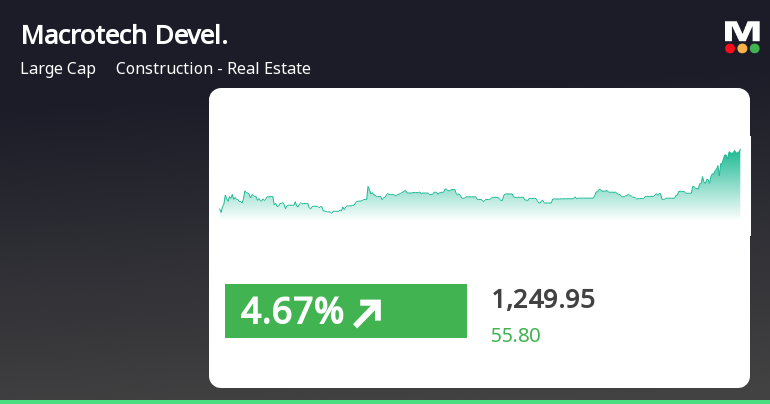

Macrotech Developers Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-04-03 08:06:20Macrotech Developers, a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1218.80, showing a notable increase from the previous close of 1155.85. Over the past year, Macrotech has demonstrated resilience, with a return of 4.47%, outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals on both weekly and monthly scales. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment on a daily basis. Macrotech's performance over various time frames highlights its abil...

Read More

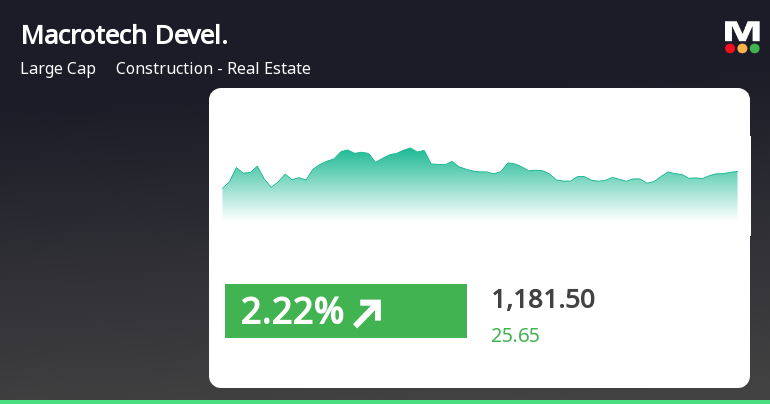

Macrotech Developers Shows Trend Reversal Amidst Mixed Market Performance

2025-04-02 09:50:23Macrotech Developers experienced a notable performance on April 2, 2025, reversing a two-day decline and reaching an intraday high. The stock has outperformed its sector today and is above certain moving averages, while showing mixed results over the past week and month compared to the Sensex.

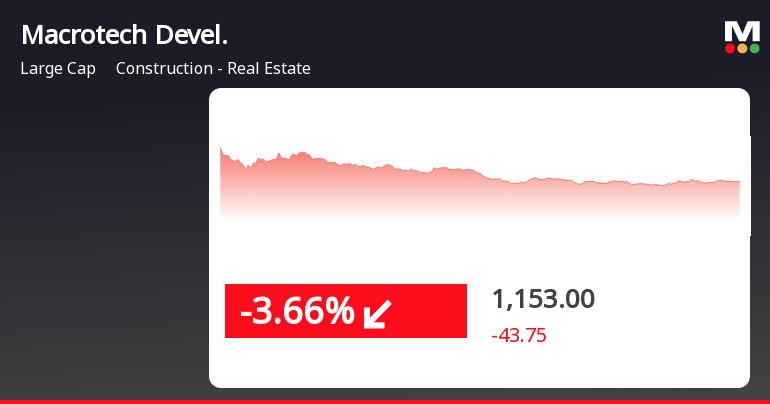

Read MoreMacrotech Developers Faces Technical Trend Shift Amid Market Challenges and Resilience

2025-04-02 08:09:52Macrotech Developers, a prominent player in the construction and real estate sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1,155.85, reflecting a decline from the previous close of 1,196.75. Over the past year, Macrotech has experienced a stock return of -1.13%, contrasting with a 2.72% return from the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also indicate a bearish sentiment for both weekly and monthly assessments. Moving averages on a daily basis align with this bearish perspective, suggesting a challenging market environment for the company. Despite the recent downturn, Macrotech Developers has shown resilience over a three-year period, boasting a remarkable return of 95.93%, significantly outperforming the ...

