Man Infraconstruction Faces Technical Trend Shifts Amid Market Evaluation Adjustments

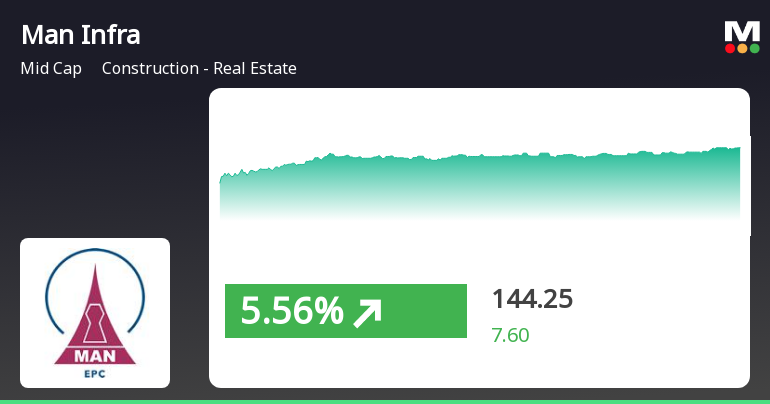

2025-04-03 08:05:06Man Infraconstruction, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 155.95, showing a notable increase from the previous close of 151.55. Over the past year, the stock has experienced a decline of 26.63%, while the Sensex has gained 3.67% in the same period, highlighting a significant underperformance relative to the broader market. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but there is no signal on a monthly scale. Bollinger Bands and KST metrics also reflect a mildly bearish trend on both weekly and monthly charts. Despite the recent fluctuations, the company has shown resilience over longer periods, with a remarkable 13...

Read MoreMan Infraconstruction Faces Mixed Technical Trends Amid Market Volatility

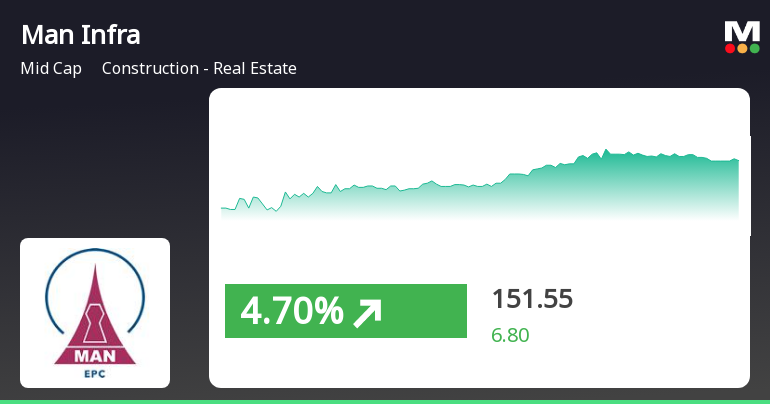

2025-04-02 08:07:32Man Infraconstruction, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 151.55, showing a slight increase from the previous close of 148.80. Over the past year, the stock has experienced significant volatility, with a 52-week high of 262.50 and a low of 135.05. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales. Bollinger Bands and KST also reflect a mildly bearish trend on a monthly basis, suggesting a cautious market sentiment. Daily moving averages are bearish, indicating short-term challenges. When comparing the stock's performance to the Sensex, Man Infraconstruction has shown mixed results. Over the past week, it has r...

Read More

Man Infraconstruction Shows Strong Short-Term Gains Amid Broader Market Trends

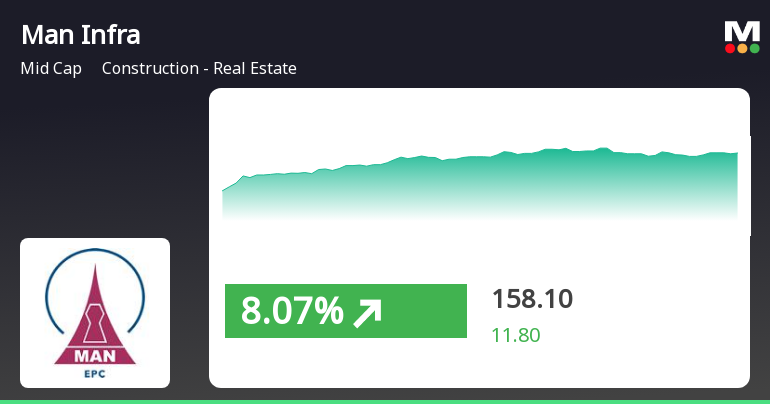

2025-03-19 10:50:18Man Infraconstruction, a midcap construction and real estate firm, experienced significant trading activity, achieving a notable gain today. The stock has shown consecutive gains over the past two days, although its performance over the past month and year remains negative. The broader market also saw small-cap stocks leading.

