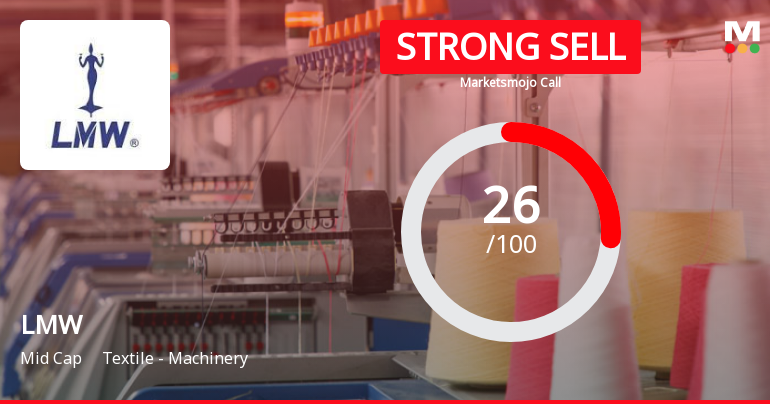

LMW Faces Revenue Decline and Increased Bearish Sentiment Amid Market Challenges

2025-04-03 08:06:40LMW, a midcap company in the Textile - Machinery sector, has experienced a recent evaluation adjustment due to shifts in technical trends. The company reported a significant decline in net sales and profitability over the past quarters, while maintaining a low debt-to-equity ratio amidst challenges in revenue growth.

Read MoreTechnical Trends Indicate Mixed Signals for LMW Amid Market Challenges

2025-04-03 08:04:18LMW, a midcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15,250.00, down from a previous close of 15,583.05. Over the past year, LMW has experienced a decline of 7.18%, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in the broader market context. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Bollinger Bands and moving averages suggest bearish conditions, while the KST reflects a bearish stance on a weekly basis and mildly bearish monthly. Notably, the Relative Strength Index (RSI) shows no signal, indicating a lack of momentum in either direction. In terms of returns, LMW has shown resilience over longer...

Read More

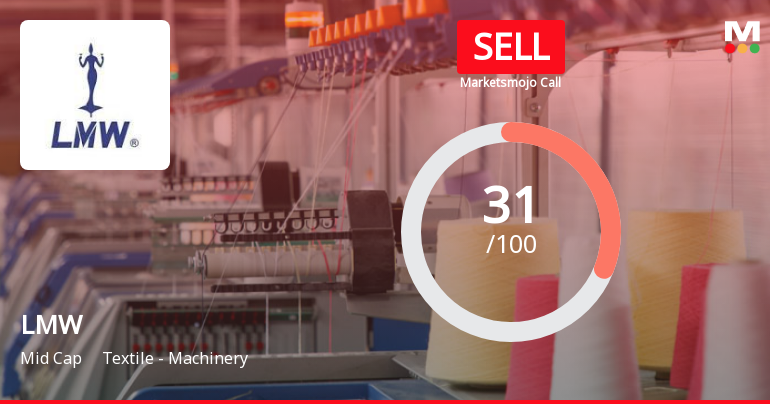

LMW Faces Evaluation Adjustment Amid Declining Sales and Mixed Technical Indicators

2025-03-20 08:05:18LMW, a midcap company in the Textile - Machinery sector, has recently experienced a change in its evaluation, reflecting shifts in its technical landscape. Despite facing challenges in net sales and profits in the latest quarter, LMW has shown resilience over the past three years, maintaining a low debt-to-equity ratio.

Read MoreTextile Machinery Firm LMW Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-20 08:02:19LMW, a midcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15,980.00, showing a notable increase from the previous close of 15,299.05. Over the past year, LMW has demonstrated a return of 15.04%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The moving averages indicate a mildly bearish sentiment on a daily basis. However, the Bollinger Bands suggest a bullish outlook on both weekly and monthly timeframes, indicating some volatility in price movements. LMW's performance over various timeframes highlights its resilience, particularly over the last five years, where it achieved a remarkable return of 514.08%, c...

Read More

LMW Faces Continued Revenue Decline Amidst Challenging Financial Landscape

2025-03-13 08:04:13LMW, a midcap company in the Textile - Machinery sector, has faced significant financial challenges, reporting a 36.87% decline in net sales for Q3 FY24-25. This marks the fourth consecutive quarter of negative results, with profit metrics also showing substantial reductions, despite a low debt-to-equity ratio and long-term growth potential.

Read MoreTechnical Indicators Signal Bearish Sentiment for LMW Amid Market Volatility

2025-03-13 08:01:29LMW, a midcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15,300.10, down from a previous close of 15,815.80. Over the past year, LMW has experienced a high of 19,031.15 and a low of 13,350.20, indicating notable volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicator aligns with this sentiment, indicating a bearish outlook on the weekly scale and mildly bearish on the monthly. In terms of performance, LMW has shown resilience compared to the Sensex. Over the past week, the stock returned 1.84%, significantly outperforming the Sensex's 0.41%. In the one-month perio...

Read MoreTechnical Indicators Signal Bearish Sentiment for LMW Amid Market Volatility

2025-03-13 08:01:29LMW, a midcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15,300.10, down from a previous close of 15,815.80. Over the past year, LMW has experienced a high of 19,031.15 and a low of 13,350.20, indicating notable volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicator aligns with this sentiment, indicating a bearish outlook on the weekly scale and mildly bearish on the monthly. In terms of performance, LMW has shown resilience compared to the Sensex. Over the past week, the stock returned 1.84%, significantly outperforming the Sensex's 0.41%. In the one-month perio...

Read More

LMW Faces Financial Challenges Amidst Long-Term Growth Potential and Low Debt Levels

2025-03-10 08:04:39LMW, a midcap in the Textile Machinery sector, has recently seen a change in its evaluation due to a significant decline in net sales and consecutive negative quarterly results. Despite these challenges, the company maintains a low debt-to-equity ratio and has shown strong long-term growth in operating profit.

Read MoreTechnical Trends Indicate Mixed Signals for LMW Amid Strong Performance Surge

2025-03-10 08:01:18LMW, a midcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15,766.95, showing a notable increase from the previous close of 15,458.00. Over the past week, LMW has demonstrated a strong performance, with a return of 15.26%, significantly outpacing the Sensex, which returned 1.55% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish outlook monthly. Moving averages also suggest a mildly bearish trend on a daily basis. Looking at the company's performance over various time frames, LMW has delivered a 7.37% return over the...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEThe Certificate under Regulation 74(5) of SEBI(DP) Regulations 2018 for the quarter ended 31st March 2025 is attached.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading Window Closure under SEBI(Prohibition of Insider Trading) Regulations 2015.

Intimation For Change In The Domain Name Of The Registrar And Share Transfer Agent (RTA).

03-Feb-2025 | Source : BSEPlease find the intimation regarding the change in the domain name of the Registrar and Share Transfer Agent (RTA) of the Company.

Corporate Actions

No Upcoming Board Meetings

LMW Ltd has declared 750% dividend, ex-date: 24 Jul 24

LMW Ltd has announced 10:100 stock split, ex-date: 13 Dec 06

No Bonus history available

No Rights history available