Manali Petrochemicals Faces Mixed Technical Signals Amid Market Volatility

2025-04-02 08:06:28Manali Petrochemicals, a microcap player in the petrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 57.57, showing a slight increase from the previous close of 56.18. Over the past year, the stock has experienced a high of 104.99 and a low of 55.05, indicating significant volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) indicates no clear signal for both weekly and monthly assessments. Bollinger Bands and Moving Averages present a bearish outlook, while the KST reflects a mildly bullish trend weekly but bearish monthly. In terms of performance, Manali Petrochemicals has faced challenges compared to the Sensex. Over the past week, the stock returned -4....

Read More

Manali Petrochemicals Faces Market Challenges Amidst Declining Performance Metrics

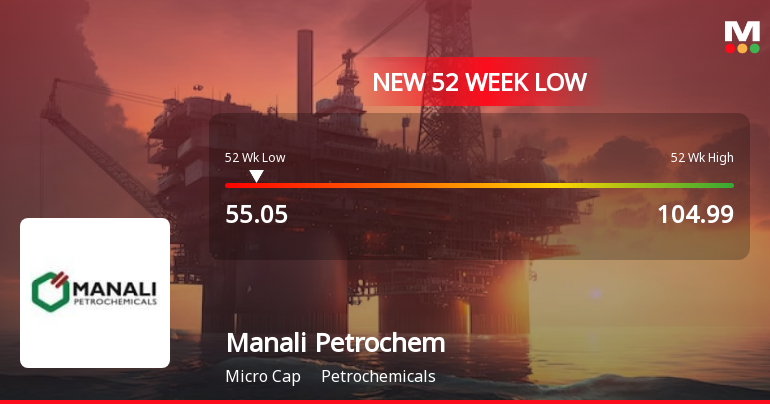

2025-04-01 11:51:52Manali Petrochemicals has reached a new 52-week low amid five consecutive days of price declines, despite a slight recovery today. The company has struggled over the past year, with declining operating profits and disappointing financial results, while its stock trades at a premium compared to peers.

Read More

Manali Petrochemicals Hits 52-Week Low Amid Ongoing Financial Struggles

2025-04-01 11:51:52Manali Petrochemicals has reached a new 52-week low, continuing a five-day losing streak despite a brief intraday recovery. The stock remains below key moving averages and has underperformed over the past year. Financial results indicate a significant decline in operating profit and net sales, raising concerns about its performance.

Read More

Manali Petrochemicals Faces Declining Performance Amidst Market Underperformance and Low Investor Confidence

2025-04-01 11:51:43Manali Petrochemicals has reached a new 52-week low, following a downward trend over the past five days. The company's one-year return is negative, and it has reported a significant decline in profit and net sales. The stock is trading below key moving averages, indicating ongoing challenges.

Read MoreManali Petrochemicals Shows Mixed Technical Trends Amid Market Volatility

2025-03-21 08:02:02Manali Petrochemicals, a small-cap player in the petrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.11, showing a notable increase from the previous close of 59.52. Over the past year, the stock has reached a high of 104.99 and a low of 55.11, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, indicating a neutral stance. Bollinger Bands reflect a sideways trend on a weekly basis, while the monthly trend is mildly bearish. Moving averages indicate a mildly bearish sentiment on a daily basis, and the KST shows mixed signals with a mildly bullish weekly trend contrasted by a bearish monthly trend. When comparing th...

Read MoreManali Petrochemicals Faces Mixed Technical Signals Amid Market Volatility

2025-03-18 08:02:31Manali Petrochemicals, a small-cap player in the petrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 59.08, down from a previous close of 61.32, with a 52-week high of 104.99 and a low of 55.11. Today's trading saw a high of 60.98 and a low of 57.50, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and moving averages indicate bearish trends, while the KST shows a mildly bullish weekly trend but leans towards bearish monthly performance. The Dow Theory reflects a mildly bearish stance weekly, with no trend identified monthly. In terms of performance, Mana...

Read MoreManali Petrochemicals Shows Mixed Technical Trends Amid Market Volatility

2025-03-06 08:01:40Manali Petrochemicals, a small-cap player in the petrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.15, showing a notable increase from the previous close of 59.55. Over the past year, the stock has experienced a high of 104.99 and a low of 55.11, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective remains bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly evaluations. Bollinger Bands and On-Balance Volume (OBV) indicate a mildly bearish trend on both weekly and monthly scales, suggesting cautious market sentiment. When comparing the stock's performance to the Sensex, Manali Petrochemicals has shown mixed results. Over the past week, the stock returned 3.12%, contrasting with ...

Read More

Manali Petrochemicals Faces Significant Volatility Amid Broader Petrochemical Market Decline

2025-01-28 11:05:22Manali Petrochemicals has faced notable volatility, nearing its 52-week low and underperforming its sector amid broader market challenges. The stock has declined 9.31% over the past three days and is trading below key moving averages, reflecting a sustained downward trend and a 27.86% decrease over the past year.

Read MoreShareholder Meeting / Postal Ballot-Notice of Postal Ballot

04-Apr-2025 | Source : BSENotice as attached

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEAs stated in the attachment

Closure of Trading Window

26-Mar-2025 | Source : BSEAs attached

Corporate Actions

No Upcoming Board Meetings

Manali Petrochemicals Ltd has declared 15% dividend, ex-date: 10 Sep 24

Manali Petrochemicals Ltd has announced 5:8 stock split, ex-date: 28 Sep 06

No Bonus history available

No Rights history available