Laxmi Organic Industries Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-12 08:00:51Laxmi Organic Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 36.28 and an EV to EBITDA ratio of 15.51, indicating its market positioning relative to its earnings and operational performance. The PEG ratio stands at 1.05, suggesting a balanced growth perspective in relation to its earnings growth. In comparison to its peers, Laxmi Organic's valuation metrics reveal a competitive stance. Bharat Rasayan, for instance, has a lower PE ratio of 23.64 but is categorized differently in terms of valuation. Rallis India shares a similar valuation grade with Laxmi Organic, showcasing a PE ratio of 30.81. Other competitors like Bhagiradha Chemicals and 3B Blackbio exhibit significantly higher valuation metrics, indicating a diverse landscape within the industry. Despite recent fl...

Read MoreLaxmi Organic Industries Adjusts Valuation Grade Amid Competitive Agrochemical Landscape

2025-03-04 08:00:12Laxmi Organic Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 34.60 and a price-to-book value of 2.54, indicating its market positioning within the industry. The EV to EBITDA stands at 14.78, while the EV to sales ratio is recorded at 1.50. Additionally, Laxmi Organic's PEG ratio is 1.00, and it offers a dividend yield of 0.35%. In terms of profitability, the latest return on capital employed (ROCE) is 10.17%, and the return on equity (ROE) is 7.22%. When compared to its peers, Laxmi Organic's valuation metrics show a competitive stance, particularly against companies like Sharda Cropchem and Rallis India, which also hold attractive valuations. However, it is noteworthy that some peers, such as Bhagiradha Chemicals and 3B Blackbio, are positioned at higher valuation levels. Over...

Read More

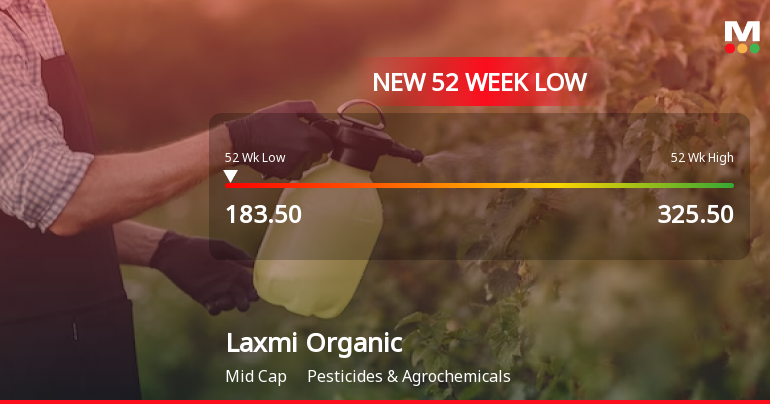

Laxmi Organic Industries Faces Significant Volatility Amidst Sector Challenges

2025-03-03 09:37:56Laxmi Organic Industries has reached a new 52-week low, continuing a downward trend over the past six days with a cumulative loss. The company has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in maintaining its market position amid broader industry fluctuations.

Read More

Laxmi Organic Industries Hits New Low Amid Ongoing Sector Challenges and Bearish Sentiment

2025-02-28 09:39:28Laxmi Organic Industries has reached a new 52-week low, continuing a downward trend with a decline over the past five days. The stock is trading below multiple moving averages, reflecting bearish sentiment. Over the past year, it has decreased significantly, contrasting with the overall market performance.

Read More

Laxmi Organic Industries Faces Persistent Downward Trend Amid Challenging Market Conditions

2025-02-27 10:05:55Laxmi Organic Industries has reached a new 52-week low, continuing a downward trend with a 5.01% decline over four days. Its one-year performance shows a significant drop of 29.59%, contrasting with the Sensex's modest gain. The stock is trading below key moving averages, indicating ongoing challenges.

Read More

Laxmi Organic Industries Faces Significant Volatility Amidst Broader Agrochemical Sector Challenges

2025-02-25 12:05:25Laxmi Organic Industries has reached a new 52-week low, reflecting significant volatility and a 5.26% decline over the past three days. The stock is trading below all major moving averages and has dropped 31.23% over the past year, underperforming compared to the broader market.

Read More

Laxmi Organic Industries Hits 52-Week Low Amid Sustained Stock Decline

2025-02-24 09:36:31Laxmi Organic Industries has reached a new 52-week low, reflecting ongoing challenges in its stock performance. The company has underperformed its sector and is trading below key moving averages. Over the past year, it has seen a significant decline, contrasting with broader market gains.

