Maharashtra Scooters Shows Mixed Technical Indicators Amid Strong Performance Trends

2025-04-02 08:07:07Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 10,636.20, down from a previous close of 11,252.95, with a notable 52-week high of 12,847.45 and a low of 7,248.95. The technical summary reveals a mixed picture: while the MACD indicates a bullish stance on a weekly basis, it leans mildly bearish on a monthly scale. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, suggesting a lack of momentum. Bollinger Bands are mildly bullish across both timeframes, indicating potential price stability. However, moving averages and the KST reflect a mildly bearish trend on a daily and monthly basis, respectively. In terms of performance, Maharashtra Scooters has demonstrated strong returns compared to the Sensex. Over the past year, the sto...

Read More

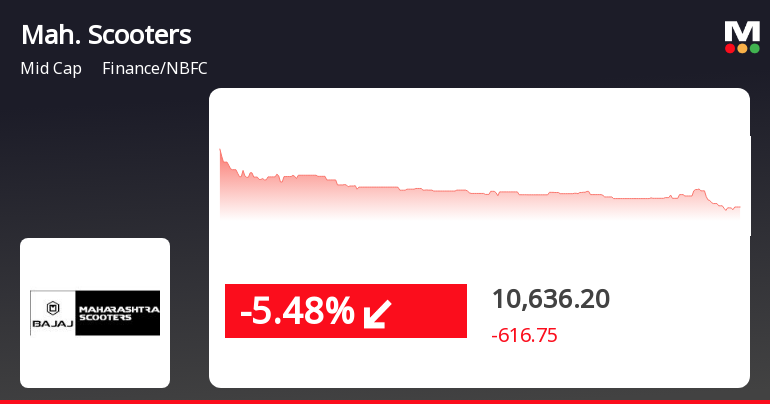

Maharashtra Scooters Faces Decline Amid Broader Market Volatility and Small-Cap Gains

2025-04-01 15:35:24Maharashtra Scooters, a midcap finance/NBFC company, saw a significant decline on April 1, 2025, following two days of gains. Despite this drop, the stock has demonstrated strong performance over various periods, including a notable increase over the past year and five years. The broader market also experienced a downturn.

Read More

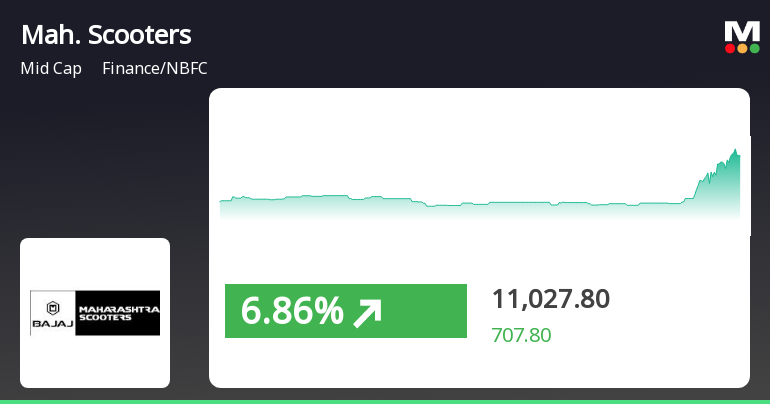

Maharashtra Scooters Shows Strong Market Recovery Amid Broader Sensex Gains

2025-03-27 14:35:22Maharashtra Scooters has experienced notable trading activity, reversing a two-day decline and reaching an intraday high. The stock is performing well above its moving averages and has shown impressive growth over the past year and five years, significantly outperforming the broader market indices.

Read MoreMaharashtra Scooters Shows Resilience Amid Technical Trend Adjustments in Market Dynamics

2025-03-26 08:03:37Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 10,344.95, showing a slight decline from the previous close of 10,390.95. Over the past year, the stock has demonstrated significant resilience, achieving a return of 46.44%, compared to the Sensex's 7.12% during the same period. In terms of technical indicators, the weekly MACD is bullish, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands indicate bullish momentum on both weekly and monthly scales, suggesting a potential for price stability. The On-Balance Volume (OBV) also reflects bullish sentiment, reinforcing the stock's positive trading activity. Maharashtra Scooters has shown impressive long-term performance, with a staggering 1,080.93% return over the last decade, significantly outpacing t...

