Man Industries Adjusts Valuation Grade Amid Competitive Steel Industry Landscape

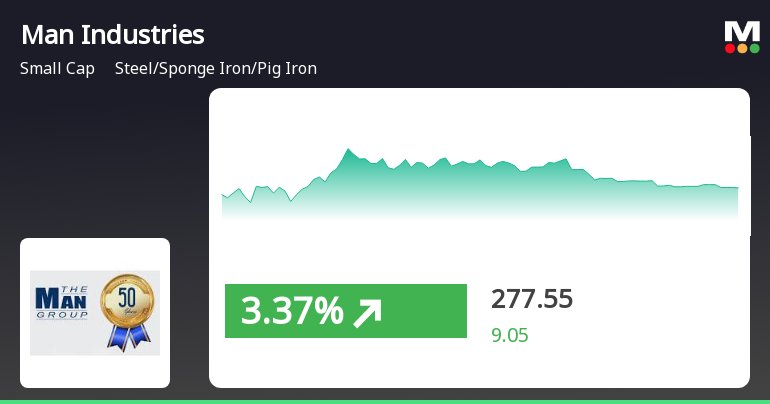

2025-04-02 08:00:12Man Industries (India), a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone a valuation adjustment. The company currently exhibits a PE ratio of 16.60 and an EV to EBITDA ratio of 6.81, indicating its financial metrics in the context of its industry. The latest return on capital employed (ROCE) stands at 13.35%, while the return on equity (ROE) is recorded at 7.24%. In terms of market performance, Man Industries has shown notable returns over various periods. Over the past week, the stock has returned 6.41%, significantly outperforming the Sensex, which declined by 2.55%. Over the last month, the stock's return reached 31.05%, compared to a modest 3.86% for the Sensex. However, on a year-to-date basis, the company has faced a decline of 14.47%, while the Sensex has also seen a slight drop of 2.71%. When compared to its peers, Man Industries holds a competitive position, pa...

Read More

Man Industries Shows Mixed Performance Amid Broader Market Decline and Small-Cap Gains

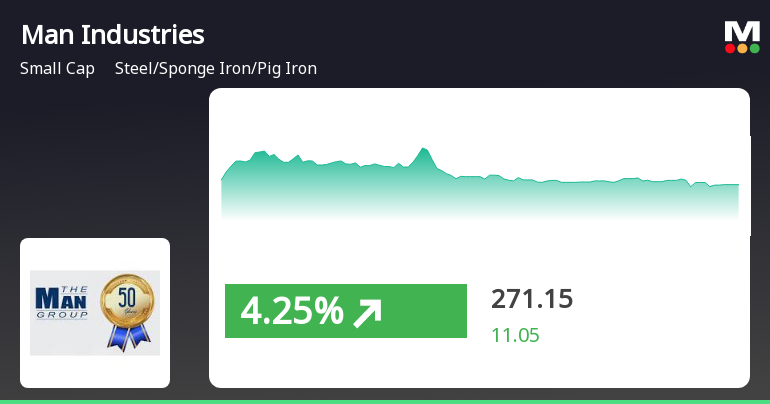

2025-04-01 10:15:29Man Industries (India) saw notable trading activity on April 1, 2025, with an intraday low reflecting a decline before recovering. The stock's performance is mixed against moving averages, while broader market conditions show a decline in the Sensex, despite small-cap stocks gaining. Year-to-date, Man Industries remains negative.

Read MoreMan Industries Faces Mixed Technical Trends Amid Market Volatility and Varied Performance

2025-04-01 08:00:08Man Industries (India), a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 268.50, showing a notable increase from the previous close of 260.10. Over the past week, the stock has experienced a high of 282.40 and a low of 265.00, indicating some volatility in its trading range. In terms of technical indicators, the MACD and KST metrics suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also reflect a similar trend, indicating cautious market sentiment. The Dow Theory presents a mixed view, with a mildly bullish signal on the weekly chart contrasted by a bearish stance on the monthly chart. When comparing the stock's performance to the Sensex, Man Industries has shown varied returns. Over the pas...

Read More

Man Industries Outperforms Sector Amid Broader Market Decline and Small-Cap Gains

2025-03-28 10:00:19Man Industries (India) has experienced notable stock performance, gaining significantly on March 28, 2025, and outperforming its sector amid a broader market decline. The stock has shown consecutive gains over the past two days and has performed strongly over the past month, surpassing the Sensex's growth.

