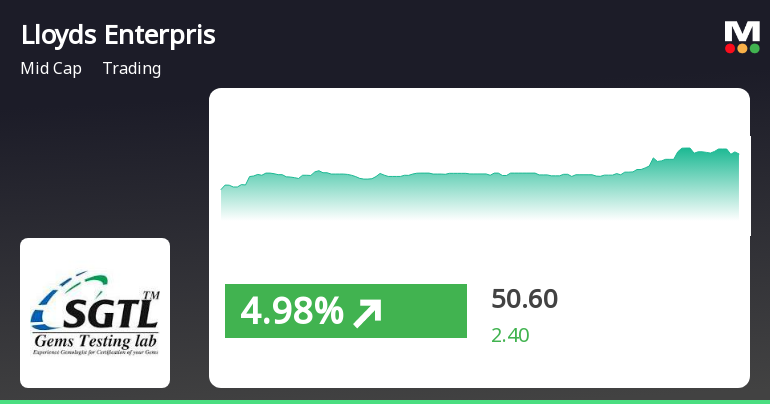

Lloyds Enterprises Exhibits Strong Performance Amid Market Volatility and Recovery

2025-04-03 11:20:18Lloyds Enterprises has demonstrated strong performance, gaining 5.35% on April 3, 2025, and outperforming its sector. The stock has consistently risen over the past five days, accumulating a 22.2% return. It is currently trading above multiple moving averages, indicating a positive trend amidst market volatility.

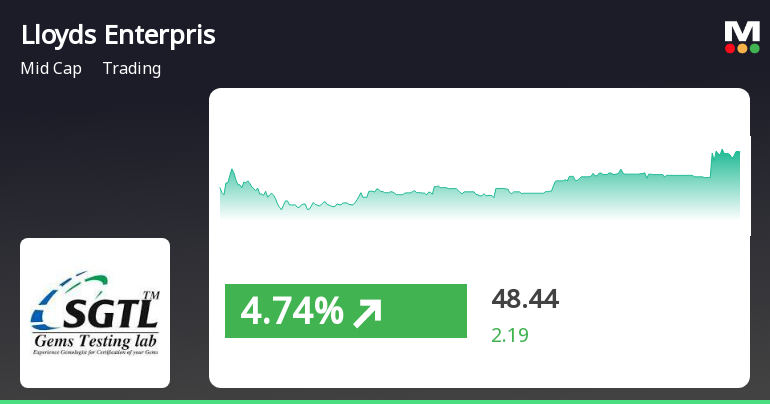

Read MoreLloyds Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:02:50Lloyds Enterprises, a midcap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 48.20, showing a notable increase from the previous close of 46.25. Over the past year, Lloyds has demonstrated impressive performance, with a return of 58.14%, significantly outpacing the Sensex's 3.67% return during the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The Moving Averages signal a bullish stance on a daily basis, while the MACD and KST reflect a mildly bearish trend on a weekly basis. Notably, the Bollinger Bands present a bullish outlook on a monthly scale, suggesting potential volatility in the stock's price. In terms of performance metrics, Lloyds has achieved a remarkable 668.74% return over the past three years and an astounding 3787.10% over t...

Read More

Lloyds Enterprises Exhibits Strong Performance Amid Broader Market Rally

2025-04-02 13:35:17Lloyds Enterprises has experienced notable gains, marking its fourth consecutive day of increases and a total return of 12.8% over this period. The company has outperformed its sector and demonstrated strong performance metrics across various time frames, significantly exceeding the broader market's growth over the past year.

Read More

Lloyds Enterprises Faces Evaluation Adjustment Amid Flat Financial Performance and High Valuation Concerns

2025-04-02 08:12:37Lloyds Enterprises has recently experienced a reevaluation of its financial standing, reporting flat third-quarter performance for FY24-25 with net sales of Rs 290.30 crore and a profit after tax of Rs 19.44 crore. Despite strong annual growth rates, the company's return on equity suggests a high valuation relative to its book value.

Read More

Lloyds Enterprises Shows Strong Rebound Amid Broader Market Recovery Trends

2025-03-27 14:45:19Lloyds Enterprises experienced significant trading activity, rebounding after two days of decline. The stock outperformed its sector and reached an intraday high, while the broader market, represented by the Sensex, also showed recovery after a negative start, marking a continued upward trend over the past weeks.

