Link Pharma Chem Adjusts Valuation Amidst Competitive Chemicals Sector Landscape

2025-03-24 08:00:20Link Pharma Chem, a microcap player in the chemicals industry, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company currently shows a price-to-earnings ratio of -15.70 and a price-to-book value of 1.14. Its enterprise value to EBITDA stands at 17.25, while the EV to sales ratio is notably low at 0.82. Despite a return on capital employed (ROCE) of 2.24% and a negative return on equity (ROE) of -3.06%, Link Pharma Chem's valuation revision positions it favorably compared to its peers. For instance, Shivalik Rasayan is marked as expensive with a significantly higher PE ratio of 59.98, while Indo Amines is rated fair with a PE of 16.98. In terms of stock performance, Link Pharma Chem has shown a 5.87% return over the past week, outperforming the Sensex, which returned 4.17% in the same period. However, its year-to-date performance reflects a declin...

Read MoreLink Pharma Chem Experiences Valuation Grade Change Amidst Unique Financial Metrics

2025-03-17 08:00:17Link Pharma Chem, a microcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 33.40, with a previous close of 35.74, and it has experienced a 52-week range between 31.10 and 50.90. Key financial metrics reveal a PE ratio of -14.83 and a price-to-book value of 1.08, indicating a unique position in the market. The EV to EBITDA stands at 16.57, while the EV to sales ratio is notably low at 0.79. Return on capital employed (ROCE) is reported at 2.24%, with a negative return on equity (ROE) of -3.06%. In comparison to its peers, Link Pharma Chem's valuation metrics present a diverse landscape. While some competitors exhibit higher PE ratios and EV to EBITDA values, Link Pharma Chem's low PEG ratio of 0.00 sets it apart. This evaluation adjustment highlights the company's distinct financial profile ami...

Read MoreLink Pharma Chem Adjusts Valuation Amidst Competitive Landscape and Profitability Challenges

2025-03-07 08:00:47Link Pharma Chem, a microcap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 36.00, reflecting a modest increase from the previous close of 34.41. Over the past year, Link Pharma Chem has experienced a stock return of -21.69%, contrasting with a slight gain of 0.34% in the Sensex. Key financial metrics reveal a PE ratio of -15.99 and an EV to EBITDA ratio of 17.47, indicating a unique position within its sector. The company's return on capital employed (ROCE) is reported at 2.24%, while the return on equity (ROE) is at -3.06%. These figures suggest challenges in profitability and capital efficiency. In comparison to its peers, Link Pharma Chem's valuation metrics present a mixed picture. While some competitors like Sr. Rayala Hypo and Indo Amines are classified favorably, others such as Sadhana Nitro and Chemcon Speciality are position...

Read More

Link Pharma Chem Faces Significant Volatility Amid Weak Financial Fundamentals and Declining Performance

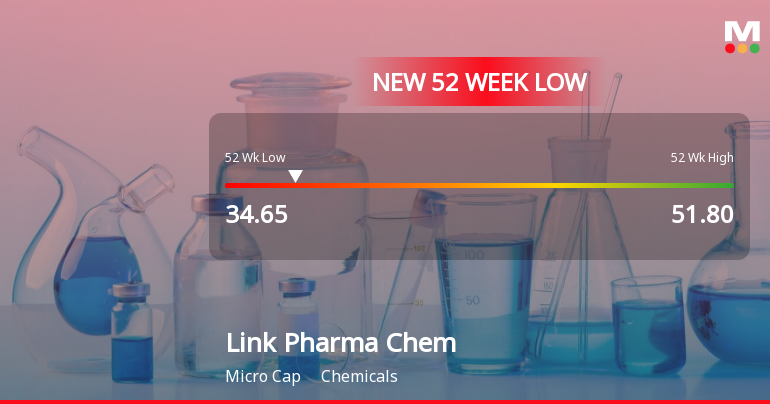

2025-03-04 09:40:19Link Pharma Chem has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock has declined for seven consecutive days, with a significant drop over the past year. Financially, the company shows weak fundamentals, including declining operating profits and a concerning debt servicing capability.

Read More

Link Pharma Chem Faces Continued Decline Amid Broader Market Volatility

2025-03-03 15:10:50Link Pharma Chem has faced notable volatility, reaching a new 52-week low and continuing a downward trend over the past six days. The stock has underperformed its sector significantly and is trading below all major moving averages. In contrast, the broader market shows mixed performance, with mid-cap stocks gaining slightly.

Read More

Link Pharma Chem Faces Market Challenges Despite Recent Resilience and Volatility

2025-02-19 09:35:32Link Pharma Chem, a microcap in the chemicals sector, has faced significant market challenges, reaching a new 52-week low. Despite a notable decline, the stock showed some resilience by outperforming its sector. Over the past year, it has declined substantially compared to broader market indices.

Read More

Link Pharma Chem Faces Significant Volatility Amidst Underperformance in Chemicals Sector

2025-02-17 10:05:22Link Pharma Chem has faced notable volatility, hitting a new 52-week low of Rs. 35.5 amid a 7.19% decline over two days. The stock has underperformed its sector and is trading below key moving averages, indicating ongoing challenges in its performance compared to broader market trends.

Read More

Link Pharma Chem Faces Ongoing Challenges Amid Broader Chemicals Sector Trends

2025-02-12 13:35:12Link Pharma Chem, a microcap in the chemicals sector, has seen notable trading activity as its stock hits a 52-week low. Despite recent gains, the company has faced a 20.84% decline over the past year, underperforming compared to the Sensex and trading below key moving averages.

Read More

Link Pharma Chem Faces Continued Volatility Amid Broader Chemicals Sector Decline

2025-02-11 12:35:12Link Pharma Chem has faced notable volatility, hitting a new 52-week low and experiencing an 11.27% decline over four days. Despite this, it outperformed its sector today. The stock is trading below all key moving averages, reflecting a bearish trend and a 21.20% decline over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEConfirmation certificate under regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of Trading Window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

08-Feb-2025 | Source : BSENewspaper Advertisements of Unaudited Financial Results for the quarter and nine months ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available