Read MoreMaharashtra Scooters Shows Mixed Technical Signals Amidst Market Volatility

2025-03-25 08:04:20Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 10,390.95, showing a notable increase from the previous close of 10,100.00. Over the past year, the stock has reached a high of 12,847.45 and a low of 6,910.20, indicating significant volatility. The technical summary reveals mixed signals across various indicators. The MACD shows bullish momentum on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) indicates no clear signal for both weekly and monthly assessments. Bollinger Bands present a bullish outlook in both timeframes, suggesting potential price stability. Moving averages reflect a mildly bearish trend on a daily basis, while the KST and Dow Theory show a similar mildly bullish stance weekly, but a bearish trend mont...

Read MoreMaharashtra Scooters Shows Mixed Technical Trends Amid Strong Market Resilience

2025-03-24 08:01:51Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 10,100.00, showing a slight increase from the previous close of 10,078.70. Over the past year, Maharashtra Scooters has demonstrated significant resilience, achieving a remarkable 46.20% return compared to the Sensex's 5.87% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands reflect a bullish stance for both weekly and monthly evaluations, suggesting a potential for upward movement. The On-Balance Volume (OBV) also indicates bullish momentum, reinforcing the stock's positive activity. In terms of price performance, Maharashtra Scooters has reached a ...

Read MoreMaharashtra Scooters Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-20 08:02:40Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 9,826.95, showing a notable increase from the previous close of 9,418.00. Over the past year, the stock has demonstrated a robust performance with a return of 43.88%, significantly outpacing the Sensex, which recorded a return of 4.77% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly scales, suggesting potential volatility in price movements. The moving averages present a mildly bearish stance on a daily basis, contrasting with the overall bullish signals from the KST and Dow Theory on a weekly basis. The company's performan...

Read MoreMaharashtra Scooters Experiences Technical Trend Adjustments Amid Strong Long-Term Performance

2025-03-10 08:01:29Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone a technical trend adjustment. The company's current price stands at 9,392.60, slightly above the previous close of 9,385.00. Over the past year, Maharashtra Scooters has demonstrated a notable stock return of 26.79%, significantly outperforming the Sensex, which recorded a mere 0.29% return in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while presenting a mildly bearish trend monthly. The Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly perspective. Additionally, the KST and Dow Theory metrics align with a mildly bearish trend on a monthly basis, while the On-Balance Volume (OBV) shows a bullish signal over the monthly timeframe. In terms of performance, Maharashtra Scooters has shown resilience, par...

Read MoreMaharashtra Scooters Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:01:57Maharashtra Scooters, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 9,312.00, showing a slight change from the previous close of 9,301.00. Over the past year, Maharashtra Scooters has demonstrated a notable return of 24.35%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and KST indicators, while the monthly metrics show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a mildly bearish outlook on the weekly chart and a bullish stance on the monthly. The daily moving averages also reflect bearish conditions, suggesting a cautious approach to the stock's performance. In terms of returns, Maharashtra Scooters has shown resilience over longer periods, w...

Read MoreBoard Meeting Intimation for Considering And Approving The Audited Financial Results For The Quarter And Year Ended 31 March 2025 And Dividend If Any

07-Apr-2025 | Source : BSEMaharashtra Scooters Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 23/04/2025 inter alia to consider and approve audited financial results for the quarter and year ended 31 March 2025 and dividend if any.

Closure of Trading Window

31-Mar-2025 | Source : BSEThe trading window shall remain closed till the declaration of standalone financial result for the quarter and financial year ending 31 March 2025 and 48 hours thereafter.

Intimation As Per Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Closure Of Factory Transfer Of Leasehold Rights In Factory Land And Sale Of Machinery Situated At Satara.

21-Feb-2025 | Source : BSEIntimation as per Regulation 30 of SEBI (LODR) Regulations 2015 - Closure of Factory Transfer of Leasehold Rights in Factory land and sale of machinery situated at Satara.

Corporate Actions

No Upcoming Board Meetings

Maharashtra Scooters Ltd has declared 1100% dividend, ex-date: 25 Sep 24

No Splits history available

No Bonus history available

No Rights history available