Read More

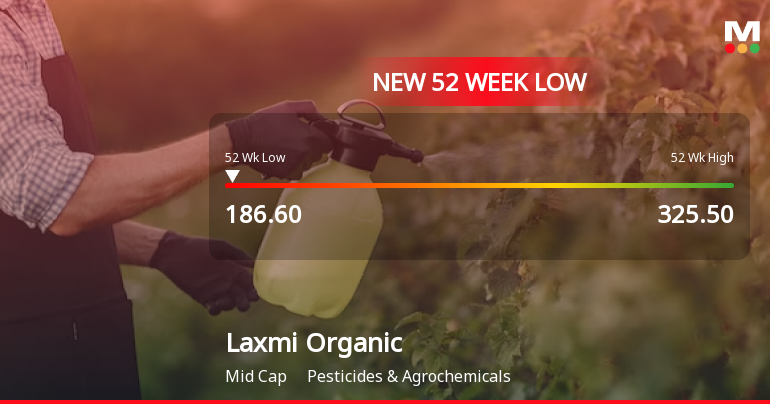

Laxmi Organic Industries Faces Market Challenges Amid Recent Stock Activity

2025-02-19 11:05:39Laxmi Organic Industries has seen notable trading activity as it nears its 52-week low, currently at Rs 186.6. The stock outperformed its sector today, reversing a four-day decline with an intraday high of Rs 194.9. However, it remains below key moving averages and has declined 27.48% over the past year.

Read More

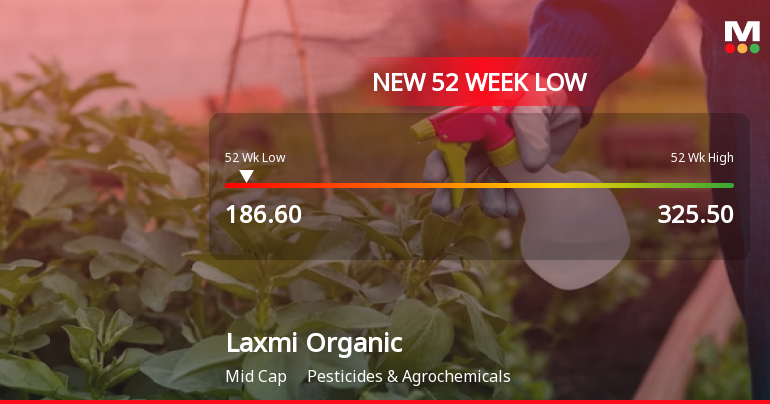

Laxmi Organic Industries Faces Significant Volatility Amidst Sustained Downward Trend

2025-02-18 11:57:18Laxmi Organic Industries has faced notable volatility, hitting a new 52-week low of Rs. 186.6 and underperforming its sector. The stock has declined 8.25% over the past four days and 29.86% over the past year, trading below key moving averages, signaling ongoing challenges for the company.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease see enclosed Certificate dated April 07 2025 received from MUFG Intime India Private Limited Registrar and Share Transfer Agent of the Company certifying compliance with the requirement of Regulation 74(5)of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended on March 31 2025. Please take the same on record.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

02-Apr-2025 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that Nomination and Remuneration Committee of the Board of Directors of the Company on Tuesday April 01 2025 by circular resolution has in accordance with the terms of ESOP - 2020 Scheme allotted 42692 equity shares of face value Rs. 2/- each in the share capital of the Company for cash at par to the eligible employees of the Company who exercised their stock options under ESOP-2020. These shares shall rank pari passu in all respects with the existing equity shares of the Company. After allotment of aforesaid equity shares the share capital of the Company stands increased from 554047626 to 554133010. We request you to take the above on record.

Closure of Trading Window

27-Mar-2025 | Source : BSEIn terms of provisions of Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations 2015 as amended from time to time and in terms of Companys code of Conduct for Prohibition of Insider Trading the Trading Window for dealing in the Equity Shares of the Company shall remain close for all Designated Persons and their immediate relatives for the period from Tuesday April 01 2025 till the end 48 hours after the declaration of the Unaudited Financial Results of the Company for the quarter ended March 31 2025. The date of Board Meeting for declaration of Unaudited Financial Results of the Company for the quarter ended March 31 2025 will be intimated in due course. This is for your information and records.

Corporate Actions

No Upcoming Board Meetings

Laxmi Organic Industries Ltd has declared 30% dividend, ex-date: 19 Jul 24

No Splits history available

No Bonus history available

No Rights history available