Mahindra Logistics Experiences Valuation Grade Change Amidst Competitive Sector Challenges

2025-03-20 08:01:02Mahindra Logistics has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the logistics sector. The company's current price stands at 268.50, showing a notable increase from the previous close of 262.00. Over the past year, Mahindra Logistics has faced challenges, with a stock return of -35.52%, contrasting sharply with a 4.77% return from the Sensex during the same period. Key financial metrics reveal a PE ratio of -46.17 and an EV to EBITDA ratio of 10.45, indicating a complex financial landscape. The company's return on capital employed (ROCE) is reported at 2.36%, while the return on equity (ROE) stands at -12.00%. In comparison to its peers, Mahindra Logistics presents a unique position; while some competitors like Gateway Distri and Allcargo Logistics boast more favorable valuation metrics, Mahindra's performance reflects a different trajectory. The logist...

Read MoreMahindra Logistics Adjusts Valuation Amidst Competitive Challenges in Logistics Sector

2025-03-13 08:00:47Mahindra Logistics has recently undergone a valuation adjustment, reflecting its current standing in the logistics sector. The company, classified as a small-cap entity, has reported a price-to-earnings (PE) ratio of -42.08, indicating a challenging earnings environment. Its price-to-book value stands at 3.91, while the enterprise value to EBITDA ratio is recorded at 9.80, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, Mahindra Logistics has a return on capital employed (ROCE) of 2.36% and a return on equity (ROE) of -12.00%, highlighting some operational challenges. The company also offers a dividend yield of 1.02%, which may appeal to certain investors. When compared to its peers, Mahindra Logistics shows a distinct position. For instance, VRL Logistics and Gateway Distri have reported more favorable PE ratios...

Read MoreMahindra Logistics Adjusts Valuation Amidst Competitive Challenges in Logistics Sector

2025-03-13 08:00:47Mahindra Logistics has recently undergone a valuation adjustment, reflecting its current standing in the logistics sector. The company, classified as a small-cap entity, has reported a price-to-earnings (PE) ratio of -42.08, indicating a challenging earnings environment. Its price-to-book value stands at 3.91, while the enterprise value to EBITDA ratio is recorded at 9.80, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, Mahindra Logistics has a return on capital employed (ROCE) of 2.36% and a return on equity (ROE) of -12.00%, highlighting some operational challenges. The company also offers a dividend yield of 1.02%, which may appeal to certain investors. When compared to its peers, Mahindra Logistics shows a distinct position. For instance, VRL Logistics and Gateway Distri have reported more favorable PE ratios...

Read More

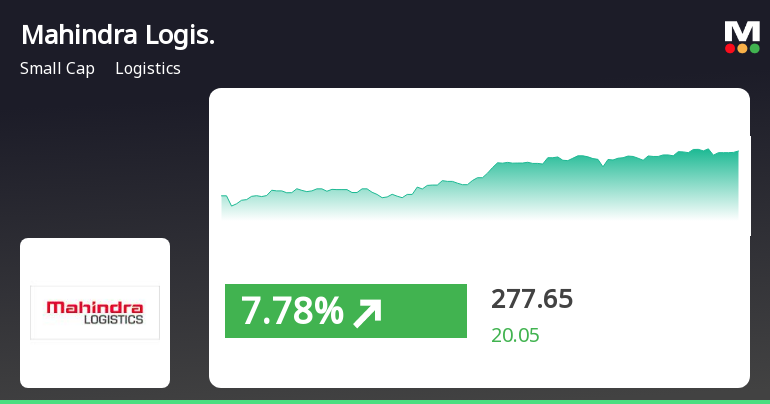

Mahindra Logistics Shows Strong Short-Term Gains Amid Long-Term Volatility Concerns

2025-03-07 10:55:57Mahindra Logistics has seen a significant increase today, outperforming its sector and achieving a total return of 13.6% over three days. The stock has shown high volatility and is currently above its 5-day moving average, though it remains below several longer-term averages. The broader market is also experiencing positive movement.

