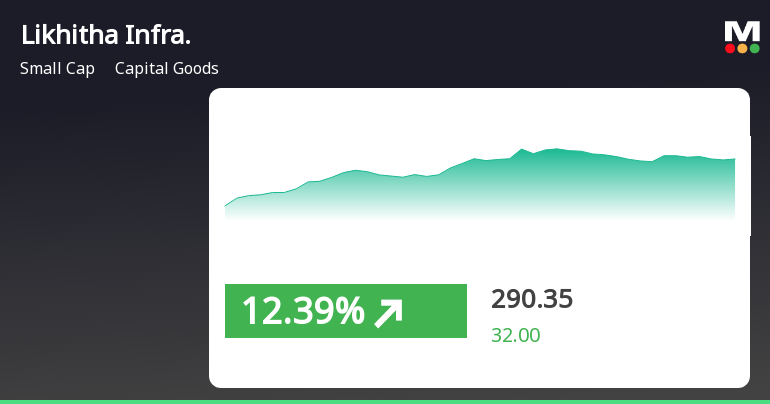

Likhitha Infrastructure Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-04-02 08:03:03Likhitha Infrastructure, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company's price-to-earnings ratio stands at 15.31, while its enterprise value to EBITDA ratio is recorded at 10.05. Additionally, Likhitha boasts a return on capital employed (ROCE) of 34.62% and a return on equity (ROE) of 20.29%, indicating robust profitability and efficient capital utilization. In comparison to its peers, Likhitha Infrastructure demonstrates a competitive edge with a favorable PEG ratio of 1.74, suggesting a balanced growth outlook relative to its earnings. Notably, while some competitors like Hindustan Construction are facing challenges with loss-making status, others such as Patel Engineering and Ramky Infrastructure also show strong valuations, yet Likhitha's metrics position it distinctly within the i...

Read MoreLikhitha Infrastructure Faces Mixed Technical Signals Amidst Fluctuating Market Performance

2025-03-25 08:06:08Likhitha Infrastructure, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 285.90, slightly down from its previous close of 287.95. Over the past year, Likhitha has shown a stock return of 15.7%, outperforming the Sensex, which recorded a return of 7.07% in the same period. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) is bearish on a monthly scale, and Bollinger Bands also reflect a bearish outlook. Daily moving averages confirm a bearish trend, while the On-Balance Volume (OBV) presents a bullish stance on a monthly basis, suggesting mixed signals in trading activity. In terms of performance, Likhitha has demonstrated notable ret...

Read MoreLikhitha Infrastructure Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-24 08:02:56Likhitha Infrastructure, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 287.95, showing a slight increase from the previous close of 287.80. Over the past year, Likhitha has demonstrated a return of 16.16%, significantly outperforming the Sensex, which returned 5.87% in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows a bearish stance on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly but is bearish monthly. Bollinger Bands and KST also reflect a mildly bearish trend on both weekly and monthly evaluations. Interestingly, the On-Balance Volume (OBV) remains bullish on both timeframes, suggesting positive trading volume trends. In ...

Read More

Likhitha Infrastructure Shows Strong Short-Term Gains Amid Mixed Long-Term Momentum

2025-03-20 09:35:32Likhitha Infrastructure, a small-cap company in the capital goods sector, experienced notable gains on March 20, 2025, outperforming its sector. The stock has shown a positive trend over the past three days and reached an intraday high, while the broader market also opened positively with small-cap stocks leading.

Read More

Likhitha Infrastructure Reports Flat Q3 Performance Amidst Mixed Financial Trends

2025-02-10 11:05:12Likhitha Infrastructure announced its financial results for the quarter ending December 2024, revealing flat performance for Q3 FY24-25. The company reported net sales of Rs 259.56 crore, a 24.08% year-on-year increase, while operating profit fell to Rs 23.20 crore, marking a low for the past five quarters.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

28-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Board Meeting Outcome for Outcome Of The Board Meeting Held On March 26 2025

26-Mar-2025 | Source : BSEOutcome of the Board Meeting held on March 26 2025

Corporate Actions

No Upcoming Board Meetings

Likhitha Infrastructure Ltd has declared 30% dividend, ex-date: 20 Sep 23

Likhitha Infrastructure Ltd has announced 5:10 stock split, ex-date: 02 Dec 22

No Bonus history available

No Rights history available