Read MoreMan Industries Faces Mixed Technical Trends Amid Market Volatility and Performance Fluctuations

2025-03-26 08:00:14Man Industries (India), a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD and Bollinger Bands signaling bearish trends on both weekly and monthly bases. The daily moving averages also align with this bearish sentiment, while the KST shows a similar pattern. Notably, the Dow Theory indicates a mildly bullish trend on a weekly basis, contrasting with the overall bearish outlook. In terms of performance, Man Industries has experienced fluctuations in its stock price, currently standing at 263.00, down from a previous close of 270.25. The stock has seen a 52-week high of 513.00 and a low of 201.45, indicating significant volatility. When comparing the company's returns to the Sensex, it has shown varied performance over different periods. Ov...

Read MoreMan Industries Faces Mixed Technical Indicators Amid Strong Long-Term Performance

2025-03-25 08:00:19Man Industries (India), a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish tendencies on a weekly basis and mildly bearish on a monthly basis. The Bollinger Bands also indicate a mildly bearish trend, while the moving averages suggest a similar sentiment on a daily scale. Despite these technical signals, Man Industries has demonstrated notable performance in comparison to the Sensex over various time frames. Over the past week, the stock returned 6.19%, outperforming the Sensex's 5.14%. In the past month, the stock's return of 13.93% significantly exceeded the Sensex's 4.74%. However, the year-to-date performance shows a decline of 17.41%, contrasting with the Sensex's slight drop of 0.20%. Over a longer horizon, Man Indu...

Read MoreMan Industries Opens Strong with 8.61% Gain, Outperforming Sector Trends

2025-03-06 09:40:08Man Industries (India) Ltd, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has shown significant activity today, opening with an impressive gain of 8.61%. The stock has outperformed its sector by 5.9%, marking a notable performance amid broader market trends. Over the past four days, Man Industries has demonstrated a strong upward trajectory, accumulating returns of 29.1%. Today, the stock reached an intraday high of Rs 281.85, reflecting a 9.33% increase. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages, indicating mixed technical signals. In comparison to the Sensex, Man Industries has performed well over the day, with a 1-day performance of 5.59% against the Sensex's slight decline of 0.08%. However, the stock has faced challenges over the past month, showing a decline of 5.49%, slightly ...

Read MoreMan Industries Surges Amid High Volatility, Outperforming Steel Sector Competitors

2025-03-05 14:00:04Man Industries (India) Ltd, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has shown remarkable activity today, hitting its upper circuit limit with an intraday high of Rs 258.79, reflecting a significant change of Rs 43.13. The stock's performance has outpaced its sector by 17.19%, marking a notable achievement in a competitive market. Throughout the trading session, Man Industries experienced a wide price range, fluctuating between a low of Rs 215.00 and the day's high, indicating high volatility with an intraday volatility rate of 5.87%. The total traded volume reached approximately 14.26 lakh shares, contributing to a turnover of Rs 34.90 crore. Notably, the stock has been on an upward trajectory, gaining 23.22% over the last two days. In terms of moving averages, the stock is currently above its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averag...

Read MoreMan Industries Experiences Surge with 17.77% Gain Amid Strong Buying Activity

2025-03-05 13:50:04Man Industries (India) Ltd is currently witnessing significant buying activity, with the stock surging by 17.77% today, outperforming the Sensex, which has only gained 0.93%. Over the past three days, the stock has shown a consecutive gain of 20.72%, indicating a strong upward momentum. The stock opened with a gap up of 2.7% and reached an intraday high of Rs 257.8. In terms of performance relative to the Sensex, Man Industries has shown mixed results over various time frames. While it has experienced a decline of 10.80% over the past month and 33.45% over the past year, it has significantly outperformed the index over the longer term, with a remarkable 221.25% increase over three years and 403.02% over five years. The steel sector, in which Man Industries operates, has also seen positive movement, gaining 2.83% today. This sector-wide performance, combined with the stock's recent volatility of 5.82%, may...

Read MoreInclusion Of CompanyS Name In Qatar Energy LNGs Approved Vendor List.

03-Apr-2025 | Source : BSEWe wish to inform you that the Companys name has been included in Qatar Energy LNGs Approved Vendor List.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

03-Apr-2025 | Source : BSEWe are enclosing herewith the Press Release in respect of inclusion of Companys name in Qatar Energy LNGs Approved Vendor List.

Intimation Of TV Interview With Zee Business On April 2 2025 At 12:00 P.M.

02-Apr-2025 | Source : BSEWe wish to inform you that a TV Interview of Mr. Nikhil Mansukhani Managing Director of the Company is scheduled to be held on Wednesday April 2 2025 at 12:00 P.M. with Zee Business.

Corporate Actions

No Upcoming Board Meetings

Man Industries (India) Ltd has declared 40% dividend, ex-date: 14 Aug 23

Man Industries (India) Ltd has announced 5:10 stock split, ex-date: 09 Oct 07

No Bonus history available

No Rights history available