly but is ...

Read More

L G Balakrishnan & Bros Shows Strong Management Efficiency Amidst Growth Challenges

2025-03-11 08:17:06L G Balakrishnan & Bros, a small-cap engineering firm, has recently adjusted its evaluation, reflecting strong management efficiency with a 16.02% return on equity and a low debt-to-equity ratio. Despite a modest growth trajectory and recent flat performance, the company has consistently outperformed the BSE 500 index over three years.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIn terms of SEBI PIT Regulations 2015 the Trading Window for dealing in the Companys Securities shall remain closed for all directors / officers / designated employees including their immediate relatives from Tuesday April 1 2025 till the expiry of 48 hours after the announcement of its Audited Financial Results for the Quarter and Year ended 31.03.2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEIn terms of SEBI PIT Regulations 2015 the Trading Window shall remain closed for all directors / officers / designated employees including their immediate relatives from Monday 01.04.2025 till the expiry of 48 hours after the announcement of its Audited Financial Results for the quarter and Year ended 31.03.2025. Kindly take the same on record.

Compliances-Reg. 50 (1) - Prior intimation about Board meeting under Regulation 50(1)

26-Mar-2025 | Source : BSEThe meeting of the Board of Directors is scheduled on Wednesday 30.04.2025 to consider and approve the Audited Financial Results for the Quarter and Financial year ended 31.03.2025 and to recommend the dividend if any for the financial year 2024-25

Corporate Actions

30 Apr 2025

L G Balakrishnan & Bros Ltd has declared 180% dividend, ex-date: 22 Aug 24

L G Balakrishnan & Bros Ltd has announced 10:1 stock split, ex-date: 15 Mar 10

L G Balakrishnan & Bros Ltd has announced 1:1 bonus issue, ex-date: 14 Jun 18

No Rights history available