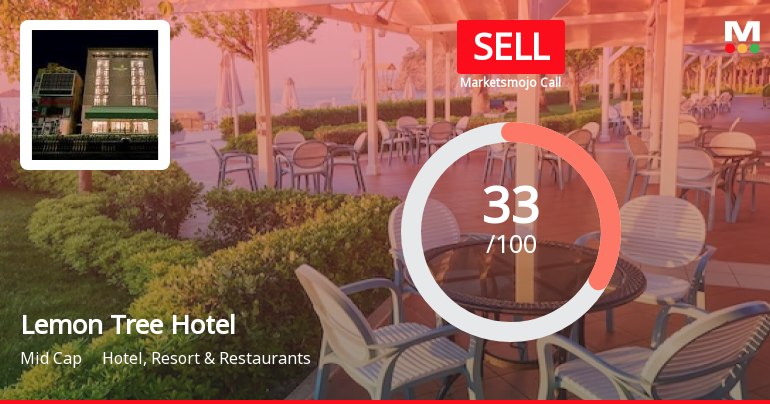

Lemon Tree Hotels Faces Mixed Market Signals Amid Strong Financial Performance and Debt Concerns

2025-04-02 08:34:03Lemon Tree Hotels has recently experienced a change in its evaluation, influenced by technical indicators and financial metrics. While the company reported strong net profit growth for Q3 FY24-25, it faces challenges such as a high debt-to-equity ratio and low return on equity, complicating its market position.

Read MoreLemon Tree Hotels Shows Mixed Technical Trends Amid Market Fluctuations

2025-04-02 08:09:27Lemon Tree Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 136.90, showing a notable increase from the previous close of 128.50. Over the past year, the stock has experienced fluctuations, with a 52-week high of 162.25 and a low of 112.30. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The moving averages indicate a mildly bearish stance on a daily basis, with Bollinger Bands reflecting a sideways movement for both weekly and monthly assessments. The Dow Theory suggests a mildly bullish trend on a weekly basis, although there is no clear trend observed monthly. When comparing the stock's performance to the Sensex, Lemon Tree Hotels has shown resilience in the short term, with a...

Read More

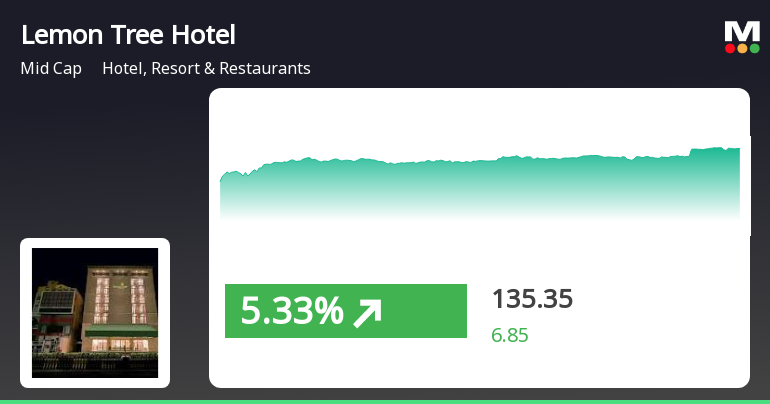

Lemon Tree Hotels Shows Resilience Amid Market Volatility with Notable Stock Gains

2025-04-01 14:20:23Lemon Tree Hotels experienced significant activity on April 1, 2025, gaining 5.29% after a five-day decline. The stock outperformed the broader market, reaching an intraday high of Rs 135.4. Despite recent volatility, it has shown resilience, with an 11.11% increase over the past month and a 521.79% rise over five years.

Read More

Lemon Tree Hotels Faces Mixed Financial Outlook Amid Technical Adjustments and High Debt Concerns

2025-03-27 08:10:57Lemon Tree Hotels has recently experienced a change in its evaluation, reflecting a cautious outlook amid mixed financial performance. Key technical indicators suggest a bearish trend, while the company grapples with a high debt-to-equity ratio despite notable profit growth. Overall, its market position remains complex.

