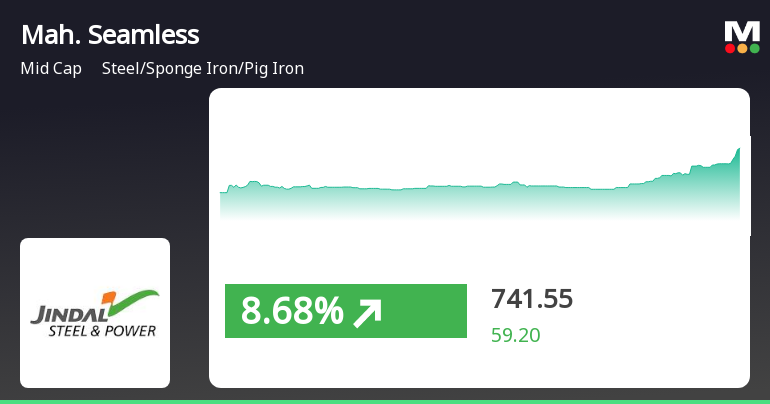

Maharashtra Seamless Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-04-03 08:04:17Maharashtra Seamless, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 733.45, slightly down from its previous close of 736.85. Over the past year, the stock has experienced a decline of 20.18%, contrasting with a modest gain of 3.67% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bullish sentiment, while the monthly metrics present a mildly bearish outlook. The stock's performance has shown variability, with a 52-week high of 964.35 and a low of 562.65. Recent trading activity has seen a daily high of 738.30 and a low of 711.35. When comparing returns, Maharashtra Seamless has outperformed the Sensex over various time frames, notably with a remarkable 665.21% return over the past five years, compared to the...

Read More

Maharashtra Seamless Faces Valuation Shift Amid Declining Financial Performance

2025-04-02 08:13:02Maharashtra Seamless has recently experienced a change in its valuation grade, indicating a shift to a more expensive classification. Key financial metrics show a PE ratio of 13.10 and a Price to Book Value of 1.66, while the company has faced challenges with declining operating profit growth and negative results over three consecutive quarters.

Read MoreMaharashtra Seamless Adjusts Valuation Grade Amidst Competitive Industry Landscape

2025-04-02 08:01:39Maharashtra Seamless, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment. The company's current price stands at 736.85, reflecting a notable increase from the previous close of 682.35. Over the past year, the stock has experienced a decline of 16.58%, contrasting with a 2.72% gain in the Sensex during the same period. However, the company has shown resilience over longer time frames, with a remarkable 668.75% return over the last five years. Key financial metrics for Maharashtra Seamless include a PE ratio of 13.10 and an EV to EBITDA ratio of 9.05, which position it within a competitive landscape. The company boasts a return on capital employed (ROCE) of 20.89% and a return on equity (ROE) of 14.19%. In comparison to its peers, Maharashtra Seamless presents a more favorable valuation profile, particularly when contrasted with companies like Sarda En...

Read More

Maharashtra Seamless Shows Resilience Amid Broader Market Downturn and Gains Momentum

2025-04-01 14:15:22Maharashtra Seamless has demonstrated notable resilience amid a broader market downturn, gaining 5.16% on April 1, 2025. The stock has consistently outperformed its sector and is trading above key moving averages, reflecting strong performance trends over various time frames, including significant long-term gains.

Read More

Maharashtra Seamless Adjusts Valuation Amidst Shifting Financial Metrics and Investor Interest

2025-03-26 08:04:18Maharashtra Seamless has recently adjusted its evaluation, reflecting a shift in valuation metrics. Key financial indicators include a PE ratio of 12.35, Price to Book Value of 1.57, and a low Debt to Equity ratio of 0.10. The company also shows strong operational efficiency with a ROCE of 20.89%.

Read More

Maharashtra Seamless Faces Valuation Shift Amid Declining Profitability and Market Underperformance

2025-03-21 08:01:13Maharashtra Seamless has recently experienced a change in its evaluation score, reflecting a shift in market perception regarding its financial metrics. The company reports a premium valuation compared to peers, but has faced challenges, including declining profitability and negative returns over the past year.

Read MoreMaharashtra Seamless Adjusts Valuation Amid Strong Performance and Competitive Industry Landscape

2025-03-21 08:00:31Maharashtra Seamless, a midcap player in the steel, sponge iron, and pig iron industry, has recently undergone a valuation adjustment. The company's current price stands at 721.00, reflecting a notable increase from the previous close of 700.50. Over the past week, Maharashtra Seamless has demonstrated a stock return of 9.13%, significantly outperforming the Sensex, which returned 3.41% in the same period. Key financial metrics for Maharashtra Seamless include a PE ratio of 12.82 and an EV to EBITDA ratio of 8.82. The company's return on capital employed (ROCE) is reported at 20.89%, while the return on equity (ROE) stands at 14.19%. These figures indicate a solid operational performance relative to its peers. In comparison, other companies in the sector exhibit varying valuation metrics. For instance, Sarda Energy and Ratnamani Metals show higher PE ratios, while Jindal Saw presents a more attractive EV ...

Read MoreMaharashtra Seamless Faces Mixed Technical Trends Amid Market Volatility

2025-03-13 08:01:28Maharashtra Seamless, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 654.35, showing a notable increase from the previous close of 637.40. Over the past year, the stock has experienced a decline of 26.00%, contrasting with a modest gain of 0.49% in the Sensex. The technical summary indicates a mixed outlook, with various indicators suggesting a mildly bearish trend in both weekly and monthly assessments. The MACD and KST metrics are bearish on a weekly basis, while the Bollinger Bands and moving averages also reflect a mildly bearish stance. However, the On-Balance Volume (OBV) shows bullish signals on both weekly and monthly charts, indicating some underlying strength in trading volume. In terms of returns, Maharashtra Seamless has outperformed the Sensex over the past three...

Read MoreMaharashtra Seamless Faces Mixed Technical Trends Amid Market Volatility

2025-03-13 08:01:28Maharashtra Seamless, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 654.35, showing a notable increase from the previous close of 637.40. Over the past year, the stock has experienced a decline of 26.00%, contrasting with a modest gain of 0.49% in the Sensex. The technical summary indicates a mixed outlook, with various indicators suggesting a mildly bearish trend in both weekly and monthly assessments. The MACD and KST metrics are bearish on a weekly basis, while the Bollinger Bands and moving averages also reflect a mildly bearish stance. However, the On-Balance Volume (OBV) shows bullish signals on both weekly and monthly charts, indicating some underlying strength in trading volume. In terms of returns, Maharashtra Seamless has outperformed the Sensex over the past three...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate under Regulation 74 (5) of SEBI (DP) Regulations 2018

Clarification On Significant Increase In The Volume

02-Apr-2025 | Source : BSEClarification on significant increase in the volume

Clarification On Spurt In Volume Required By NSE

02-Apr-2025 | Source : BSEClarification on Spurt in Volume required by NSE

Corporate Actions

No Upcoming Board Meetings

Maharashtra Seamless Ltd has declared 200% dividend, ex-date: 14 Aug 24

Maharashtra Seamless Ltd has announced 5:10 stock split, ex-date: 18 Apr 06

Maharashtra Seamless Ltd has announced 1:1 bonus issue, ex-date: 25 Nov 22

No Rights history available