Read More

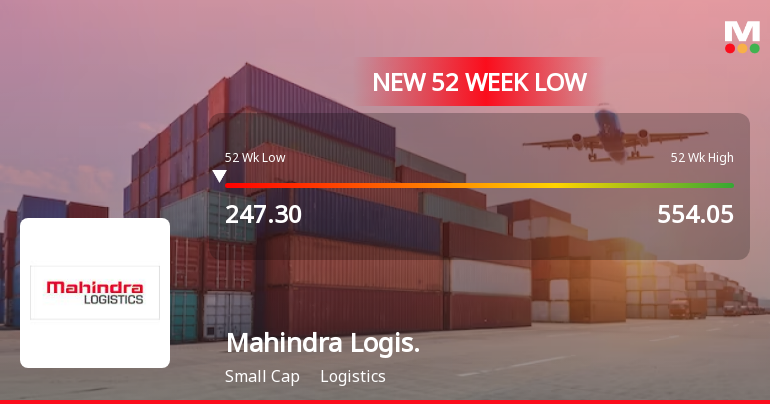

Mahindra Logistics Hits 52-Week Low Amid Broader Market Decline and Ongoing Struggles

2025-03-04 10:33:45Mahindra Logistics has hit a new 52-week low, continuing its trend of underperformance in the logistics sector. The company has faced significant challenges, including declining operating profits and a high debt-equity ratio, raising concerns about its long-term viability and market position compared to peers.

Read More

Mahindra Logistics Faces Significant Volatility Amid Broader Sector Decline

2025-03-03 10:36:49Mahindra Logistics has faced significant volatility, hitting a new 52-week low of Rs. 242 and experiencing a cumulative drop of 14.76% over the past week. Despite this, it outperformed its sector, which declined by 2.51%. The stock has decreased by 43.71% over the past year.

Read More

Mahindra Logistics Hits 52-Week Low Amid Broader Sector Challenges

2025-02-28 09:39:11Mahindra Logistics has reached a new 52-week low, continuing a six-day decline that has seen the stock drop nearly 10%. Currently trading below key moving averages, the stock has decreased by over 40% in the past year, amid broader challenges in the logistics sector.

Read More

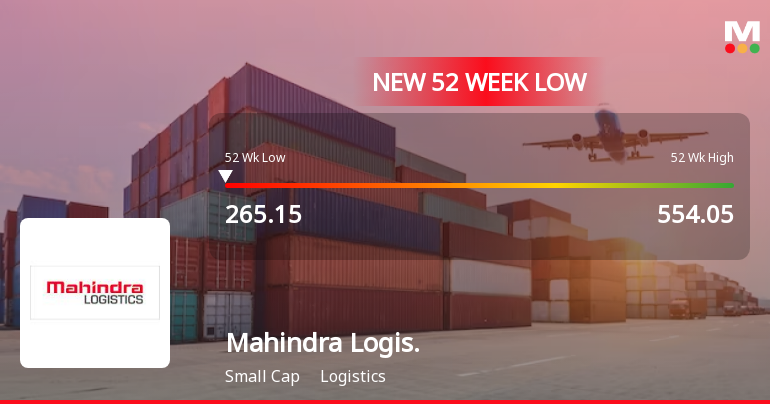

Mahindra Logistics Faces Sustained Downward Trend Amid Sector Underperformance

2025-02-27 09:36:12Mahindra Logistics has faced significant volatility, hitting a new 52-week low of Rs. 265.15. The stock has declined 7.8% over the past five days and 39.95% over the past year, underperforming its sector and trading below key moving averages, indicating ongoing challenges in the logistics market.

Read More

Mahindra Logistics Hits 52-Week Low Amid Ongoing Sector Challenges

2025-02-25 15:35:32Mahindra Logistics has reached a new 52-week low, continuing a downward trend for four consecutive days with a total decline of 5.99%. Over the past year, the stock has fallen 30.61%, underperforming the Sensex, and is trading below multiple moving averages, highlighting ongoing challenges in the logistics sector.

Read MoreCertificate For The Quarter Ended 31 March 2025 Pursuant To The SEBI Master Circular For Issue And Listing Of Non-Convertible Securities Securitised Debt Instruments Security Receipts Municipal Debt Securities And Commercial Paper Dated 22 May 2024 (SEBI

08-Apr-2025 | Source : BSEDetailed disclosure is attached.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEThe Certificate received by the RTA for the period 1 January 2025 to 31 March 2025 is enclosed.

Announcement under Regulation 30 (LODR)-Change in Management

07-Mar-2025 | Source : BSEIntimation w.r.t appointment of Mr. B Jei Srihari as Head - Consumer & Manufacturing Business and SMP of the Company w.e.f 10 March 2025 is attached.

Corporate Actions

No Upcoming Board Meetings

Mahindra Logistics Ltd has declared 25% dividend, ex-date: 12 Jul 24

No Splits history available

No Bonus history available

No Rights history available