Read More

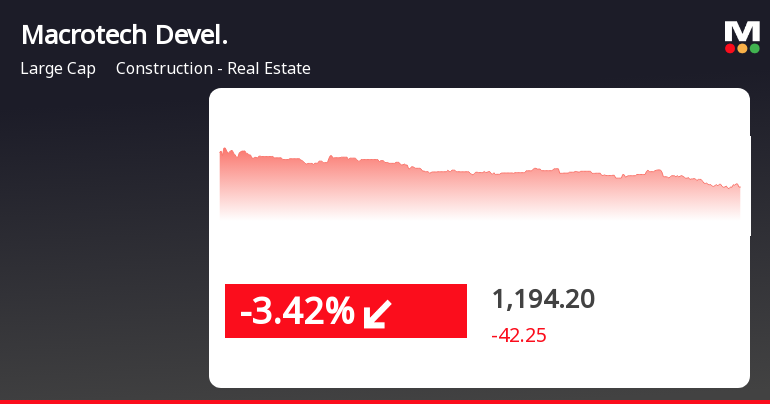

Macrotech Developers Faces Significant Stock Decline Amid Broader Market Challenges

2025-04-01 11:40:52Macrotech Developers has faced a significant decline amid a broader market downturn, with its stock dropping over the past few days. Despite recent challenges, the company has shown strong long-term performance, significantly outperforming the Sensex over the past three years, although it has underperformed its sector recently.

Read More

Macrotech Developers Faces Mixed Performance Amid Broader Market Decline

2025-03-28 15:20:29Macrotech Developers has seen a decline in stock performance, underperforming compared to its sector peers. While the stock is above some moving averages, it lags behind others. The broader market has also turned negative, though Macrotech has shown slight gains over the past week and month, despite significant declines over three months and year-to-date.

Read More

Macrotech Developers Shows Trend Reversal Amid Broader Market Recovery

2025-03-27 15:20:33Macrotech Developers experienced a notable performance today, reversing a two-day decline with a significant intraday high. The stock is currently above several short-term moving averages but below longer-term ones, indicating mixed signals. Over the past week, it has outperformed the Sensex, despite a year-to-date decline.

Read MoreSurge in Open Interest for Macrotech Developers Signals Shift in Market Dynamics

2025-03-26 15:00:46Macrotech Developers Ltd (symbol: LODHA), a prominent player in the construction and real estate sector, has experienced a notable increase in open interest today. The latest open interest stands at 21,374 contracts, reflecting a rise of 2,182 contracts or 11.37% from the previous open interest of 19,192. The trading volume for the day reached 29,284 contracts, contributing to a total futures value of approximately Rs 48,791.22 lakhs. In terms of price performance, Macrotech Developers has outperformed its sector by 0.61%, despite facing a decline of 1.36% over the past two days. The stock reached an intraday high of Rs 1,252.95, marking a 3.57% increase at its peak. However, it has shown a decrease of 0.79% in its one-day return, while the sector and Sensex reported declines of 1.38% and 0.61%, respectively. Additionally, the stock's liquidity remains robust, with a delivery volume of 2.17 lakh shares on...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Macrotech Developers

2025-03-26 14:00:32Macrotech Developers Ltd (symbol: LODHA), a prominent player in the construction and real estate sector, has experienced a significant increase in open interest today. The latest open interest stands at 21,144 contracts, reflecting a rise of 1,952 contracts or 10.17% from the previous open interest of 19,192. This uptick comes alongside a trading volume of 26,947 contracts, indicating robust activity in the derivatives market. In terms of price performance, Macrotech Developers has outperformed its sector by 0.49%, despite facing a consecutive decline over the past two days, with a total return of -0.98% during this period. The stock reached an intraday high of Rs 1,252.95, marking a 3.57% increase at its peak. However, it is noteworthy that the stock's delivery volume has decreased significantly, falling by 69.55% compared to the five-day average. Currently, the stock is trading above its 5-day, 20-day, ...

Read MoreMacrotech Developers Sees Surge in Open Interest Amid Active Trading Environment

2025-03-26 13:00:24Macrotech Developers Ltd, a prominent player in the construction and real estate sector, has experienced a significant increase in open interest today. The latest open interest stands at 21,134 contracts, reflecting a rise of 1,942 contracts or 10.12% from the previous open interest of 19,192. This uptick coincides with a trading volume of 25,103 contracts, indicating active market engagement. In terms of price performance, Macrotech Developers reached an intraday high of Rs 1,252.95, marking a gain of 3.57% for the day. The stock's performance is currently in line with its sector, although it has shown a slight decline of 0.06% over the day. Notably, the stock is trading above its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages. Despite the positive movement in open interest, there has been a notable decline in investor participation, with delivery vol...

Read MoreKey Operational Updates For Q4FY25

07-Apr-2025 | Source : BSEKey Operational Updates for Q4FY25

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

04-Apr-2025 | Source : BSEThe Company has informed the stock exchange regarding allotment of 45389 securities pursuant to ESOP.

Corporate Actions

No Upcoming Board Meetings

Macrotech Developers Ltd has declared 22% dividend, ex-date: 16 Aug 24

No Splits history available

Macrotech Developers Ltd has announced 1:1 bonus issue, ex-date: 31 May 23

No Rights history available