Read MoreLloyds Enterprises Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-26 08:02:02Lloyds Enterprises, a midcap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 42.36, down from a previous close of 44.37, with a 52-week high of 63.17 and a low of 27.30. Today's trading saw a high of 45.18 and a low of 41.80, indicating some volatility in its performance. The technical summary reveals a mixed outlook, with the MACD showing bearish signals on a weekly basis and mildly bearish on a monthly basis. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly periods. Bollinger Bands present a bearish trend weekly while showing a mildly bullish stance monthly. Moving averages suggest a mildly bullish trend on a daily basis, contrasting with the overall bearish sentiment reflected in the KST and Dow Theory metrics. In terms of performance, Lloyds Enterprises h...

Read More

Lloyds Enterprises Faces Short-Term Challenges Amid Long-Term Growth Trajectory

2025-03-25 15:15:19Lloyds Enterprises has faced a decline today, underperforming against the Sensex. The stock, which reached an intraday low, shows mixed signals in relation to its moving averages. Despite the recent downturn, it has demonstrated substantial long-term growth, with significant increases over the past three and five years.

Read More

Lloyds Enterprises Adjusts Evaluation Amid Mixed Financial Performance and Growth Potential

2025-03-25 08:10:04Lloyds Enterprises has recently adjusted its evaluation, reflecting a shift in its technical trend. The company has shown impressive long-term growth, with significant increases in net sales and operating profit. Despite recent challenges, it maintains a low debt-to-equity ratio and has consistently outperformed the BSE 500.

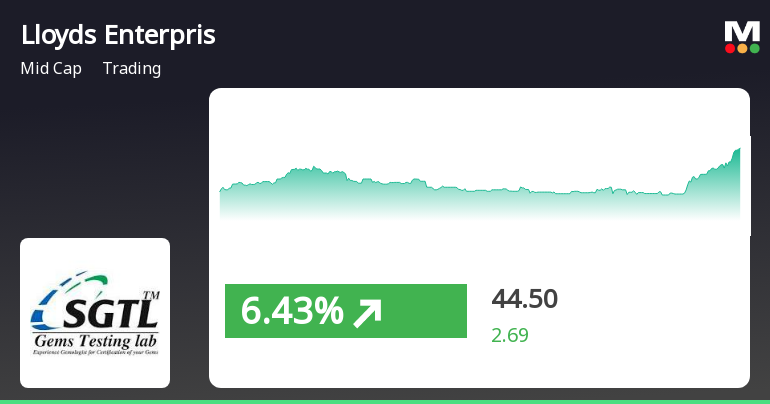

Read MoreLloyds Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:02:23Lloyds Enterprises, a midcap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 44.37, showing a slight increase from the previous close of 43.70. Over the past year, Lloyds has demonstrated significant resilience, with a return of 48.54%, notably outperforming the Sensex, which recorded a return of 7.07% in the same period. The technical summary indicates a mixed performance across various indicators. The Moving Averages suggest a mildly bullish sentiment on a daily basis, while the MACD and KST metrics reflect a bearish stance on a weekly basis. However, the monthly outlook for Bollinger Bands shows a mildly bullish trend, indicating some positive momentum. In terms of volatility, the stock has seen a 52-week high of 63.17 and a low of 27.30, highlighting its capacity for substantial price movement. Notab...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of Securities and Exchange Board of India (Depositories and Participants) Regulation 2018 for the quarter ended 31st March 2025.

Board Meeting Outcome for Outcome Of The Board Meeting In Accordance With The SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015

29-Mar-2025 | Source : BSEOutcome of the Board Meeting in accordance with the SEBI (Listing Obligations and Disclosure Requirements) Regulation 2015

Intimation Under Regulation 30 Of SEBI (Listing Obligation And Disclosure Requirements) Regulation 2015 As Amended

29-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements) Regulation 2015.

Corporate Actions

No Upcoming Board Meetings

Lloyds Enterprises Ltd has declared 10% dividend, ex-date: 01 Jul 24

Lloyds Enterprises Ltd has announced 1:5 stock split, ex-date: 21 Dec 16

No Bonus history available

No Rights history available