MTNL Shows Mixed Technical Trends Amid Strong Long-Term Performance Resilience

2025-04-03 08:00:06Mahanagar Telephone Nigam Limited (MTNL), a small-cap player in the telecommunication service provider industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 44.70, slightly down from the previous close of 45.49. Over the past year, MTNL has shown a notable return of 25.74%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands suggest a mildly bearish outlook weekly, contrasting with a bullish monthly perspective. The daily moving averages indicate a bearish trend, while the On-Balance Volume (OBV) reflects bullish momentum on both weekly and monthly scales. ...

Read MoreMTNL Shows Mixed Technical Trends Amid Strong Long-Term Performance Resilience

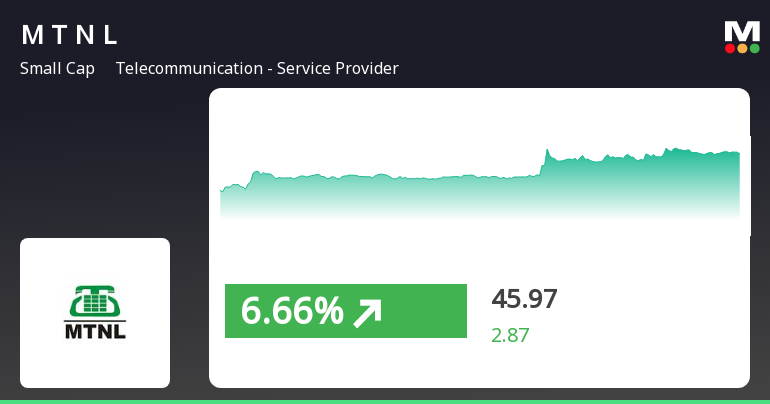

2025-04-02 08:00:09Mahanagar Telephone Nigam Limited (MTNL), a small-cap player in the telecommunications service provider industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 45.49, showing a notable increase from the previous close of 43.10. Over the past year, MTNL has experienced a significant return of 31.63%, outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and KST indicators, while the monthly metrics show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a mildly bearish outlook on the weekly chart and a bullish stance on the monthly chart. Additionally, the moving averages signal a bearish trend on a daily basis, suggesting a cautious approach to the stock's performance. In terms of returns, MTNL has demonstrated resi...

Read More

Mahanagar Telephone Nigam Shows Resilience Amid Broader Market Decline

2025-04-01 12:15:15Mahanagar Telephone Nigam, a small-cap telecommunications provider, experienced notable trading activity, achieving an intraday high and outperforming its sector. While its stock is above short-term moving averages, it lags behind longer-term ones. Over the past month and year, it has significantly outperformed the broader market index.

Read MoreMTNL Shows Mixed Technical Trends Amid Strong Long-Term Performance in Telecom Sector

2025-03-26 08:00:03Mahanagar Telephone Nigam Limited (MTNL), a small-cap player in the telecommunications service provider industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 44.29, down from a previous close of 45.95, with a 52-week high of 101.88 and a low of 32.12. Today's trading saw a high of 46.43 and a low of 43.90. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands reflect a bearish stance weekly but are bullish on a monthly basis. Moving averages indicate a bearish trend daily, while the KST shows a bearish weekly trend and a mildly bearish monthly outlook. Interestingly, the On-Balance Volume (OBV) is bulli...

Read MoreMTNL Faces Mixed Technical Signals Amidst Strong Long-Term Performance

2025-03-25 08:00:04Mahanagar Telephone Nigam Limited (MTNL), a small-cap player in the telecommunication service provider industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 45.95, slightly down from the previous close of 45.97. Over the past year, MTNL has shown a notable return of 37.16%, significantly outperforming the Sensex, which returned 7.07% in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mix of mildly bearish and bullish signals. The Bollinger Bands reflect a bearish trend on a weekly basis, contrasting with a bullish outlook on a monthly scale. The KST and Dow Theory also suggest a bearish stance in the short term. In terms of stock performance, MTNL has experienced a 1.82% return over the past week, while the Sensex has returned 5.14%. Ye...

