Magadh Sugar & Energy Ltd Sees Surge in Trading Activity Amid Increased Investor Participation

2025-03-24 10:01:17Magadh Sugar & Energy Ltd, a microcap player in the sugar industry, has experienced significant trading activity today, hitting its upper circuit limit with a high price of Rs 686.3. The stock's last traded price (LTP) stands at Rs 648.5, reflecting a notable change of Rs 76.55, or 13.38%. Throughout the trading session, the stock reached an intraday low of Rs 574.8, with a total traded volume of approximately 1.27 lakh shares, resulting in a turnover of Rs 8.26 crore. Despite the day's performance, the stock underperformed its sector by 3.26%, with a 1D return of -1.77%. The price summary indicates that the stock is currently above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Notably, there has been a significant increase in investor participation, with delivery volume rising by 298.19% compared to the 5-day average. In conclusion, Maga...

Read More

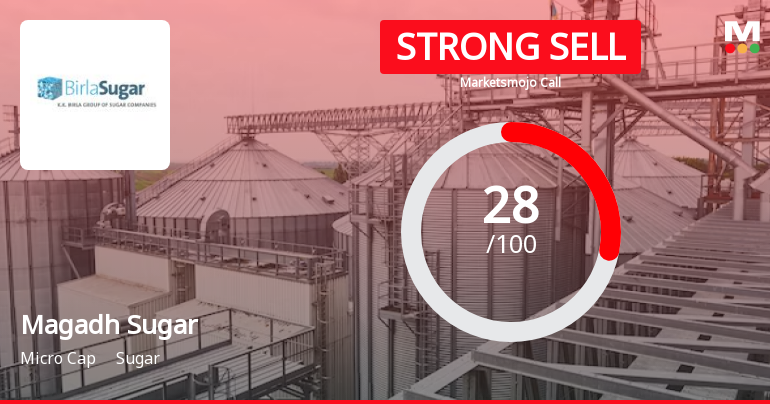

Magadh Sugar Faces Technical Shift Amid Debt Challenges and Declining Profits

2025-03-20 08:10:27Magadh Sugar & Energy has recently experienced a reevaluation of its technical indicators, which now reflect a mildly bearish trend. The company faces challenges in debt servicing and has reported negative results for three consecutive quarters, despite modest growth in net sales and a favorable return on capital employed.

Read MoreMagadh Sugar & Energy Faces Technical Trend Shifts Amid Market Volatility

2025-03-19 08:04:38Magadh Sugar & Energy, a microcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 561.90, showing a notable increase from the previous close of 513.55. Over the past week, the stock has reached a high of 585.00 and a low of 522.00, indicating some volatility in its trading activity. In terms of technical indicators, the MACD suggests a bearish stance on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands and moving averages also reflect a mildly bearish trend, indicating cautious market sentiment. The KST aligns with this view, presenting a bearish outlook on the weekly scale and mildly bearish on the monthly. When comparing the stock's performance to the Sensex, Magadh Sugar has sho...

Read More

Magadh Sugar Faces Financial Challenges Amid Declining Profitability and High Debt Concerns

2025-03-18 08:22:21Magadh Sugar & Energy has recently experienced a reevaluation reflecting its financial challenges, including declines in profit metrics and concerns over debt servicing. Despite modest growth over five years, recent trends show three quarters of unfavorable results, leading to cautious sentiment among investors and minimal mutual fund interest.

Read More

Magadh Sugar & Energy Faces Financial Challenges Amid Declining Profitability and Debt Concerns

2025-03-12 08:09:47Magadh Sugar & Energy has recently adjusted its financial evaluation following a challenging third quarter for FY24-25, marked by significant declines in profit metrics. The company's debt servicing capability is under scrutiny, and it has underperformed the broader market, despite maintaining an attractive valuation relative to peers.

