Lux Industries Adjusts Valuation Grade Amid Competitive Textile Sector Dynamics

2025-03-19 08:00:15Lux Industries, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 22.20 and a price-to-book value of 2.32, indicating its market valuation relative to its earnings and assets. Additionally, Lux Industries shows an enterprise value to EBITDA ratio of 15.98, which provides insight into its operational efficiency. In terms of performance metrics, the company has a return on capital employed (ROCE) of 12.66% and a return on equity (ROE) of 9.75%, suggesting a moderate level of profitability. The dividend yield stands at 0.16%, reflecting its approach to shareholder returns. When compared to its peers, Lux Industries' valuation metrics indicate a competitive landscape. For instance, Ganesha Ecosphere and Cantabil Retail also fall within the expensive category,...

Read MoreLux Industries Adjusts Valuation Grade Amid Competitive Textile Industry Dynamics

2025-03-12 08:00:14Lux Industries, a small-cap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 1246.30, reflecting a decline from its previous close of 1277.45. Over the past year, Lux Industries has shown a return of 4.48%, which is notably higher than the Sensex's return of 0.82% during the same period. However, the company's performance has been less favorable in shorter time frames, with a year-to-date return of -37.94%, compared to the Sensex's -5.17%. Key financial metrics for Lux Industries include a PE ratio of 21.69 and an EV to EBITDA ratio of 15.61, which positions it competitively within its sector. The company's PEG ratio stands at 0.34, indicating a potentially attractive growth relative to its valuation. In comparison to its peers, Lux Industries maintains a favorable position, particularly against companies like SG Mart and Ganesha Ecosphe, ...

Read MoreLux Industries Experiences Valuation Grade Change Amidst Competitive Textile Sector Dynamics

2025-03-06 08:00:23Lux Industries, a small-cap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 1,325.00, reflecting a notable shift from its previous close of 1,274.15. Over the past year, Lux Industries has shown a return of 10.76%, contrasting with a minimal gain of 0.07% in the Sensex. Key financial metrics for Lux Industries include a PE ratio of 23.06 and an EV to EBITDA ratio of 16.62. The company's return on capital employed (ROCE) is reported at 12.66%, while its return on equity (ROE) stands at 9.75%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Lux Industries presents a mixed picture. For instance, SG Mart and Kewal Kir. Cloth. are positioned differently in terms of valuation, with varying PE ratios and EV to EBITDA metrics. This highlights the competitive landscape within ...

Read MoreLux Industries Adjusts Valuation Grade Amidst Mixed Performance and Competitive Positioning

2025-02-28 08:00:16Lux Industries, a small-cap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 1,315.15, reflecting a decline from its previous close of 1,357.50. Over the past year, Lux Industries has shown a return of 9.65%, which contrasts with the Sensex's return of 2.08% during the same period. However, the company's performance has been less favorable in shorter time frames, with a year-to-date return of -34.51%, compared to the Sensex's -4.51%. Key financial metrics for Lux Industries include a price-to-earnings (PE) ratio of 22.89 and an EV to EBITDA ratio of 16.49. The company's PEG ratio stands at 0.36, indicating a potentially attractive growth relative to its valuation. In comparison to its peers, Lux Industries maintains a competitive position, particularly when looking at its valuation metrics against companies like SG Mart and Kitex Garments,...

Read More

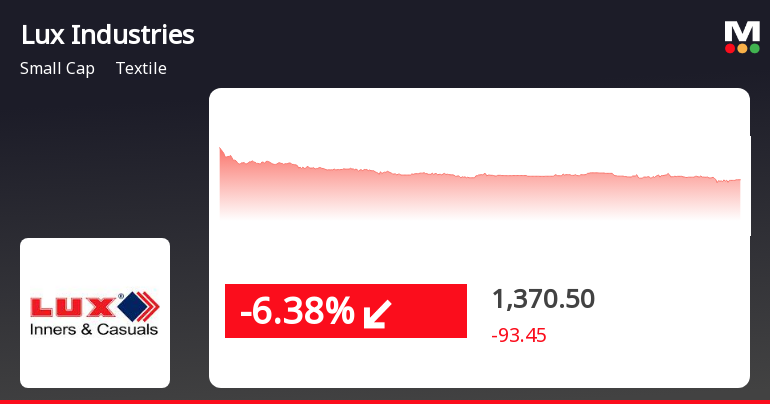

Lux Industries Faces Significant Stock Volatility Amid Challenging Market Conditions in February 2025

2025-02-14 15:30:17Lux Industries has faced notable stock volatility on February 14, 2025, with a significant decline following a brief gain. The stock's performance has been weak over the past month, underperforming its sector and trading below multiple moving averages, indicating ongoing challenges in the market.

Read More

Lux Industries Reports Strong Financial Growth and Improved Operational Efficiency in December 2024 Results

2025-02-13 18:17:16Lux Industries reported strong financial results for the quarter ending December 2024, with a Profit Before Tax of Rs 38.33 crore and a Profit After Tax of Rs 32.06 crore, reflecting significant year-on-year growth. Net sales reached Rs 552.63 crore, indicating robust market performance and operational efficiency.

Read More

Lux Industries Reports 56.1% Profit Increase Amid Long-Term Growth Concerns in Q2 FY24-25

2025-02-06 18:41:54Lux Industries has recently experienced a change in evaluation, reflecting its financial performance in the second quarter of FY24-25, where profits increased significantly. The company demonstrates strong cash flow and low debt levels, although its long-term growth prospects appear limited, with modest operating profit expansion over recent years.

Read More

Lux Industries Reports Positive Financial Performance Amidst Sideways Market Trend

2025-02-01 18:29:23Lux Industries, a small-cap textile company, has recently experienced a change in evaluation amid positive financial results over the past three quarters. Key metrics include an operating cash flow of Rs 239.60 crore and a profit before tax of Rs 53.74 crore, reflecting growth despite a sideways technical trend.

Read More

Lux Industries Reports 56.1% Profit Increase Amid Long-Term Growth Concerns in Q2 FY24-25

2025-01-27 18:45:45Lux Industries has recently experienced a change in evaluation, reflecting its financial performance. The company reported a significant profit increase in Q2 FY24-25, although its long-term growth appears limited. Strong debt management and consistent positive results over three quarters highlight its operational stability amid market valuation concerns.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended on 31st March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window for the declaration of Audited Financial Results for the quarter and year ended 31st March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window for the declaration of Audited Financial Results for the quarter and year ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Lux Industries Ltd has declared 100% dividend, ex-date: 19 Sep 24

Lux Industries Ltd has announced 2:10 stock split, ex-date: 06 Jun 16

No Bonus history available

No Rights history available