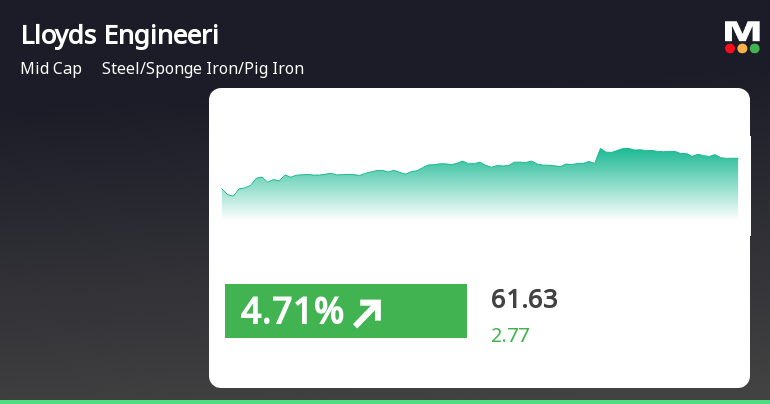

Lloyds Engineering Works Outperforms Sector Amid Broader Market Recovery Trends

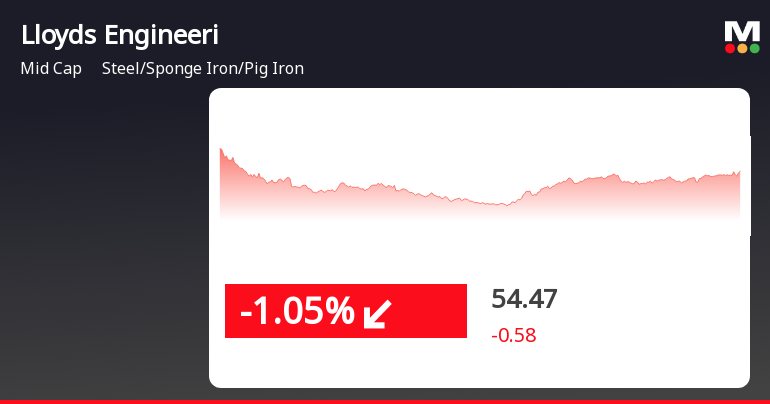

2025-03-21 10:35:29Lloyds Engineering Works has experienced notable trading activity, outperforming its sector and achieving a significant intraday high. While it shows mixed trends in moving averages, the stock has increased over the past week and year, contrasting with its monthly performance. The broader market is also seeing gains, particularly in small-cap stocks.

Read More

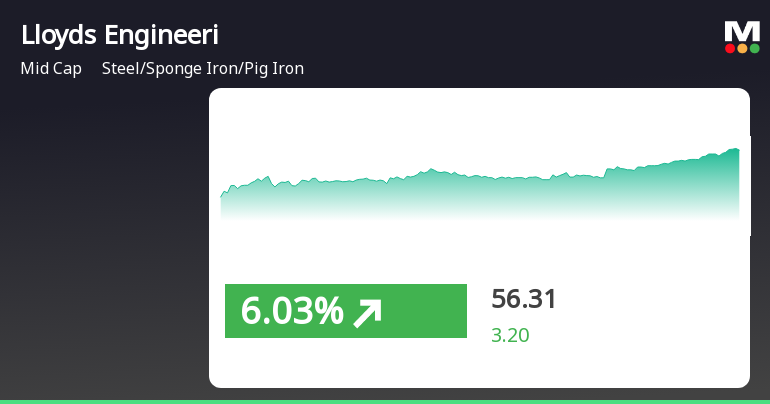

Lloyds Engineering Works Shows Resilience Amid Broader Market Gains and Challenges

2025-03-18 11:45:30Lloyds Engineering Works saw a significant increase on March 18, 2025, after a series of declines, outperforming its sector. Despite this day's gains, the stock remains below key moving averages and has faced recent declines. However, it has shown strong yearly performance compared to the Sensex.

Read More

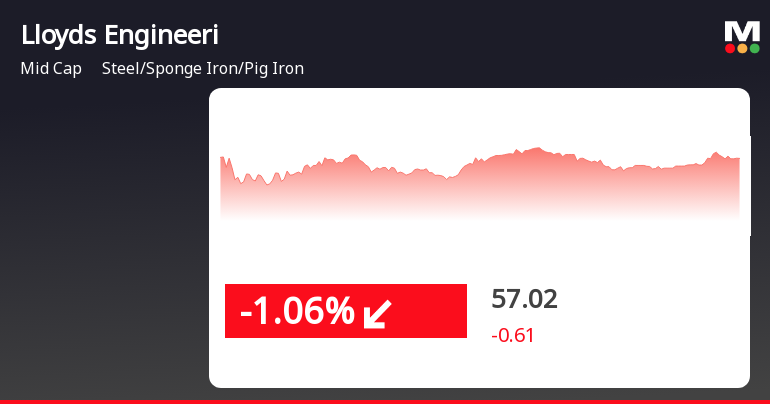

Lloyds Engineering Works Faces Potential Trend Reversal Amid Broader Market Decline

2025-03-10 15:35:26Lloyds Engineering Works, a midcap in the Steel/Sponge Iron/Pig Iron sector, faced a notable decline on March 10, 2025, following a series of gains. The stock underperformed its sector and is currently positioned below several key moving averages, while the broader market also showed bearish trends.