Read MoreMagadh Sugar & Energy Adjusts Valuation Grade Amid Strong Financial Metrics in Sugar Industry

2025-03-12 08:00:46Magadh Sugar & Energy has recently undergone a valuation adjustment, reflecting its strong financial metrics within the sugar industry. The company boasts a price-to-earnings (P/E) ratio of 8.35 and an enterprise value to EBITDA ratio of 6.15, indicating a competitive position in the market. Additionally, its price-to-book value stands at 0.96, while the dividend yield is reported at 2.99%. The company's return on capital employed (ROCE) is 15.43%, and return on equity (ROE) is 11.44%, showcasing effective management of resources and profitability. In comparison to its peers, Magadh Sugar's valuation metrics are notably favorable. For instance, while competitors like Godavari Bioref. and Dhampur Sugar have higher P/E ratios, Magadh Sugar maintains a lower valuation, which may appeal to certain market segments. Over the past year, the stock has experienced a decline of 16.1%, contrasting with the Sensex's...

Read More

Magadh Sugar & Energy Faces Financial Challenges Amidst Declining Profitability and Debt Concerns

2025-03-06 08:11:01Magadh Sugar & Energy has recently adjusted its evaluation amid disappointing financial results for Q3 FY24-25, showing significant declines in profit metrics. Concerns about debt servicing arise from a high Debt to EBITDA ratio. Despite challenges, the company retains an attractive valuation compared to peers.

Read More

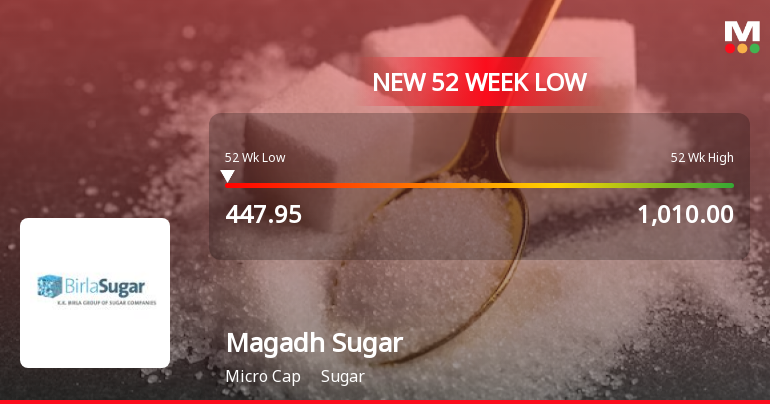

Magadh Sugar & Energy Faces Significant Market Challenges Amidst Declining Stock Performance

2025-03-03 10:08:07Magadh Sugar & Energy has faced significant volatility, hitting a new 52-week low and underperforming its sector. The stock has declined consecutively over three days and is trading below various moving averages. Despite a high dividend yield, it has dropped substantially over the past year compared to the broader market.

Read MoreMagadh Sugar & Energy Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-01 08:00:36Magadh Sugar & Energy has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the sugar industry. The company currently boasts a price-to-earnings (P/E) ratio of 7.69 and a price-to-book value of 0.88, indicating a favorable valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 5.83, while the enterprise value to EBIT is recorded at 6.87, showcasing efficient operational performance. The company also offers a dividend yield of 3.24%, which is appealing for income-focused investors. Return on capital employed (ROCE) is at 15.43%, and return on equity (ROE) is 11.44%, both of which suggest effective management of resources and profitability. In comparison to its peers, Magadh Sugar's valuation metrics are notably competitive. For instance, while it maintains a lower P/E ratio than some of its peers, it also demonstrates a ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI(DP) Regulations 2018 is attached

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

21-Mar-2025 | Source : BSEOutcome of Postal Ballot along with Scrutinisers Report and e-voting Results

Corporate Actions

No Upcoming Board Meetings

Magadh Sugar & Energy Ltd has declared 100% dividend, ex-date: 25 Jul 24

No Splits history available

Magadh Sugar & Energy Ltd has announced 4:10 bonus issue, ex-date: 27 Jun 19

No Rights history available