LWS Knitwear Faces Evaluation Adjustment Amidst Strong Financial Performance and Market Challenges

2025-04-02 08:09:00LWS Knitwear, a microcap textile company, has experienced a recent evaluation score adjustment influenced by market dynamics and technical indicators. Despite positive financial results over six consecutive quarters, concerns about long-term fundamentals persist. Increased promoter confidence suggests potential for recovery amid a complex financial landscape.

Read MoreLWS Knitwear Ltd Experiences Notable Price Surge Amid Increased Buying Activity

2025-03-25 09:50:11LWS Knitwear Ltd, a microcap player in the textile industry, is witnessing significant buying activity, with the stock rising by 4.96% today, outperforming the Sensex, which gained 0.66%. Over the past week, LWS Knitwear has shown a robust performance with a total increase of 10.64%, compared to the Sensex's 4.25%. Notably, the stock has been on a consecutive gain streak for the last three days, accumulating a total return of 11.62% during this period. Despite its recent gains, LWS Knitwear's longer-term performance reveals challenges, with a decline of 48.88% over the past year, contrasting sharply with the Sensex's 7.78% increase. The stock's year-to-date performance also reflects a decrease of 29.11%, while the Sensex has remained relatively stable with a 0.46% gain. Today's trading session opened with a gap up, indicating strong buyer sentiment. The stock's price is currently above its 5-day and 20-da...

Read MoreLWS Knitwear Ltd Sees Notable Buying Surge Amidst Market Resilience

2025-03-24 10:25:08LWS Knitwear Ltd is witnessing significant buying activity, with the stock rising by 4.96% today, outperforming the Sensex, which gained 0.87%. This marks the second consecutive day of gains for LWS Knitwear, accumulating a total return of 8.76% over this period. Over the past week, the stock has increased by 5.09%, while the Sensex rose by 4.59%. Despite a challenging performance over the longer term, with a 50.19% decline over the past year, LWS Knitwear's recent uptick may be attributed to various factors, including potential market sentiment shifts or sector-specific developments within the textile industry. The stock opened with a gap up, indicating strong initial buyer interest, and has shown resilience compared to its sector peers, outperforming by 4.11% today. In terms of moving averages, LWS Knitwear is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-d...

Read More

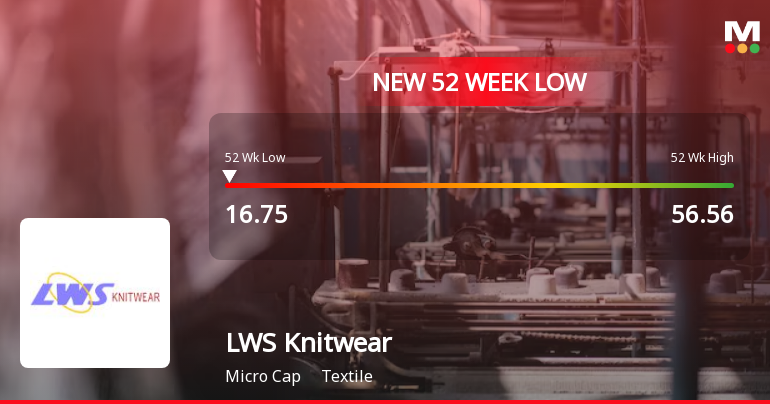

LWS Knitwear Hits 52-Week Low Amid Broader Market Bearish Sentiment

2025-03-19 14:06:22LWS Knitwear has reached a new 52-week low, continuing a downward trend with a notable decline over the past two days. Despite this, the company has shown consistent growth in net sales and profits over the last six quarters, and promoter confidence has increased with a higher stake.

Read MoreLWS Knitwear Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-18 15:20:40LWS Knitwear Ltd is currently facing significant selling pressure, with today's trading session showing a stark absence of buyers. The stock has recorded a notable decline of 4.97%, contrasting sharply with the Sensex, which has gained 1.55% today. This marks a continuation of a troubling trend, as LWS Knitwear has experienced consecutive days of losses, with a weekly decline of 6.12% and a monthly drop of 10.20%. Over the past three months, the stock has plummeted by 38.16%, while the Sensex has only decreased by 6.06%. Year-to-date, LWS Knitwear's performance is down 37.54%, compared to the Sensex's modest decline of 3.61%. The stock's one-year performance is particularly concerning, showing a decrease of 56.73% against the Sensex's increase of 3.54%. Currently, LWS Knitwear is trading close to its 52-week low, just 2.44% above Rs 15.17. The stock is also underperforming its sector by 6.41% and is tra...

Read MoreLWS Knitwear Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-13 15:30:08LWS Knitwear Ltd is currently facing significant selling pressure, with today's trading session showing a complete absence of buyers. The stock has recorded a notable decline of 4.97%, starkly contrasting with the Sensex's minor drop of 0.25%. This marks a continuation of a troubling trend, as LWS Knitwear has now experienced consecutive days of losses, with a weekly decline of 6.56% compared to the Sensex's 0.67%. Over the past month, LWS Knitwear's performance has deteriorated further, down 17.47%, while the Sensex has only slipped by 3.02%. The three-month performance reveals a staggering 45.93% drop for LWS Knitwear, against the Sensex's 10.10% decline. Year-to-date, the stock has plummeted 36.77%, while the Sensex has shown a more modest decrease of 5.50%. The stock is currently trading close to its 52-week low, just 3.38% above Rs 15.17. Additionally, LWS Knitwear is underperforming its sector by 3...

Read More

LWS Knitwear Faces Sustained Downward Trend Amid Significant Market Volatility

2025-03-03 10:36:07LWS Knitwear, a microcap in the textile sector, has faced significant volatility, hitting a new 52-week low. The stock has declined 14.54% over the past six days and 60.96% in the last year, underperforming compared to the broader market. Its trading remains below key moving averages.

Read More

LWS Knitwear Faces Market Challenges Amid Short-Term Gains and Long-Term Decline

2025-02-28 12:05:20LWS Knitwear, a microcap in the textile sector, is nearing its 52-week low while showing a slight uptick today. Despite outperforming its sector temporarily, the stock has seen a significant decline over the past year and is trading below key moving averages, indicating ongoing market challenges.

Read More

LWS Knitwear Faces Continued Market Challenges Amid Significant Stock Volatility

2025-02-27 09:35:49LWS Knitwear, a microcap in the textile sector, has hit a new 52-week low, continuing a downward trend with a significant decline over the past year. The company has underperformed its sector and is trading below key moving averages, highlighting ongoing market challenges.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

04-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | LWS Knitwear Ltd |

| 2 | CIN NO. | L17115PB1989PLC009315 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 14.35 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary cum Compliance Officer

EmailId: lwsknitwear@gmail.com

Designation: CFO

EmailId: ikapoor.arjun@gmail.com

Date: 04/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Disclosure Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares & Takeovers) Regulation 2011

04-Apr-2025 | Source : BSEDisclosure under Regulation 31(4) of SEBI SAST regulations 2011

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of trading window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

LWS Knitwear Ltd has announced 19:10 rights issue, ex-date: 28 Nov 24