Read More

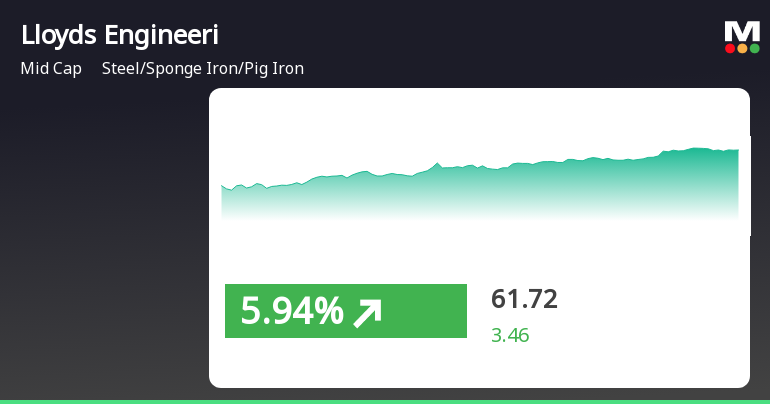

Lloyds Engineering Works Outperforms Sector Amid Broader Market Gains

2025-03-07 10:55:57Lloyds Engineering Works, a midcap in the Steel/Sponge Iron/Pig Iron sector, has experienced notable gains, outperforming its industry. The stock has risen consistently over four days, achieving a significant total return. Despite this positive momentum, it remains below several long-term moving averages, indicating mixed trends.

Read More

Lloyds Engineering Works Faces Ongoing Stock Volatility Amid Industry Challenges

2025-03-03 11:35:28Lloyds Engineering Works has faced notable stock volatility, marking six consecutive days of losses and a significant decline over the past month. Despite an intraday high, the stock closed lower and has underperformed relative to its sector, indicating ongoing challenges in the market.

Read MoreLloyds Engineering Works Faces Short-Term Challenges Amidst Long-Term Growth Potential

2025-03-03 10:28:48Lloyds Engineering Works, a mid-cap player in the Steel/Sponge Iron/Pig Iron industry, has experienced significant stock activity today, reflecting broader market trends. The company's market capitalization stands at Rs 6,165.55 crore, with a price-to-earnings (P/E) ratio of 61.71, notably higher than the industry average of 31.93. Over the past year, Lloyds Engineering Works has seen a decline of 10.03%, contrasting with the Sensex's decrease of 1.19%. Today's performance shows a drop of 3.91%, while the Sensex fell by 0.37%. The stock's performance over the past week and month has also been underwhelming, with declines of 14.14% and 27.69%, respectively. Year-to-date, the stock is down 31.08%, compared to the Sensex's 6.67% decline. Despite these short-term challenges, Lloyds Engineering Works has demonstrated remarkable long-term growth, with a three-year performance increase of 315.69% and an impressi...

Read MoreLloyds Engineering Works Faces Bearish Technical Trends Amid Market Volatility

2025-03-03 08:00:55Lloyds Engineering Works, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 55.05, down from a previous close of 57.43, with a notable 52-week high of 93.49 and a low of 42.20. Today's trading saw a high of 57.03 and a low of 53.50, indicating volatility in its performance. The technical summary for Lloyds Engineering Works reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a challenging environment for the stock. The KST and Dow Theory indicators align with this sentiment, indicating a consistent bearish trend. In terms of performance, the company's returns have been under pressure compared to the Sens...

Read MoreLloyds Engineering Works Faces Bearish Technical Trends Amidst Market Challenges

2025-03-02 08:00:55Lloyds Engineering Works, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 55.05, down from a previous close of 57.43, with a notable 52-week high of 93.49 and a low of 42.20. Today's trading saw a high of 57.03 and a low of 53.50. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly evaluations. Moving averages on a daily basis align with this bearish outlook, further supported by the KST and Dow Theory metrics, which are mildly bearish on both weekly and monthly scales. Interestingly, the On-Balance Volume (OBV) presents a mildly bearish trend weekly, contrasting with a bullish mon...

Read MoreLloyds Engineering Works Faces Mixed Technical Trends Amid Market Volatility

2025-03-01 08:00:54Lloyds Engineering Works, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 55.05, has seen fluctuations with a 52-week high of 93.49 and a low of 42.20. Today's trading session recorded a high of 57.03 and a low of 53.50, indicating volatility in its price movements. The technical summary for Lloyds Engineering Works presents a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect bearish conditions. The daily moving averages align with this sentiment, suggesting a cautious outlook. The KST shows mildly bearish trends on both timeframes, and the Dow Theory supports this view as well. Interestingly, the On-Balance Volume (OBV) presents a mildly bullish signal on a monthly basis, hinting at some underlying strength. I...

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting

08-Apr-2025 | Source : BSEOutcome of Board Meeting for Rights Issue of shares

Board Meeting Intimation for Rights Issue Of Shares

03-Apr-2025 | Source : BSELloyds Engineering Works Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 08/04/2025 inter alia to consider and approve matters in connection with the Rights Issue.

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and Financial year ending March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Lloyds Engineering Works Ltd has declared 20% dividend, ex-date: 19 Jul 24

No Splits history available

No Bonus history available

Lloyds Engineering Works Ltd has announced 1:17 rights issue, ex-date: 14 Dec 23