Read MoreLemon Tree Hotels Faces Bearish Technical Trends Amidst Long-Term Resilience

2025-03-27 08:03:50Lemon Tree Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 131.95, down from a previous close of 136.00. Over the past year, Lemon Tree Hotels has experienced a slight decline of 0.23%, contrasting with a 6.65% gain in the Sensex, indicating a lag in performance relative to the broader market. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Additionally, the Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment for the stock. The KST indicator aligns with this sentiment, indicating bearish trends on a weekly basis. Despite these challenges, Lemon Tree Hotels has demonstrated resilience over long...

Read MoreLemon Tree Hotels Faces Technical Trend Adjustments Amid Strong Long-Term Performance

2025-03-20 08:03:48Lemon Tree Hotels, a midcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 135.95, showing a slight increase from the previous close of 134.55. Over the past year, Lemon Tree Hotels has demonstrated a return of 4.94%, slightly outperforming the Sensex, which returned 4.77% in the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Moving averages indicate a mildly bearish stance on a daily basis, while the Bollinger Bands reflect a sideways trend weekly and a bullish trend monthly. Notably, Lemon Tree Hotels has shown strong performance over longer periods, with a remarkable 339.97% retur...

Read MoreLemon Tree Hotels Shows Resilience Amid Market Fluctuations and Long-Term Growth Potential

2025-03-19 18:00:44Lemon Tree Hotels, a mid-cap player in the Hotel, Resort & Restaurants industry, has shown notable activity in the stock market today, with a daily performance increase of 1.04%, outperforming the Sensex, which rose by 0.20%. Over the past week, Lemon Tree Hotels has gained 6.92%, significantly higher than the Sensex's 1.92% increase. Despite a challenging three-month period where the stock declined by 13.76%, it has demonstrated resilience with a strong three-year performance of 146.51%, compared to the Sensex's 30.39%. The company's market capitalization stands at Rs 10,715.00 crore, with a price-to-earnings (P/E) ratio of 60.20, which is below the industry average of 71.88. In terms of technical indicators, the weekly MACD suggests a bearish trend, while the monthly outlook is mildly bearish. The stock's moving averages indicate a mildly bearish sentiment on a daily basis. Overall, Lemon Tree Hotels c...

Read MoreLemon Tree Hotels Faces Mixed Technical Trends Amid Market Fluctuations

2025-03-18 08:04:12Lemon Tree Hotels, a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 128.65, showing a slight increase from the previous close of 127.10. Over the past year, the stock has experienced fluctuations, with a 52-week high of 162.25 and a low of 112.30. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish trend weekly, transitioning to a sideways movement monthly. Daily moving averages suggest a mildly bullish sentiment, contrasting with the overall bearish indicators from the KST and Dow Theory. When comparing the stock's performance to the Sensex, Lemon Tree Hotels has shown varied ret...

Read MoreLemon Tree Hotels Adjusts Valuation Amid Competitive Market Dynamics and Performance Challenges

2025-03-01 08:00:16Lemon Tree Hotels has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the hotel, resort, and restaurant industry. The company currently exhibits a price-to-earnings (PE) ratio of 54.02 and a price-to-book value of 9.51, indicating a premium valuation relative to its peers. Its enterprise value to EBITDA stands at 19.77, while the enterprise value to EBIT is recorded at 25.64. In terms of profitability, Lemon Tree Hotels shows a return on capital employed (ROCE) of 13.04% and a return on equity (ROE) of 14.94%. These figures suggest a solid operational performance, although they are positioned against a backdrop of varying valuations among competitors. For instance, EIH and Mahindra Holidays present lower PE ratios of 28.44 and 43.52, respectively, while Chalet Hotels and Ventive Hospital are noted for their significantly higher valuations. In...

Read MoreSigning Of License Agreement - Keys Select By Lemon Tree Hotels Siliguri West Bengal

08-Apr-2025 | Source : BSEPlease find attached herewith Disclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Signing Of License Agreement - Lemon Tree Hotel Vrindavan Uttar Pradesh

04-Apr-2025 | Source : BSEPlease find enclosed herewith Disclosure under Regulation 30 of SEBI (Listing obligations and Disclosure Requirements) Regulations 2015

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

03-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Patanjali Govind Keswani & Others

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available