Read More

Man Infraconstruction Shows Recovery Amid Broader Market Gains and Ongoing Challenges

2025-03-18 14:20:17Man Infraconstruction experienced a rebound on March 18, 2025, after five days of decline, outperforming the construction sector. Despite today's gains, the stock remains below key moving averages and has seen a significant decline over the past month and year-to-date, contrasting with the overall market's upward trend.

Read More

Man Infraconstruction Faces Continued Volatility Amid Declining Financial Performance and Increased Institutional Interest

2025-03-17 12:37:07Man Infraconstruction, a midcap construction and real estate firm, has hit a new 52-week low amid ongoing volatility. The company reported a 12.7% decline in net sales and a 15.2% drop in profit before tax. Despite challenges, management efficiency remains high, with a 17.1% return on equity.

Read More

Man Infraconstruction Faces Significant Volatility Amid Declining Sales and Stock Performance

2025-03-13 11:36:36Man Infraconstruction, a midcap construction and real estate firm, has faced notable volatility, reaching a new 52-week low. The company reported a decline in net sales and profit before tax, while its stock trades below key moving averages. However, management efficiency remains strong, with increased institutional investment.

Read MoreMan Infraconstruction Experiences Technical Trend Shift Amidst Market Volatility

2025-03-11 08:03:52Man Infraconstruction, a midcap player in the construction and real estate sector, has recently undergone a technical trend adjustment. The company's current price stands at 149.45, reflecting a decline from the previous close of 154.25. Over the past year, the stock has experienced significant volatility, with a 52-week high of 262.50 and a low of 139.15. In terms of technical indicators, the weekly MACD and Bollinger Bands are currently bearish, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish sentiment. Notably, the Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, indicating a lack of momentum in either direction. When comparing the company's performance to the Sensex, Man Infraconstruction has shown varied returns. Over the past week, the stock returned 3.25%, outperforming the Sensex, which returned 1.41%. Ho...

Read MoreMan Infraconstruction Faces Stock Volatility Amidst Broader Market Stability

2025-03-10 18:00:38Man Infraconstruction Ltd, a mid-cap player in the construction and real estate sector, has experienced significant fluctuations in its stock performance recently. As of today, the stock has declined by 3.11%, contrasting with a slight drop of 0.29% in the Sensex. Over the past year, Man Infraconstruction has seen a notable decrease of 27.91%, while the Sensex has remained relatively stable with a change of just 0.01%. In terms of market metrics, the company holds a market capitalization of Rs 5,719.00 crore and a price-to-earnings (P/E) ratio of 20.69, which is considerably lower than the industry average P/E of 62.49. This disparity highlights the company's current valuation relative to its peers. Looking at longer-term performance, Man Infraconstruction has shown resilience with a 43.56% increase over the past three years and an impressive 904.17% rise over the last five years. However, the stock has f...

Read More

Man Infraconstruction Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-05 09:45:25Man Infraconstruction, a midcap construction and real estate firm, experienced significant trading activity, achieving a notable gain today. The stock reached an intraday high and has shown consecutive gains over the past two days. However, its performance over the past month and year has been challenging.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Man Infraconstruction Ltd |

| 2 | CIN NO. | L70200MH2002PLC136849 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | A+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CARE RATINGS LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | NSE |

Designation: COMPANY SECRETARY

EmailId: durgesh@maninfra.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: ashok@maninfra.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed the certificate received from MUFG Intime India Private Limited under Reg 74 (5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Intimation Of Analyst(S)/Institutional Investor(S) Meeting

27-Mar-2025 | Source : BSEPursuant to Regulation 30 of SEBI LODR Regulations 2015 we hereby inform that the Companys Official had a one-on-one meeting with Analyst of Emkay Global Financial Services Limited on 27th March 2025.

Corporate Actions

No Upcoming Board Meetings

Man Infraconstruction Ltd has declared 22% dividend, ex-date: 12 Feb 25

Man Infraconstruction Ltd has announced 2:10 stock split, ex-date: 28 Aug 14

Man Infraconstruction Ltd has announced 1:2 bonus issue, ex-date: 17 Nov 21

No Rights history available