Read MoreMahanagar Telephone Nigam Ltd Sees Surge in Trading Activity Amid Sector Underperformance

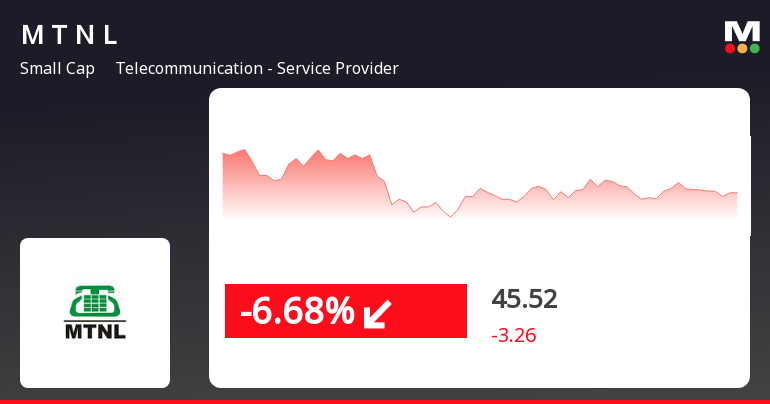

2025-03-17 10:00:03Mahanagar Telephone Nigam Ltd (MTNL) has emerged as one of the most active stocks today, with a total traded volume of 5,859,982 shares and a total traded value of approximately Rs 269.21 crore. The stock opened at Rs 46.75, reflecting a loss of 4.36% from the previous close of Rs 48.88. Throughout the trading session, MTNL reached a day high of Rs 46.99 and a day low of Rs 45.00, ultimately closing at Rs 45.48. Despite the notable trading activity, MTNL underperformed its sector by 5.94%, marking a decline of 7.53% for the day. This drop follows two consecutive days of gains, indicating a potential trend reversal. The stock's performance is currently above its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day moving averages. Investor participation has seen a significant increase, with delivery volume on March 13 rising by 655.04% compared to the 5-day average. The stock...

Read More

Mahanagar Telephone Nigam Faces Significant Decline Amidst Recent Gains and Long-Term Growth

2025-03-17 09:45:14Mahanagar Telephone Nigam, a small-cap telecommunications provider, saw a notable decline on March 17, 2025, following two days of gains. Despite today's downturn, the stock has shown strong long-term performance, with a 523.66% increase over five years, significantly outperforming the Sensex during the same period.

Read MoreMTNL's Technical Indicators Reveal Mixed Signals Amid Strong Long-Term Performance

2025-03-17 08:00:03Mahanagar Telephone Nigam Limited (MTNL), a small-cap player in the telecommunications service provider industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 48.78, showing a notable increase from the previous close of 43.34. Over the past year, MTNL has demonstrated a robust performance with a return of 48.31%, significantly outpacing the Sensex, which recorded a return of 1.47% during the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Interestingly, Bollinger Bands indicate a bullish trend on both weekly and monthly charts, suggesting some volatility in price movements. Moving averages reflect a mildly bearish sentiment on a daily basis, while t...

Read MoreMahanagar Telephone Nigam Ltd Sees Surge in Trading Activity and Investor Participation

2025-03-13 11:00:03Mahanagar Telephone Nigam Ltd (MTNL) has emerged as one of the most active stocks in the equity market today, particularly in terms of trading value. The company, operating within the telecommunication service provider industry, has seen a total traded volume of approximately 37.9 million shares, translating to a total traded value of around Rs 1,867.49 million. The stock opened at Rs 46.3, reflecting a gain of 7.08% from the previous close of Rs 43.24. Throughout the trading session, MTNL reached an intraday high of Rs 51.18, marking an increase of 18.36%. The stock has demonstrated a notable performance, outperforming its sector by 13.22% and achieving a consecutive gain over the last two days, with returns of 20.09% during this period. Investor participation has also risen, with a delivery volume of 1.68 million shares on March 12, which is an increase of 82.66% compared to the five-day average. The st...

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

09-Apr-2025 | Source : BSELETTER ATTACHED

COMPLIANCE WITH REGULATION 30 OF SEBI (LODR) 2015 - FUNDING OF 09TH SEMI ANNUAL INTEREST WRT MTNL BOND SERIES V (INE153A08089).

09-Apr-2025 | Source : BSELETTER ATTACHED

COMPLIANCE OF REGULATION 30 OF SEBI (LODR) 2015-DISCLOSURE OF EVENTS OR INFORMATION - DISCLOSURE OF IMPOSITION OF FINE OR PENALTY.

08-Apr-2025 | Source : BSELETTER ATTACHED

Corporate Actions

No Upcoming Board Meetings

Mahanagar Telephone Nigam Ltd has declared 10% dividend, ex-date: 17 Sep 09

No Splits history available

No Bonus history available

No Rights history available